Quarterly Forecast: Housing Market Expected to Remain Strong Despite Major Supply Shortage and Historically High House Prices Across the U.S. Slowing Sales

The latest employment report from the U.S. Labor Department showed that while the U.S. economy added 850,000 nonfarm payroll jobs in June, it is still down 6.8 million jobs from February 2020. Job openings have surged to a record high of 9.2 million, and as the economy continues to reopen, we expect the economy to continue to mend. Consensus forecasts put full year U.S. Real GDP growth over 6% in 2021, which would help to close the large gap between the current level of economic activity and potential output.

Consumer price inflation surged in May, and the all item Consumer Price Index increased 5.0% year-over-year while the index for all items less food and energy increased 3.8% year-over-year. The Personal Consumption Expenditures (PCE) price index for May increased 3.9% year-over-year. Excluding food and energy, the core PCE price index (the Fed's preferred measure of price inflation) for May increased 3.4% year-over-year. Many economists consider these increased inflation readings to be transitory in nature and have forecasted inflation to fall back towards 2% over the next two years.

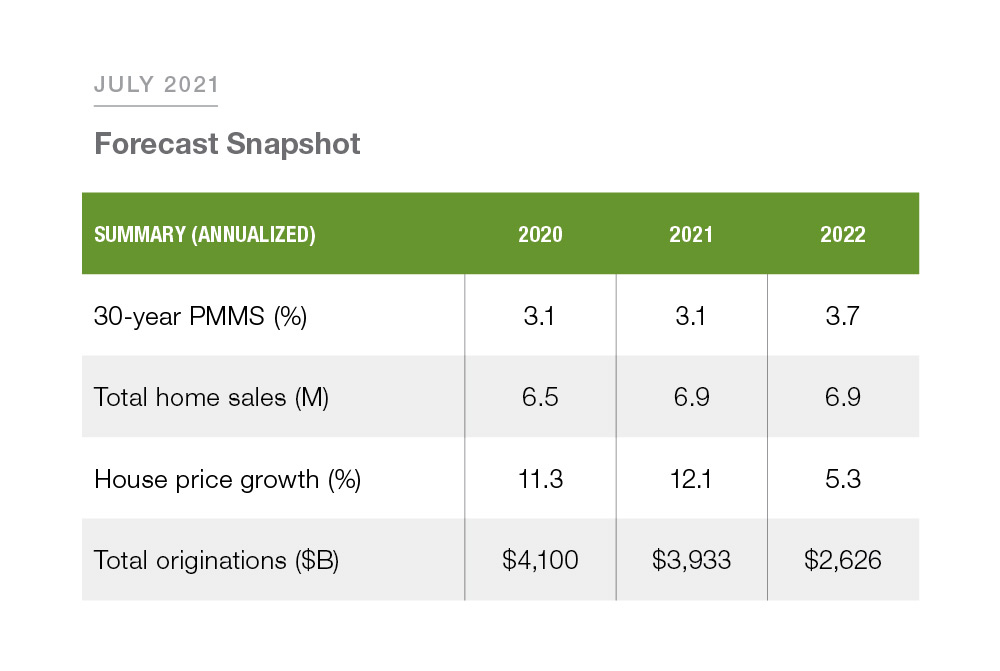

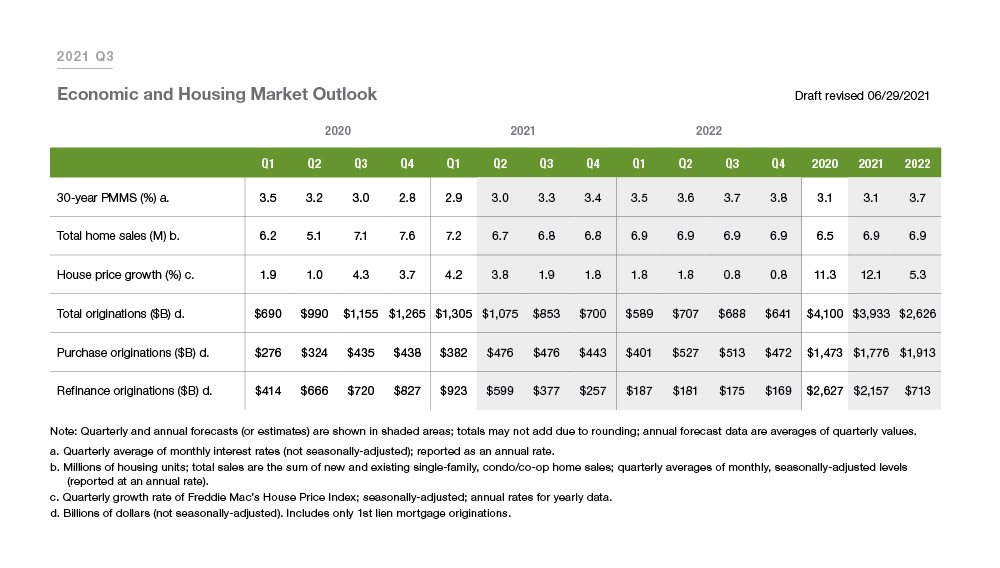

Indeed, the bond market has shrugged off these inflation readings, and long-term interest rates have fallen recently. The U.S. weekly average 30-year fixed-rate mortgage was 2.9% for the week of July 8, 2021. And, while we forecast rates to increase gradually later in the year, we don't expect to see a rapid increase. At the end of the year, we forecast 30-year rates will be around 3.4%, rising to 3.8% by the fourth quarter of 2022.

We expect low rates and a recovering labor market to be supportive of housing market activity. The single-family housing market remains robust, with U.S. house prices increasing 17% year-over-year in the May release of the Freddie Mac House Price Index (FMHPI). That's the highest 12-month house price growth in the history of the FMHPI going back to 1975, higher than the mid-2000s house price boom and higher than the inflation years of the late 1970s and early 1980s. In fact, according to data compiled by Nobel Prize winning economist Robert Shiller, current real (inflation-adjusted) house prices are the highest they have been in 131 years of data dating back to 1890.

High house price growth has been supported by increased demand due to low mortgage rates, disposable after-tax income that has risen during the current recession and a major shortage of housing supply relative to our population. The increase in house price growth will be less transitory than the increase in consumer prices, as the U.S. housing market will continue to struggle with a shortage of available housing for many months to come. But, we do forecast house price growth to moderate in 2022, with full year house price growth of 12.1% in 2021 followed by 5.3% in 2022.

The rapid run up in house prices may be starting to exhaust potential homebuyers. We've seen indications of softening demand in recent home purchase mortgage applications data. And, while sales metrics remain above pre-pandemic levels, the pace of sales has cooled since the first quarter of this year with home sales slowing for the past four consecutive months. That’s reflected in our home sales forecast, which has total home sales declining to 6.9 million in 2021 and 2022 after reaching a seasonally adjusted annual rate of 7.6 million and 7.2 million in the fourth quarter of 2020 and first quarter of 2021, respectively.

Strong home sales and robust house price growth will lift home purchase mortgage originations from $1.8 trillion in 2021 to $1.9 trillion in 2022. We expect refinance activity to soften as higher mortgage rates dampen activity, with refinance originations declining from $2.2 trillion in 2021 to $713 billion in 2022. Overall, we forecast that total originations will decline from $3.9 trillion in 2021 to $2.6 trillion in 2022.

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP