One of the Most Important Challenges our Industry will Face: The Significant Shortage of Starter Homes

While the economy is improving since the emergence of the pandemic, there are still some areas of concern. For example, several industries, such as retail, hospitality and tourism, remain fragile. Supply overhangs and shortages continue to affect the economy. And unfortunately, the housing market is among the industries where fundamental shortages exist.

Even before the COVID-19 pandemic and current recession, the housing market was facing a substantial supply shortage and that deficit has grown. In 2018, we estimated that there was a housing supply shortage of approximately 2.5 million units, meaning that the U.S. economy was about 2.5 million units below what was needed to match long-term demand. Using the same methodology, we estimate that the housing shortage increased to 3.8 million units by the end of 2020. A continued increase in a housing shortage is extremely unusual; typically in a recession, housing demand declines and supply rises, causing inventory to rise above the long-term trend.

The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes, which we document in two Insights: The Housing Supply Shortage: State of the States and The Major Challenge of U.S. Housing Supply. That decline has resulted in the decrease in supply of entry-level single-family homes or, "starter homes."

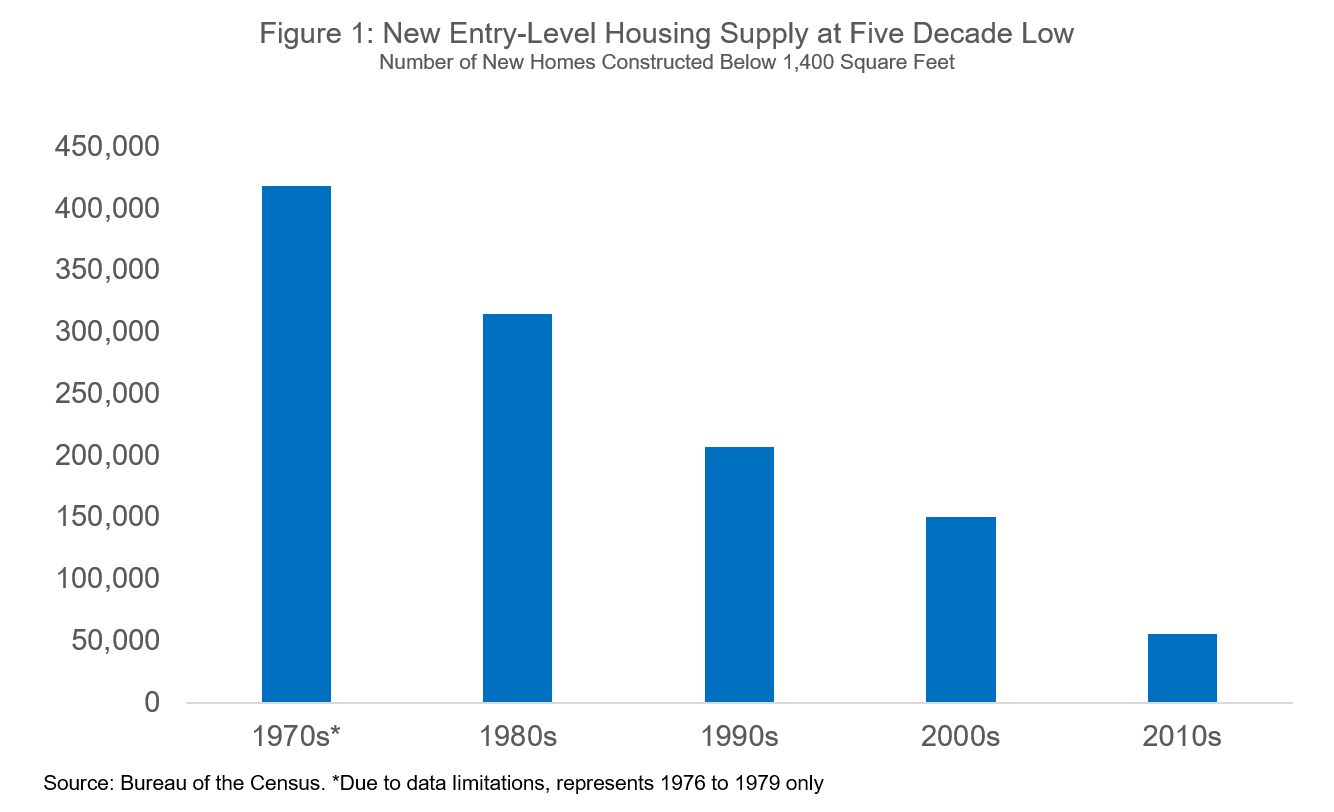

In the late 1970s, the construction of new entry-level homes averaged 418,000 units per year (Figure 1). During the 1980s, mortgage rates increased dramatically, rising from an average of 8.9% to 12.7%. As a result, entry-level housing supply fell by more than 100,000 units to 314,000.

In the 1990s, a decline in mortgage rates led to a surge in purchase demand of new single-family construction, which reached a 20-year high by 1999. However, while new construction was high, entry-level supply continued to decline, dropping to 207,000 units a year during the 1990s.

The 2000s experienced a substantial rise in new housing supply in response to then record low mortgage rates and new subprime and Alt-A products that led to record home purchase demand. Despite this demand and a rise in single-family total supply, entry-level supply continued a downward trajectory, declining to 150,000 units a year. Even at its cyclical peak during the 2000s, entry-level supply reached only 186,000 in 2004 – the same year that homeownership peaked. The fact that the homeownership rate peaked the same year as entry-level supply is indicative of the strong impact that entry-level supply has on homeownership. Very simply, renters can't buy houses that don't exist.

During the 2010s, new entry-level supply decreased further to 55,000 units a year and for 2020 alone, we estimate that there were 65,000 new entry-level homes completed. In the span of five decades, entry level construction fell from 418,000 units per year in the late 1970s to 65,000 in 2020.

While in 2020 only 65,000 entry-level homes were completed, there were 2.38 million first-time homebuyers that purchased homes. Not all renters looking to purchase their first home were in the market for entry-level homes, however the large disparity illustrates the significant and rapidly widening gap between entry-level supply and demand.

As we navigate our way through the year and get beyond the pandemic, we expect the housing supply shortage to continue to be one of the largest obstacles to inclusive economic growth in the U.S. Simply put, we must build more single-family entry-level housing to address this shortage, which has strong implications for the wealth, health and stability of American communities.

Even though Freddie Mac does not finance the construction of homes, we are committed to working with the industry to help lower the costs of housing overall. Our continuous support in all economic climates, and in markets that might otherwise be neglected, provides stability to the housing market and helps low- and moderate-income families rent, buy and keep homes they can afford. Additionally, we are working to find new ways to incentivize greater investment and bring diverse sources of capital to the market. We're also doing our part when it comes to serving our mission: First-time homebuyers represented 46% of new single-family purchase loans in 2020 while more than 650,000 single-family loans we financed were affordable to low- and very low-income households.

Freddie Mac will continue to closely monitor and report on impacts of this housing supply shortage while exploring possible solutions to help address this significant obstacle to homeownership.

1We define entry-level homes as homes with 1,400 square feet or less. The median single-family home had about 2,300 square feet in 2019 according to the U.S. Department of Census.

2https://miblog.genworth.com/first-time-homebuyer-market-report/

©2024 by Freddie Mac.