The Housing Market Continues to Stand Firm

Investors were increasingly optimistic of a possible trade deal between the United States and China in October which relieved some of the downward pressure on Treasury yields.

The first week of November saw the highest 10-year Treasury yields since July. However, the market has seen increased volatility in November as hopes for a favorable resolution to the trade dispute have recently waned. The second week of November saw the 10-year Treasury yield plummet by nearly 15 basis points.

The labor market stood firm in October as the unemployment rate remained near historical lows at 3.6%. Inflation remains subdued, with the consumer price index increasing just 1.8% year-over-year in October. With low interest rates, modest inflation and a solid labor market, the U.S. housing market continues to show strength. Our forecast is for the U.S. housing market to maintain momentum over the next two years.

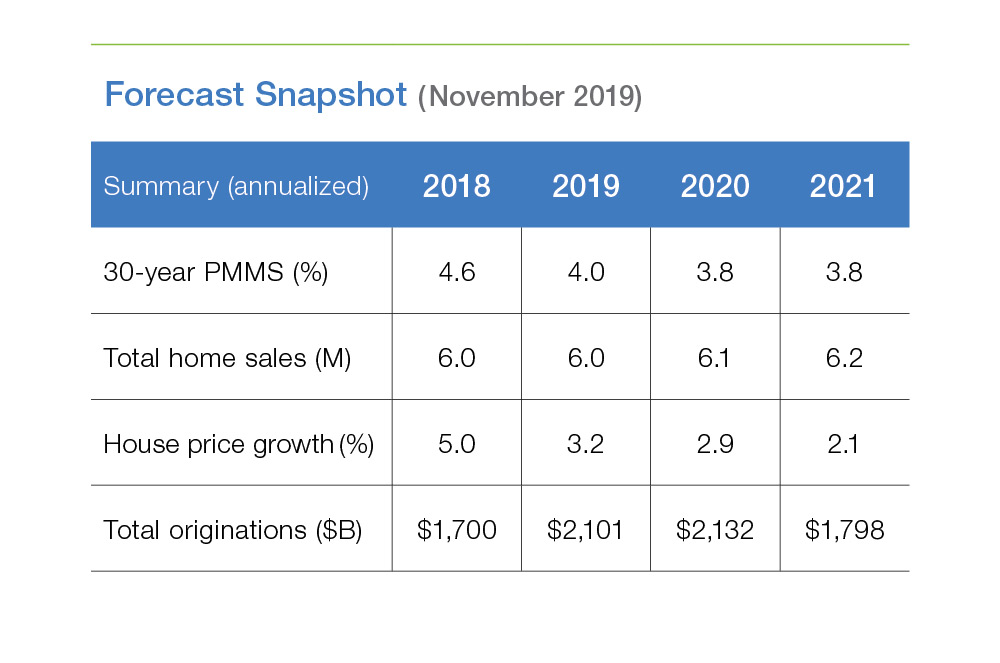

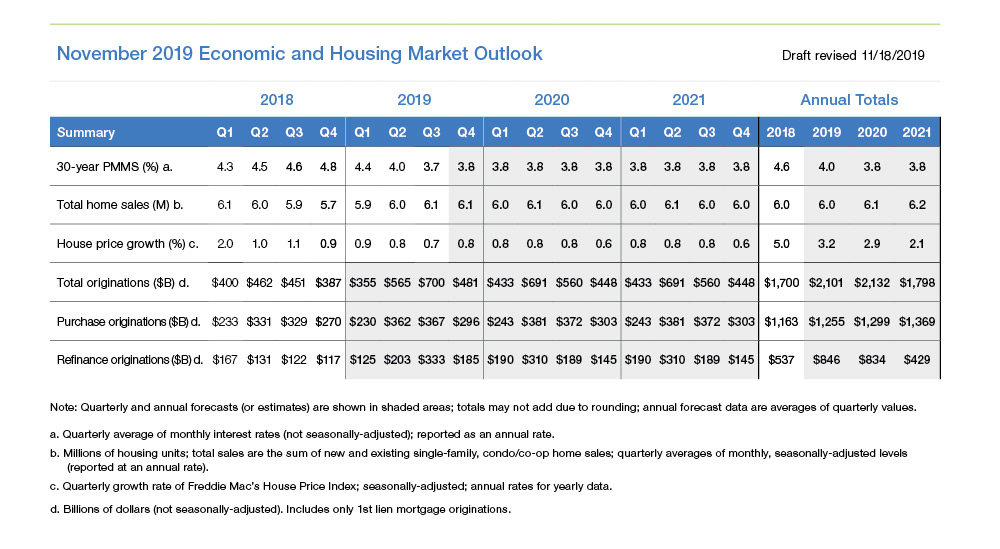

We forecast that the average 30-year fixed-rate mortgage rate will be 3.8% in the fourth quarter of 2019 and 4.0% for full-year 2019. We expect rates to remain low, falling to a yearly average of 3.8% in 2020 and 2021. The housing market will continue to stand firm: home sales will rise in 2019 to 6.0 million before increasing to 6.1 million and then to 6.2 million in 2020 and 2021, respectively. House price growth will continue to decelerate through 2021 with annual rates of 3.2%, 2.9% and 2.1% in 2019, 2020 and 2021, respectively.

The low mortgage rate environment led to a surge in refinance mortgage originations. The surge in refinance activity will carry over into next year, with $846 billion and $834 billion in single-family refinance mortgage originations in 2019 and 2020, respectively. As rates are expected to remain steady, we will likely see refinance originations taper off in the second half of 2020 and full year 2021. Modest increases in home sales and house prices will boost purchase mortgage originations for the foreseeable future. We expect purchase originations to rise steadily to $1,255 billion in 2019, $1,299 billion in 2020, and $1,369 in 2021.

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP