The Return of the $2 Trillion Mortgage Market

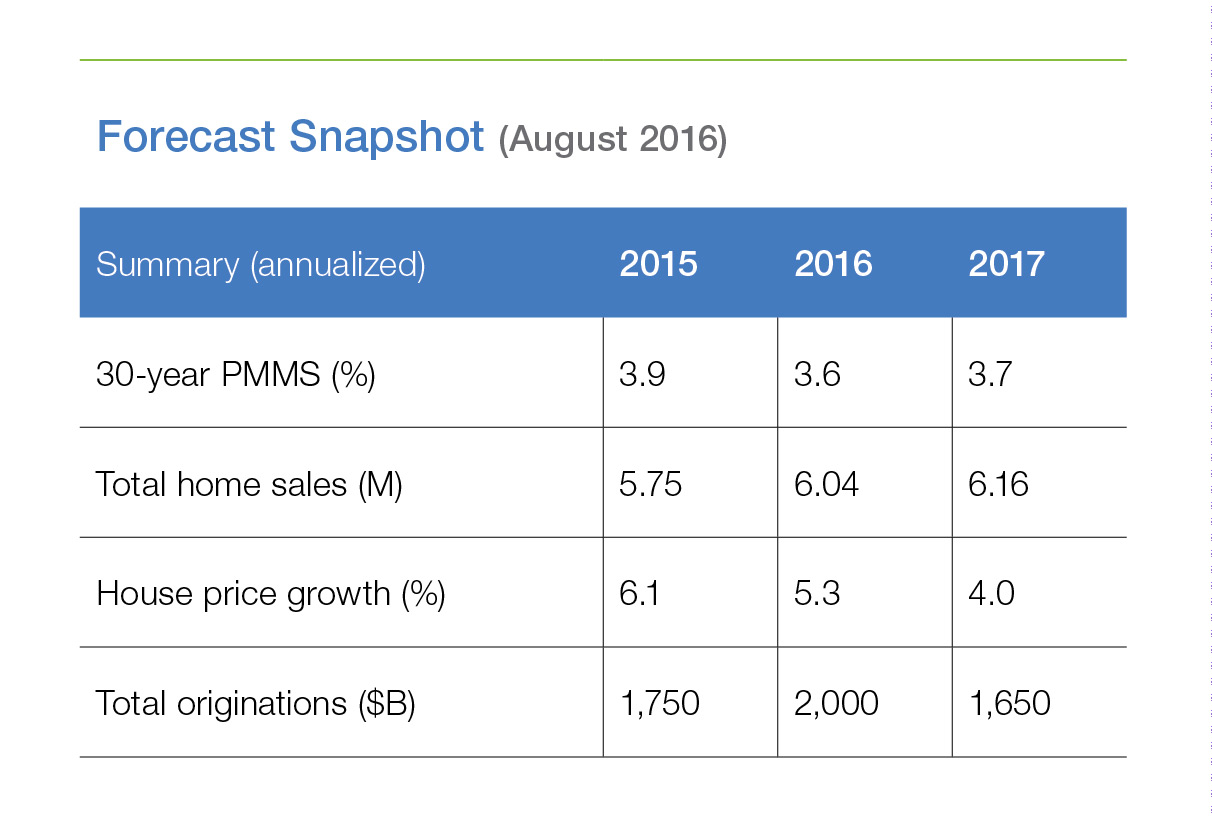

For the first time since 2012, mortgage originations are forecasted to top $2 trillion in 2016. Here’s why. Near-historic low mortgage interest rates are once again spurring a burst of refinance activity. Strong home sales are supporting purchase mortgage activity and are forecasted to reach their highest level since 2006. And that’s despite weak overall economic growth. House price growth also remains strong and low levels of inventory across many markets will continue to put upward pressure on house prices for the foreseeable future. Meanwhile, housing construction as measured by housing starts will increase, albeit at a measured pace, only gradually bringing more supply online.

Consumers carry the economy forward.

The Bureau of Economic Analysis’s advance estimate for second quarter Gross Domestic Product (GDP) continues to show the economy as sluggish for the first half of 2016. Initial estimates for GDP came in at an underwhelming 1.2 percent and were revised down for the first quarter from 1.1 to 0.8 percent growth.

The disappointing growth in the second quarter can be partly attributed to Nonresidential fixed investment, which has been hindered by falling energy prices and a slowdown in overall business activity. Moreover, Residential fixed investment contracted 6.1 percent in the second quarter after averaging 11 percent growth per quarter since the second quarter of 2014. Conversely, while investment struggles to contribute to GDP growth, consumers are carrying the economy forward. Personal consumption expenditures grew at an annual rate of 4.2 percent in the second quarter, the highest rate since the fourth quarter of 2014.

Overall, we expect GDP growth to bounce back to just over 2 percent for the remainder of 2016 as inventory investment rebounds and the drag by energy begins to ease and push Nonresidential investment up. However, recent global uncertainty and its effects on domestic production have led us to reduce our forecast for GDP growth in 2017 by 30 basis points to 1.9 percent.

The Consumer Price Index for June continued the trend of flat price growth that has been present throughout most of this year. Year-over-year headline inflation came in at only 1 percent for the month, down a tenth of a percentage point from May, as we continue to recover from the big drop in oil prices over the previous 12 months. In fact, the energy index is still down from a year ago, 15 and 19 percent respectively. On a positive note, the energy index did increase 1.3 percent in June, making it four consecutive months of positive energy price growth. The slow recovery of energy prices should start to gradually put pressure on overall price growth. Therefore, we believe inflation will start ticking up, eventually reaching 2.5 percent by the fourth quarter of 2017.

Employment is a bright spot.

May’s dismal employment numbers have been quickly forgotten, given recent releases. The August release of July's employment situation shows 255,000 jobs were created in July. Furthermore, upward revisions to both June and May’s numbers paint a much brighter picture about the overall health of the economy. With job growth continuing its respectable pace, we expect the unemployment rate to average 4.9 percent for 2016 and 4.8 percent in 2017. In fact, tightness in labor markets might finally be translating into wage growth. Average hourly earnings increased 2.6 percent year-over-year in the latest data, continuing an upward trend over the past year and a half.

The impact of the Brexit vote keeps mortgage rates low.

The continued flight to safety brought on by global uncertainty (mainly Brexit) held the average 10-year Constant Maturity Treasury yield for July to only 1.5 percent. When compared to its foreign counterparts, the U.S. 10-year Treasury yields are much higher. Low or negative yields in much of the developed world are constraining long-term interest rates in the U.S. The outlook for a rapid global recovery is muted, so it’s likely this pressure will persist for an extended period.

Mortgage rates have also been struggling to rise since the recent Brexit vote. Our weekly Primary Mortgage Market Survey shows the average 30-year fixed mortgage rate falling from 3.56 percent in the week of June 23 (pre-Brexit) to 3.45 percent in our most recent (August 11) survey. The 30-year fixed-rate mortgage averaged only 3.44 percent in July. That is the lowest monthly average since January 2013. The low mortgage rate environment is likely to continue, given the high level of uncertainty that is present in financial markets. Accordingly, we have lowered our projections for mortgage rates from last month. We lowered our 10-year Treasury rate forecast for 2016 by 10 basis points to 1.8 percent and our 2017 forecast by 30 basis points to 2.1 percent. Since mortgage rates closely follow 10-year Treasury yields, we have also reduced our 30-year fixed mortgage rate forecast for 2017 by 30 basis points to 3.7 percent.

Home sales are expected to reach their highest level since 2006.

Through the first six months of 2016, total home sales — both new and existing home sales — were 2.9 million (non-seasonally adjusted), the fastest pace since the first half of 2007. We are forecasting that home sales will outpace 2007 in the second half of this year, reaching the highest level since 2006. With the job market consistently improving, wage growth ticking higher, and mortgage interest rates remaining low – we expect home sales to rise throughout the rest of this year.

Lack of inventory remains a key constraint. Housing starts have averaged 1.16 million through the first half of 2016 at a seasonally adjusted annual rate. We are forecasting a gradual increase in housing starts, with 2016 expected to reach 1.2 million units. This is the highest annual total since 2007, but well below long-run demand, which we estimate lies between 1.5 and 1.7 million units.

Given robust demand and low supply, it is no surprise that house prices keep rising. Home prices continue to increase at a brisk pace, averaging 6.2 percent nationally in June according to the Freddie Mac House Price Index. Other indices show similar trends. In recent months, the pace of house price appreciation has moderated slightly. For example, the FHFA Purchase-Only Index slowed from 6.24 percent year-over-year appreciation in March of 2016 to 5.6 percent in May of 2016—but the rate of appreciation remains well above income growth, which is rising at a 2 to 3 percent pace.

Look for house price growth to moderate over the next two years as new supply gradually comes online and homebuyer demand is tempered by high prices. If mortgage interest rates creep higher, price gains could decelerate quickly—as they did in 2013.

Mortgage originations show strength.

Mortgage originations are set to top $2 trillion for the first time since 2012.

We estimate that mortgage originations hit $535 billion in the second quarter of 2016, the highest volume since the second quarter of 2013. Declining mortgage interest rates in the third quarter should boost mortgage originations further. According to the Mortgage Bankers Association Weekly Mortgage Applications Survey, refinance applications are up over 50 percent from a year ago. Strong refinance and purchase mortgage activity should generate $595 billion in mortgage originations in the third quarter of 2016, the highest level of mortgage activity since the fourth quarter of 2012.

We don’t anticipate rates to fall further, stabilizing around 3.5 percent and gradually ticking higher next year. This should allow refinance volume to remain relatively high in the fourth quarter of 2016 and into 2017, before gradually tapering late next year. The next section provides additional analysis around our mortgage refinance estimates.

With low mortgage rates, more borrowers have a rate incentive to refinance.

Back in February 2016 we analyzed refinance potential when rates dropped below 4 percent for the 30-year fixed-rate mortgage. In this section, we update this analysis to account for data through June 30, 2016.

In the February 2016 Outlook, we noted there was about $655 billion in outstanding conventional 30-year mortgage-backed securities (MBS) with a coupon greater than 4 percent. With the 30-year fixed mortgage rates falling below 3.5 percent (average 3.45 percent as of August 11), even more borrowers have a rate incentive to refinance. Currently, there is about $1.15 trillion in outstanding 30-year MBS with a coupon greater than 3.5 percent. This figure is a rough upper bound on the potential rate refinance volume from conventional conforming 30-year fixed-rate loans in agency MBS.

Realistically, some of these loans are unlikely to be refinanced this year despite the potential for a reduction in mortgage interest rates. Many borrowers have ignored extended refinance opportunities and are said to be burned out. Market analysts assume these loans have a low probability of refinancing in the future, regardless of the level of mortgage rates. Some borrowers may have paid the balance of their existing loan down to the point that the transaction costs of a refinance outweigh the benefit of a lower interest rate. And some borrowers may be averse to applying for a refinance, perhaps because the fear they will be turned down.

Using a similar approach to February 2016, we estimate the rate refinance potential for the remainder of 2016 as follows: We start with the $1.15 trillion loans in securities with a coupon greater than or equal to 4 percent, then subtract loans that may be ineligible for refinancing because of delinquencies, currently-high (both HARP and non-HARP) loan-to-value ratios (LTVs), and burned-out loans. This leaves approximately $680 billion in rate refinance potential from the $1.15 trillion we started with. Our current forecast for the remainder of 2016 refinance volume is $530 billion.

Of course, not all refinance originations will come from loans in 30-year agency securities and not all refinances will come from the desire to lower the mortgage rate (rate refinance). We also have term refinances (refinances that result in a shorter or longer loan term, e.g., 30-year to 15-year term), and cash-out refinances. This estimate does not include other mortgage products including loans guaranteed by FHA, VA or RHS and loans held in portfolio (e.g. Jumbo loans).

This analysis shows that there is a large dollar volume of mortgage loans that could refinance with rates around 3.5 percent. Indeed, as we noted above, refinance mortgage applications spiked following the decline in rates after the Brexit vote. As we forecast rates to remain below 4 percent throughout the remainder of 2016, refinance volume should remain robust for the balance of this year and into next.

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP