Quarterly Forecast: The Housing Market Faces Challenges Amid Economic Uncertainty

As large swathes of the U.S. economy shut down to battle the COVID-19 pandemic, the housing market faces its greatest challenge in over a decade.

The depth and duration of the pandemic is unknown. While some economies overseas are already recovering, the contours of the recovery vary by country, which makes forecasts of economic activity much more uncertain than usual. We assume that most of the economic damage from the virus is contained to the first half of the year. Starting in the third quarter a recovery begins, but it takes a full year before the economy gets back on its feet.

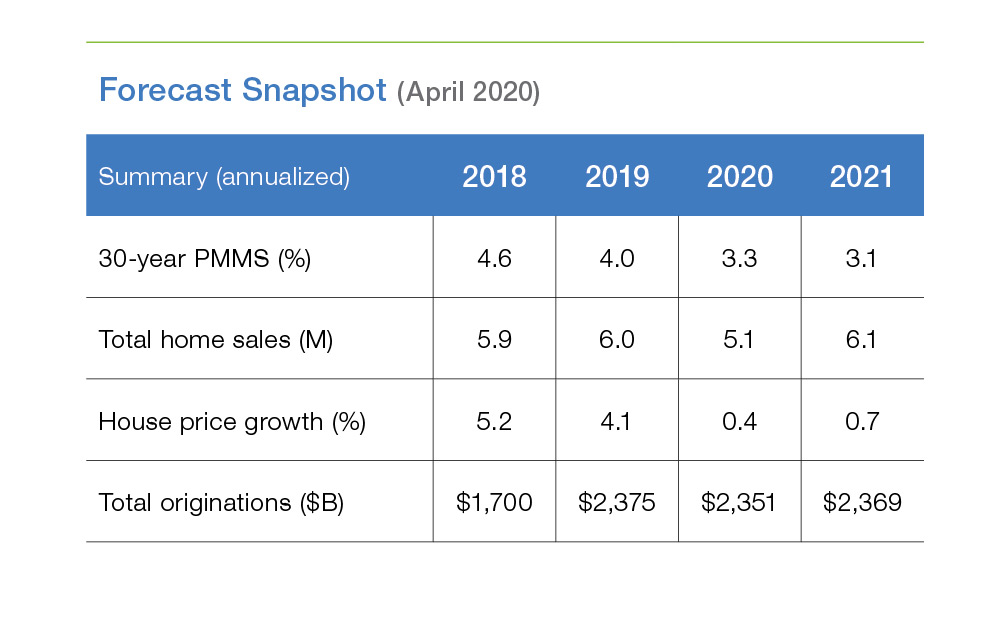

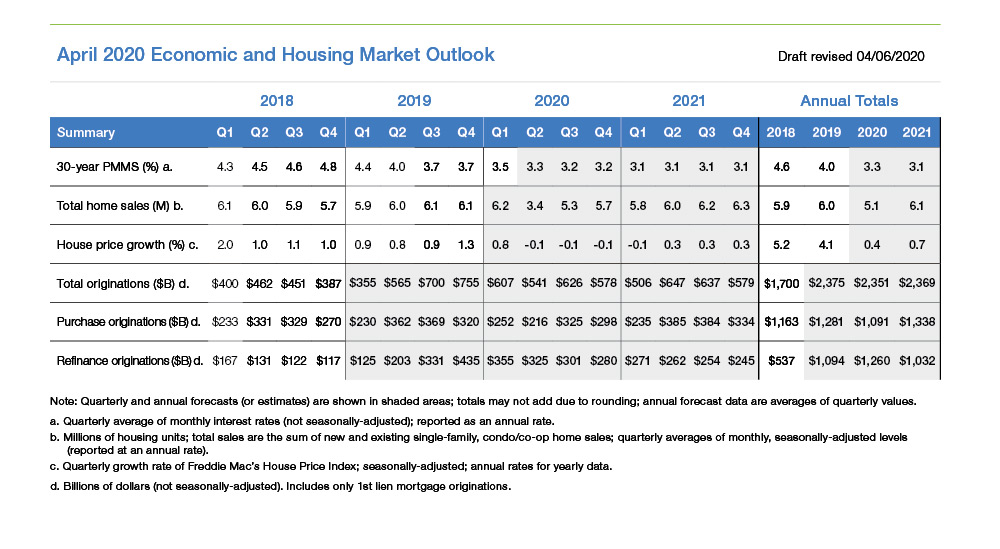

With much of the country under stay-at-home orders, we expect to see housing markets deviate from their typical spring surge. At a seasonally adjusted annual rate home sales fall 45% in the second quarter of 2020. Home sales bounce back but take a year to recover to the level reached in the first quarter of this year.

The fiscal stimulus provided by the CARES Act will mute the impact that the economic shock has on house prices. Additionally, forbearance and foreclosure mitigation programs will limit the fire sale contagion effect on house prices. We forecast house prices to fall 0.5 percentage points over the next four quarters. Two forces prevent a collapse in house prices. First, as we indicated in our earlier research report, U.S. housing markets face a large supply deficit. Second, population growth and pent up household formations provide a tailwind to housing demand. Price growth accelerates back towards a long-run trend of between 2 and 3% per year.

The Federal Reserve has stepped in to buy mortgage-backed securities. That has helped to stabilize mortgage markets and bring mortgage interest rates lower. Reduced economic growth will keep inflation in check. Long-term interest rates, including mortgage rates, remain lower over the next two years. Mortgage refinance activity resumes the surge we saw in the early part of the first quarter of 2020. With mortgage rates flat, refinance activity slows next year. The surge in refinance activity in 2020 and decline in 2021 mirrors a reverse pattern in home purchases. Thus, total mortgage originations remain around $2.4 trillion in 2020 and 2021.

Our forecast is relatively optimistic for the economy and there are significant downside risks. Over the past month, bellwether economic data, such as unemployment insurance claims and payroll employment growth, have surprised on the downside. If the economic contraction is larger and longer than what we currently forecast the housing market will suffer. Home sales may be slower to bounce back if potential buyers do not come to market. House price declines could also be larger than what we expect, particularly if forbearance and foreclosure mitigation programs do not successfully limit contagion effects on house prices. In the downside scenario mortgage origination volumes would be significantly lower than we forecast.

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP