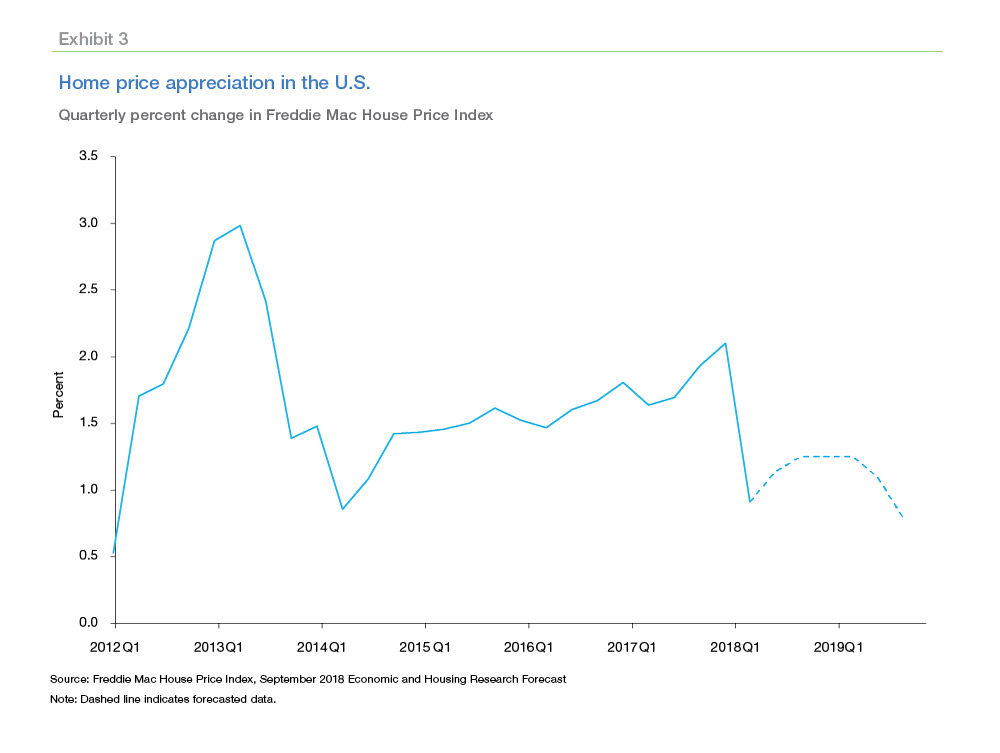

Economic Growth Quickens in the Second Quarter

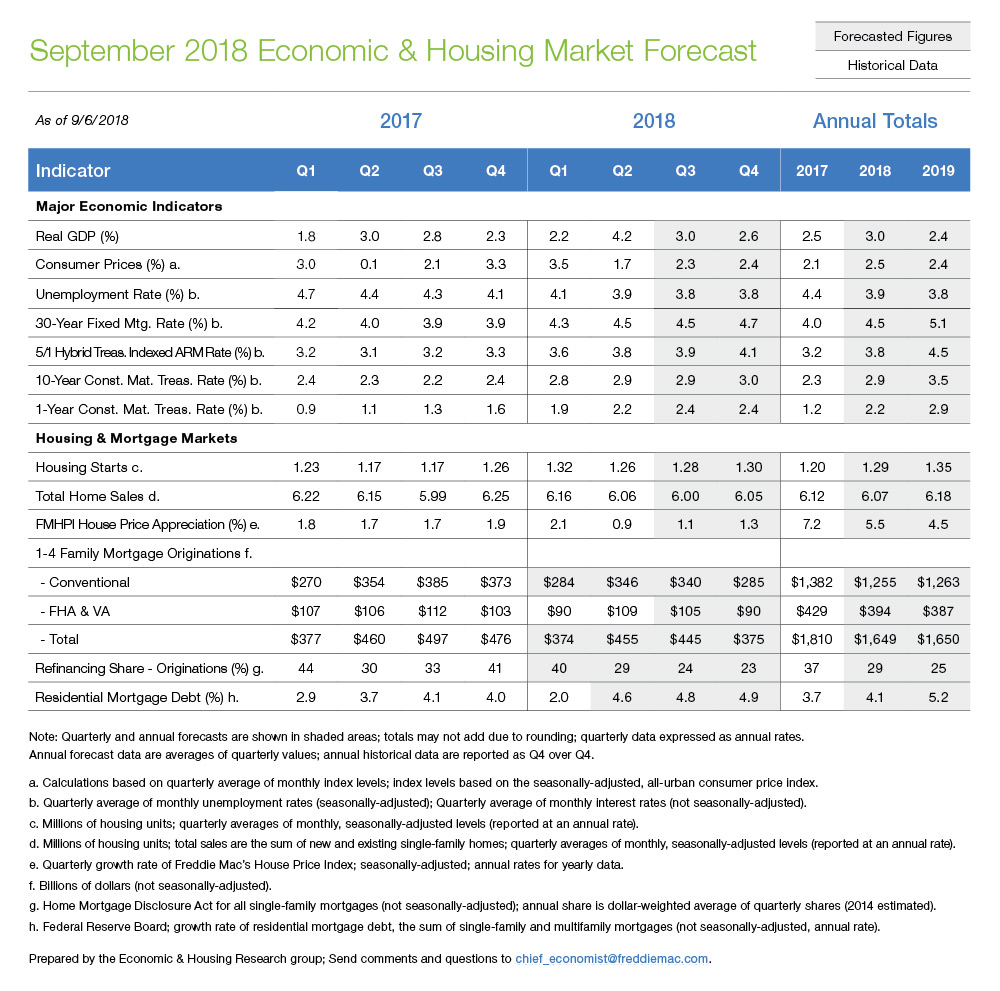

The U.S. economy grew at a 4.2 percent rate in the second quarter, which exceeded the advance estimate (4.1 percent) and was the fastest pace in almost four years. The robust expansion reflects a rebound in consumer spending, as well as upward revisions to nonresidential and private inventory investments. For the year, we expect the economy to grow at a rate of 3.0 percent, before moderating to 2.4 percent next year.

Mortgage rates stabilized this summer, but may be on the rise again

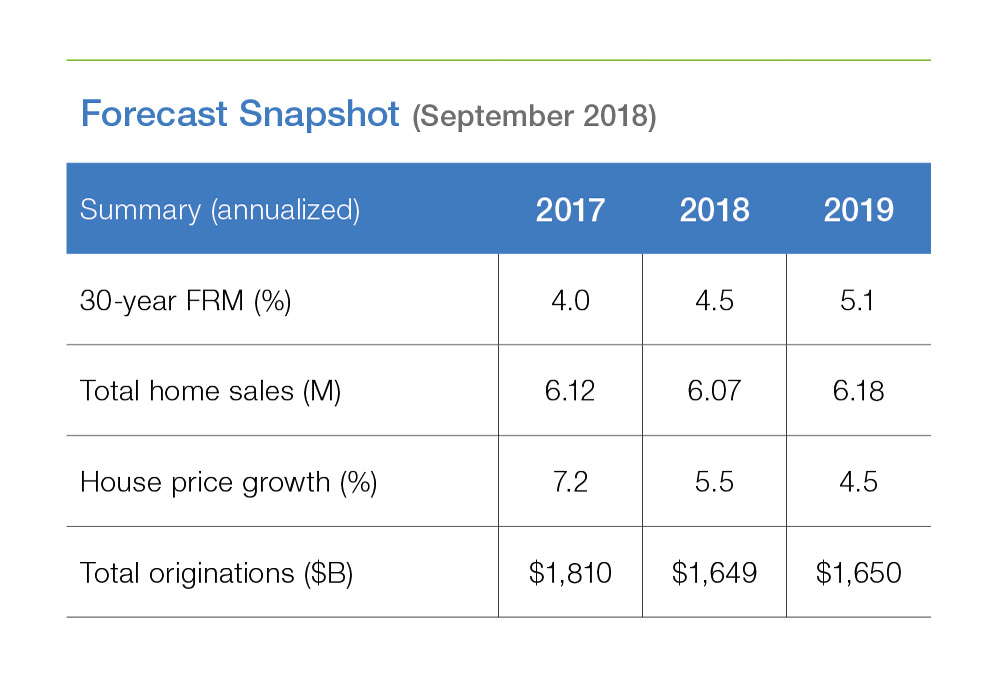

After a quick run-up earlier this year, mortgage rates inched backward over the summer and have most recently started to trend higher again. The U.S. weekly average mortgage rate reached 4.66 percent in May of this year and was 4.60 percent as of September 13. Looking ahead, we anticipate the 30-year fixed-rate mortgage to gradually increase again, averaging 4.5 percent this year and 5.1 percent in 2019.

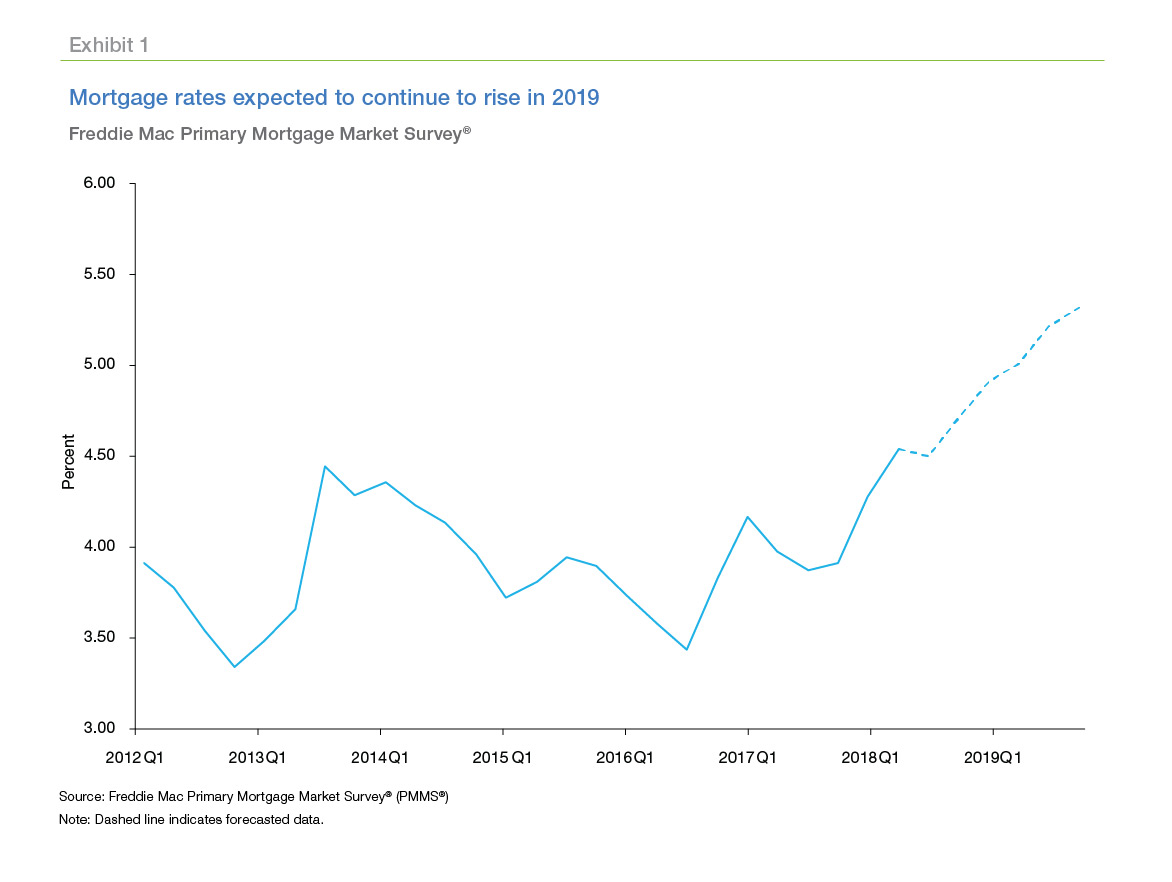

Sales activity is weakening

Home sales declined in the second quarter and showed further weakness going into the third quarter. Specifically, total single-family home sales (new and existing) decreased for a fourth consecutive month in July to an annualized rate of 5.97 million units. New home construction also lost momentum in the second quarter, falling 4.5 percent from the first quarter.

Based on this downward trend, we have lowered our home sales and housing starts projections for the remainder of this year and next. We now expect total home sales to decline 0.9 percent to 6.07 million in 2018, before increasing 1.8 percent to 6.18 million in 2019. Housing starts are now forecast to rise 7.5 percent this year and 4.7 percent in 2019.

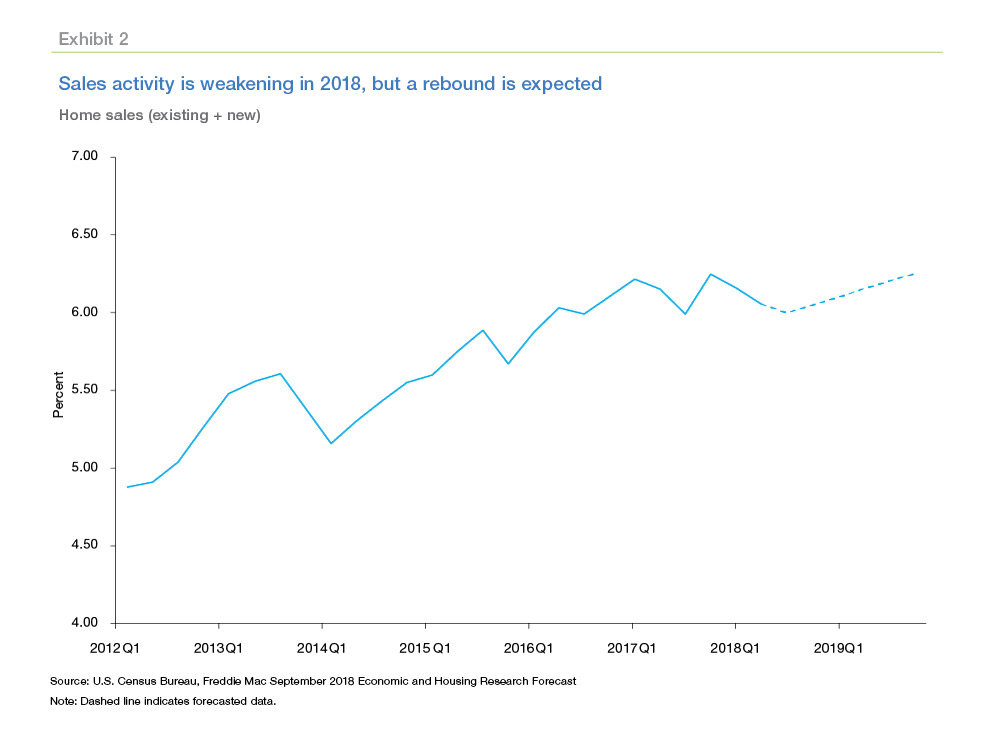

Amidst homebuyers' budget constraints and slight improvements in supply levels, home prices grew at a slower pace last quarter. The Freddie Mac House Price Index (FMHPI) increased 0.9 percent in the second quarter, down from a robust 2.1 percent increase in the first quarter. For the year, we anticipate that home prices will increase 5.5 percent, with the growth rate moderating to 4.5 percent in 2019.

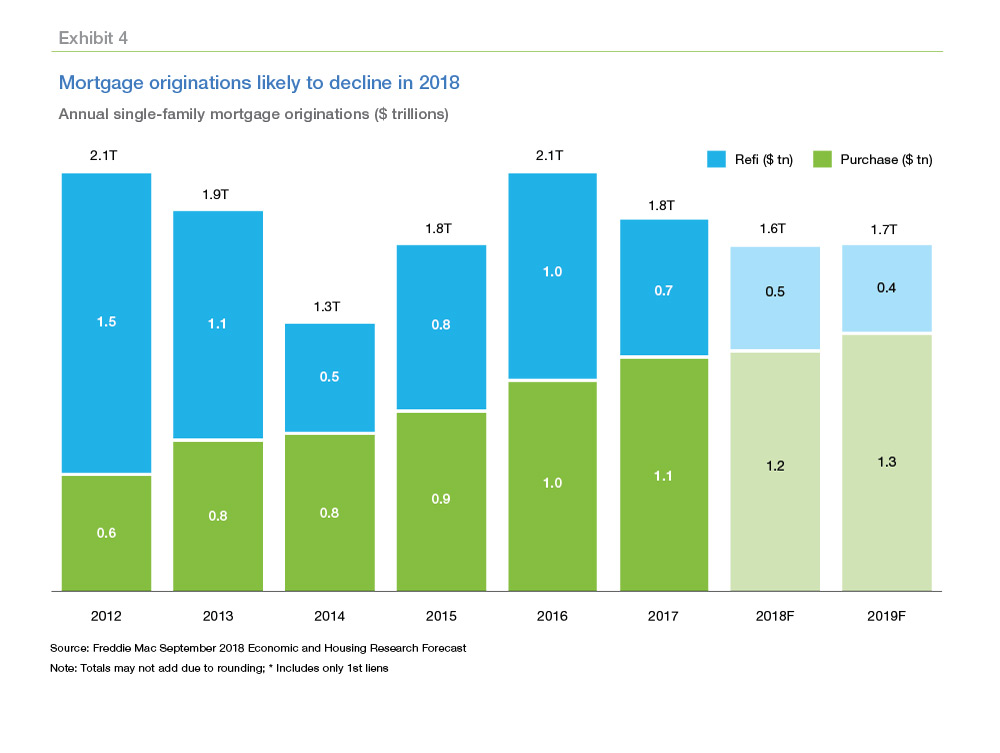

Fewer home sales and slower price growth weigh on originations

The slowdown in home sales and price growth have caused us to further revise our forecast for single-family mortgage originations. We now forecast single-family mortgage originations in 2018 to decline to $1.65 trillion (down 8.9 percent year-over-year).

Quarterly Refinance Report

According to Freddie Mac's Quarterly Refinance Statistics second quarter data set, "cash-out" borrowers, those that increased their loan balance by at least five percent, represented 77 percent of all refinance loans – up from 57 percent a year ago.

Are homeowners cashing out?

In 2006, a lot of homeowners took advantage of their rising home equity and cashed-out an estimated $102.3 billion (in 2017 dollars). Exhibit 5 illustrates that in recent years, even with house prices surpassing the 2006 levels, homeowners are not cashing-out the equity in their homes the way they did in 2006. Even though the cash-out share of refinances are approaching the highs of 2005 and 2006, the dollar volume cashed-out is well below the volume extracted in 2005 and 2006.

While the share of cash-out refinances last quarter was the highest since the third quarter of 2008 (78 percent), the total dollar volume of cash-out refinance activity remains much lower than the highs seen a decade ago. Adjusted for inflation (in 2017 dollars), an estimated $15.5 billion in net home equity was cashed out in the second quarter, down slightly from $15.7 billion a year earlier and substantially less than the peak cash-out refinance volume of $102.3 billion in the second quarter of 2006.

Borrowers who refinanced their first-lien mortgage last quarter either kept the same interest rate or took slightly higher interest rates. Many of these borrowers refinanced not for rate reduction, but for cashing out equity to consolidate other higher interest debt, pay other bills or use towards home improvements.

More than 95 percent of refinancing borrowers chose a fixed-rate loan. Fixed-rate loans were preferred regardless of their original loan product. For example, 93 percent of borrowers who had a hybrid ARM refinanced into a fixed-rate loan. In contrast, only 3 percent of borrowers who had a fixed-rate loan refinanced into an ARM.

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP