Quarterly Forecast: Housing Market Continues to Rebound as Mortgage Rates Hover at Record Lows

Economic activity stalled in early July. Even with many businesses reopening, unemployment claims remained high through September. Total jobless claims were about 26 million in the second week of September. The unemployment rate declined to 7.9% in September, but a shift from temporary to permanent unemployment and a deterioration in the labor force participation rate signal underlying weakness in the labor market.

Even as the economy faces challenges from the coronavirus pandemic, the housing market has been showing strength. Total mortgage origination volumes increased as many homeowners took advantage of historically low mortgage rates. The main force for such high origination volumes stems from a surge in mortgage refinance originations. Therefore, even though the overall economic recovery is uneven, the housing market has made a remarkable comeback.

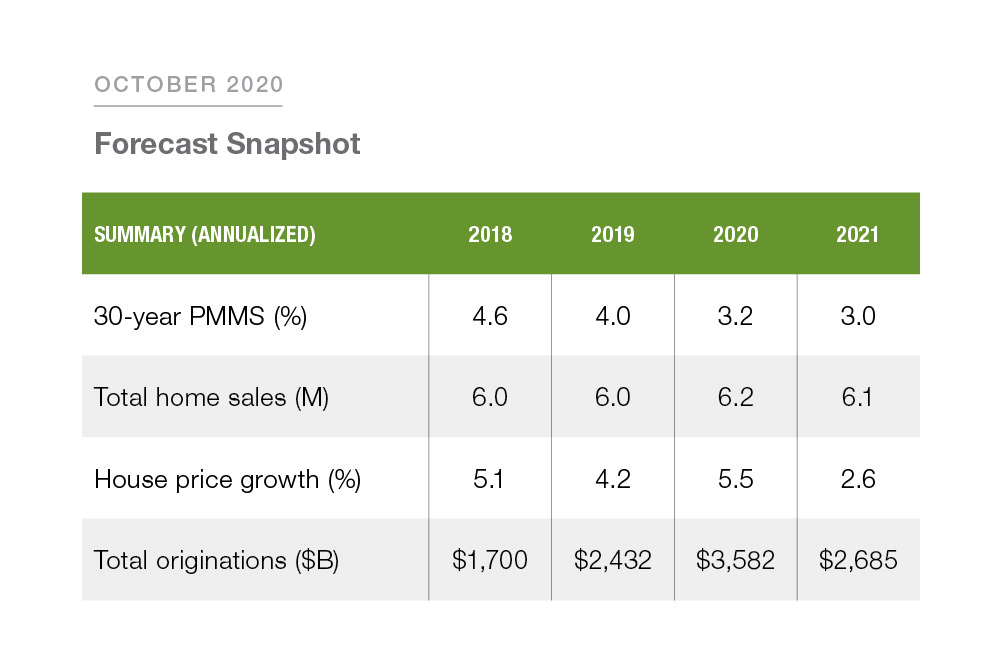

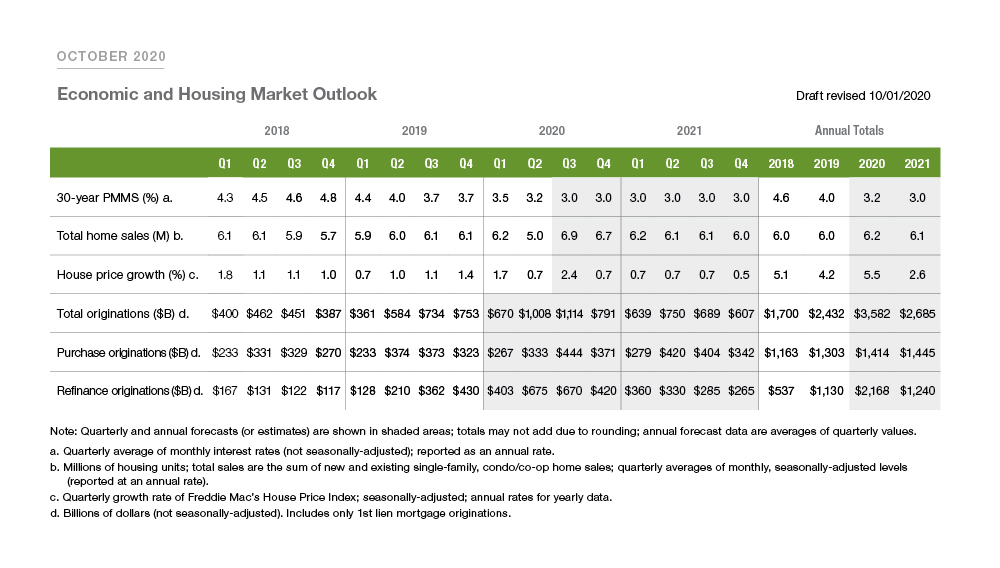

One of the main drivers of the strong housing recovery is historically low mortgage interest rates. The U.S. weekly average 30-year fixed mortgage rate hit an all-time low of 2.86% in the second week of September. Given weakness in the broader economy, the Federal Reserve’s signal that its policy rate will remain low until inflation picks up, and no signs of inflation, we forecast mortgage rates to remain flat over the next year. From the third quarter of 2020 through the end of 2021, we forecast mortgage rates to remain unchanged at 3%.

There was a sizeable increase in total home sales, with strong monthly showings from both new and existing sales. In August, new homes sales surpassed 1 million units at an annualized rate, the highest since Q2 2006. Existing home sales reached 6 million units at an annualized rate in the same month. The recent surge in home sales will help propel total annual sales to 6.2 million in 2020. While construction has rebounded, the slowdown in activity in the spring and early summer of 2020 will translate to fewer new homes available for sale next year. Thus we forecast home sales to decline slightly to 6.1 million in 2021.

This surge in home sales has put pressure on housing inventory and resulted in an acceleration in house price growth this summer. Total housing inventory declined 18.6% in August from the same month a year ago. We forecast house prices to increase by 2.4% quarter over quarter in Q3 2020 and 5.5% over the calendar year. Next year look for house price growth to moderate to 2.6%.

We expect total mortgage originations to reach $1.1 trillion in Q3 2020 and $3.6 trillion for full year 2020. For Q3 2020, we forecast purchase originations to be around $444 billion and refinance originations to be $670 billion. For full year 2020, we forecast purchase originations and mortgage refinance originations to total $1.4 and $2.2 trillion, respectively. For 2021, we forecast purchase originations to remain at $1.4 trillion, while refinance originations are expected to be lower at $1.2 trillion. Overall, we forecast total originations to decline to $2.7 trillion in 2021.

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP