Quarterly Forecast: Housing Market Continues to Perform Strongly Primarily Driven by Historically Low Mortgage Rates

It’s been close to a year since the pandemic began, and economic growth continues to remain uncertain. The availability of a COVID-19 vaccine and its widespread distribution should steer the economy towards recovery, but the timelines remain unknown. The labor market has recovered from the lows it reached in April of last year but continues to be weak. As of mid-December of 2020, jobless claims were still around 20 million, remaining well above the pre-pandemic levels. The unemployment rate was 6.7% in December with more permanent job losses and less labor force participation signaling a slowdown in the current labor market recovery.

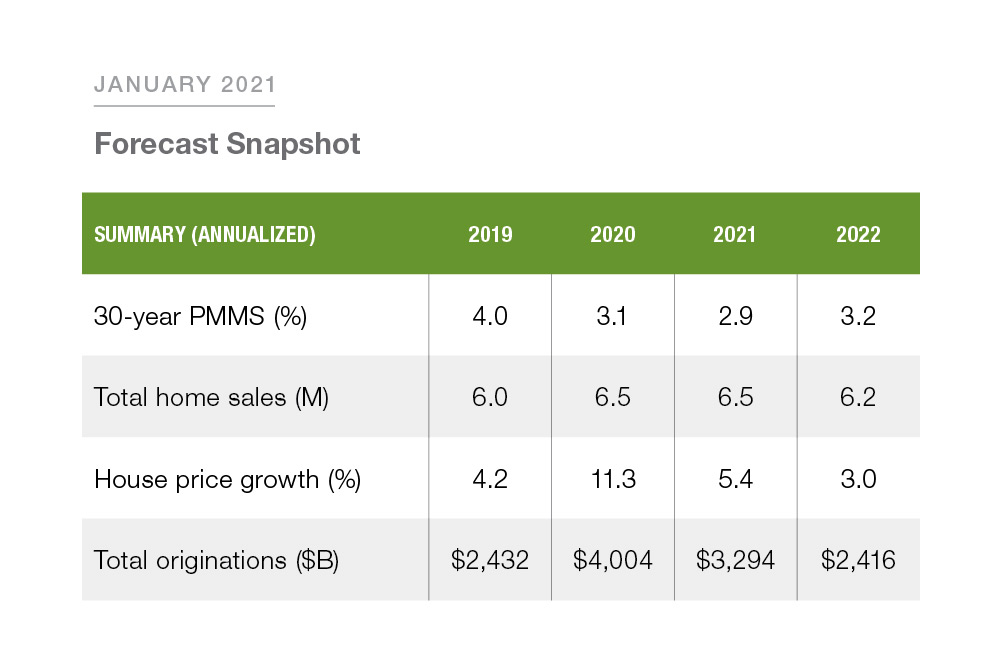

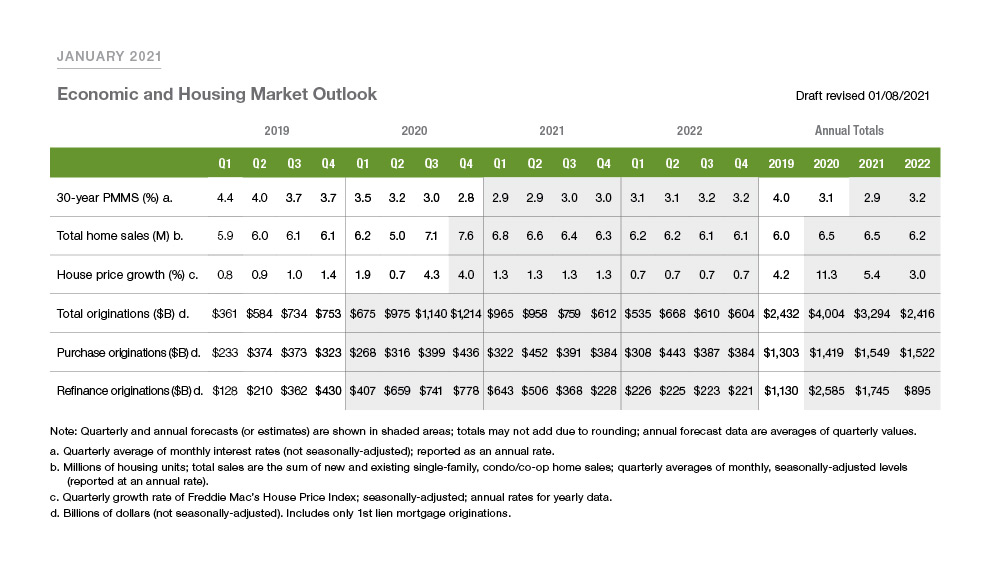

The housing market, which rebounded strongly over the summer, continued to perform well in the second half of the year. One of the biggest reasons the housing market performed strongly during the pandemic is the record low mortgage interest rates. As of the first week of January 2021, the U.S. weekly average 30-year fixed mortgage rate reached another historical low of 2.65%. This low mortgage interest rate environment is projected to continue through 2021 and 2022 as the Federal Reserve has voted to keep the interest rates anchored near zero for a longer period of time, if needed until the economy rebounds. With mortgage interest rates averaging around 2.8% in the fourth quarter of 2020, it is forecasted to average around 2.9% through the end of 2021.

These low interest rates and the ability to work remotely have continued to support the demand for housing, which is reflected in home sales reaching levels not seen since 2006. Total home sales reached 7.6 million in the fourth quarter of 2020 with strong showings from both existing and new home sales. Freddie Mac forecasts total home sales to be 6.8 million in the first quarter of 2021 and to average 6.5 million for full year 2021.

The surge in home sales has put pressure on housing inventory and caused the unsold inventory to hit an all-time low of 1.23 million, with only a 2.3-month supply at the current sales pace. The high volume of home sales and low supply of housing has edged up house prices by 4% quarter-over- quarter in the fourth quarter of 2020. Freddie Mac forecasts house price growth to moderate over 2021 and 2022 to 1.3% and 0.7%, respectively.

The low mortgage rates, increasing home sales, and increasing house prices have also given a boost to mortgage originations. Total mortgage originations are forecast to hit a historical high of $4 trillion in 2020, with refinance originations projected to hit nearly $2.6 trillion and purchase originations to hit $1.4 trillion. Total mortgage originations are forecast to be $1.2 trillion in the fourth quarter of 2020, mainly driven by a surge in refinance originations. The mortgage refinance originations are projected to hit $778 billion and purchase originations are projected to be at $436 billion in the fourth quarter of 2020. Freddie Mac forecasts total originations to decline to $3.3 trillion in 2021and decline further to $2.4 trillion in 2022.

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP