Housing Market Remains Strong While Economic Slowdown Looms

September was the most volatile month for mortgage rates since the beginning of 2018 with an average week to week change of 11 basis points for the 30-year fixed rate mortgage.

The recent volatility in the market is due to several causes. The outlook for a favorable resolution to the trade dispute between the United States and China changes day-by-day or even hour-by-hour, introducing volatility into financial markets and the benchmark 10-year Treasury yield. The second week of October saw the 10-year Treasury yield rise by nearly 25 basis points from Monday to Friday.

In September 2019, the unemployment rate was 3.5%, the lowest rate since December 1969. Despite these seemingly strong numbers, the possible downside risks have only increased in the past few weeks. The weakness in manufacturing has worsened with the ISM Manufacturing Index reporting the lowest reading in over a decade.

On a positive note, recent statistical releases indicate that the housing market remains on solid ground with housing starts, building permits, existing home sales, and new home sales all significantly outperforming consensus expectations in August.

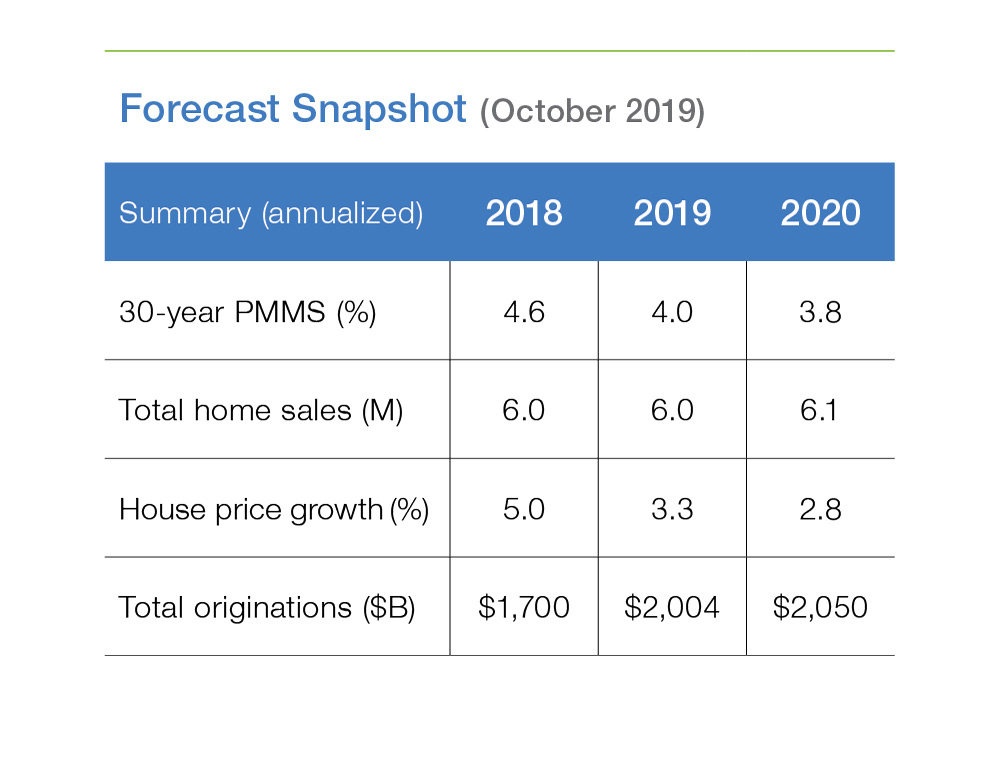

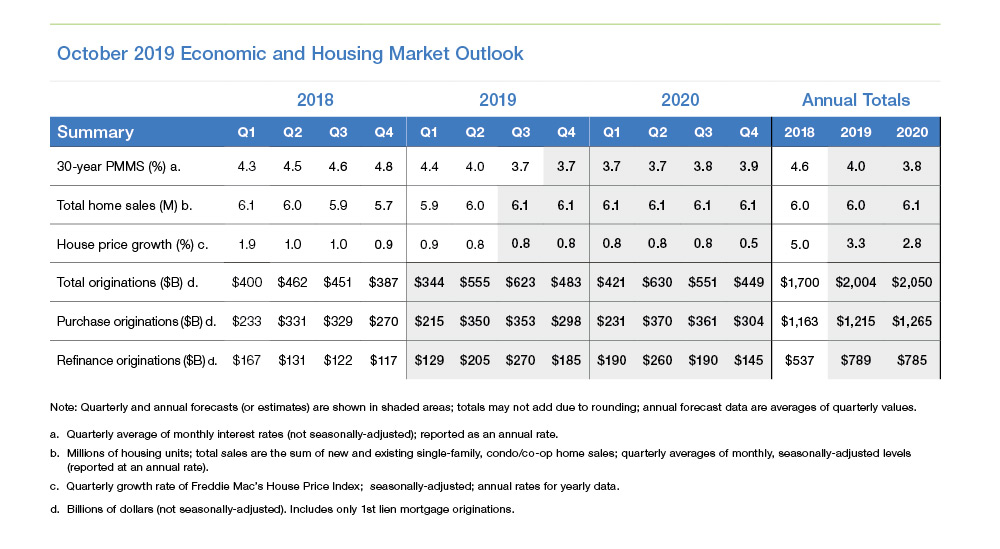

We forecast that the 30-year mortgage rates will be 3.7% for the remainder of 2019 and will tick up slightly to 3.8% in 2020. The housing market will continue to firm: home sales will rise to 6.0 million for 2019 before increasing to 6.1 million for 2020. House prices will increase 3.3% and 2.8% in 2019 and 2020, respectively.

The low mortgage rate environment led to a surge in refinance mortgage originations. The surge in refinance activity will carry over into next year, with $789 billion and $785 billion in single-family refinance mortgage originations in 2019 and 2020, respectively. Modest increases in home sales and house prices will boost purchase mortgage originations to $1.2 trillion and $1.3 trillion in 2019 and 2020, respectively. Overall, expect annual mortgage origination levels of $2.0 trillion in 2019 and $2.1 trillion in 2020.

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP