New Survey Reveals Affordability Challenges for Renters and Homeowners

A new Freddie Mac survey of renters and homeowners shows that affordability issues continue to have profound impacts on homeowners and renters — with more than half of Americans making spending or housing changes to afford their monthly housing payment. For younger generations, the costs of child care and student loans are key factors affecting housing decisions. Freddie Mac’s “Profile of Today’s Renter and Owner” surveyed approximately 4,000 households to determine attitudes toward housing.

Key Findings:

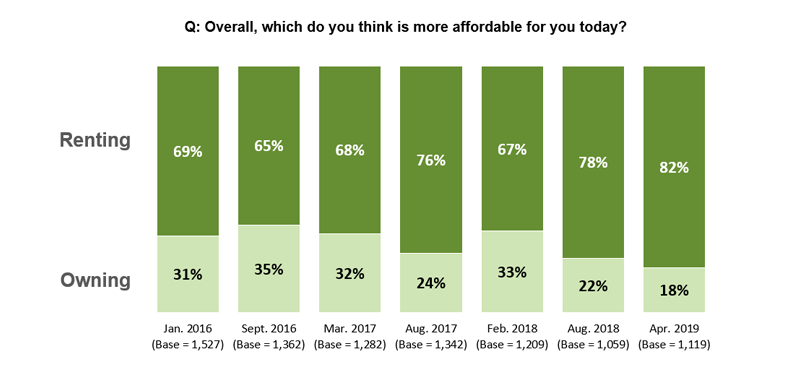

- 82% of renters view renting as more affordable than homeownership, up 15 points from February 2018

- 51% of Americans have made spending or housing changes to afford their monthly housing payment

- 44% of renters and 35% of owners who had trouble affording their housing payment over the last two years reported having to move to afford housing costs

- Over half of workers employed in the essential workforce (e.g., teachers, nurses and law enforcement) have made housing decisions with their student loan repayment obligations in mind

- Half of owners and 44% of renters in the essential workforce say they had to make different housing choices to afford daycare

Perceptions of Affordability

The survey finds the majorities of both renters and homeowners believe their living situation is the most affordable option for them, however, both groups increasingly see renting as more affordable. Specifically, the spring 2019 survey released today reveals that 82% of renters now view renting as more affordable than homeownership — an all-time high for the survey and up 15 points from February 2018.

Even though more than 80% of renters and owners view their housing choice as the most affordable option, the survey finds renters are more likely to be cost burdened. According to the survey, 34% of renters spend more than one-third of their income on rent, while only 25% of homeowners spend that much on their mortgage. The survey also finds that baby boomer homeowners tend to spend less on housing as a percentage of their income than renters of any generation. Just 17% of this generation’s homeowners spend more than a third of their income on housing versus 41% of renters.

The Obstacle: Down Payments and Closing Costs

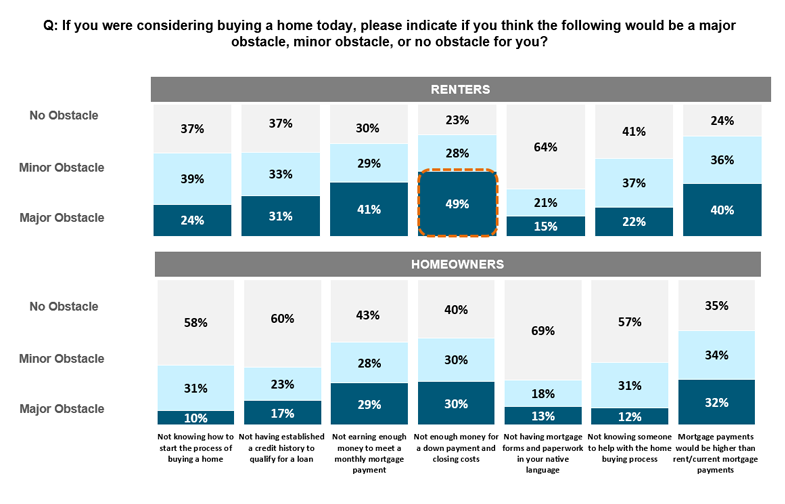

The upfront costs of purchasing a home, including down payments and closing costs, are commonly rated by all renters as a primary obstacle to homeownership. Specifically, nearly nine in ten (88%) low-income renters said that having the money for a down payment and closing costs would be an obstacle to homeownership if they were considering buying a home. Middle-income renters (72%) also indicate the same challenge. Of these groups, 62% of low-income and 39% of middle-income renters consider having these funds a “major obstacle” to homeownership.

The impact of these costs is also stark across generations of current renters; 80% of millennials, 81% of Gen Xers and 71% of baby boomers perceive not having enough money for a down payment or for closing costs as an obstacle to homeownership.

In addition, the expectation that mortgage payments would be higher than rent payments is also rated as a major obstacle to owning by 40% of renters. However, female renters are significantly more likely than their male counterparts (48% vs. 28%) to say high mortgage payments would be a major obstacle for them.

Cutting Spending to Afford Housing

In one of its most dramatic findings, the survey shows that majorities of both renters and homeowners have made changes over the last two years to afford their current monthly rent or mortgage. More than half of Americans (51%) say they have made spending or housing changes to afford their monthly housing payments, including 62% of renters and 47% of homeowners.

Among these renters, more than half — 55% — said they have reduced spending on non-essential items, such as entertainment, while 42% spent less on food, utilities and other essentials over the past two years. Surprisingly, 44% of renters who said they had trouble affording housing in the last two years reported having to move, a 14-point jump over the August, 2018 survey findings. Homeowners are not immune from these affordability concerns —of those who had to make changes to afford housing, 52% of owners spent less on non-essential items over the past two years to cut costs, while 33% spent less on food, utilities and other essentials. Moreover, 35% of owners who reported trouble affording housing in the last to years reported having to move to find a more affordable place to live, an increase of nine points since August.

Student Loans, Child Care Costs Taking a Toll

Finally, the survey looks at how the common costs of everyday life impact renters and owners. It finds that a majority, 51%, of younger millennials (aged 23-29) who rent had to make a different housing choice because of student loans, compared with 38% of younger millennials who own a home. In addition, the survey found 41% of older millennials (aged 30-38) who rent and 36% who own experienced the same phenomenon. In addition, over half of workers employed in the essential workforce, serving in crucial positions like healthcare, education and law enforcement, have made housing decisions with their student loan repayment obligations in mind. This includes 51% of owners and 53% of renters working essential jobs.

In addition, the survey finds renters and owners also made housing decisions based on child care costs, such as daycare and the proximity to daycare. In fact, half (50%) of owners and 44% of renters in the essential workforce say they had to make different housing choices to afford daycare, compared with owners (11%) and renters (13%) in the non-essential workforce. Of those who had to make changes, the top decisions included choosing a less expensive home (26% of owners/21% of renters); postponing buying a home (24%/15%); choosing a lower-cost area to live in (23% /22%) and making other housing decisions based on child care costs.

Survey Methodology

Freddie Mac contracted with Harris Insights & Analytics to conduct the online survey over a four-day period, beginning April 1. The poll collected data from 4,040 respondents over the age of 18, including 2,864 homeowners, 1,119 renters and 57 others. The data has been weighted to reflect the composition of the US adult population.

Additional findings from Freddie Mac’s survey, including several cross-tabulations based on region, income, gender and ethnicity, can be found here