Fulfilling the Dream of Homeownership: How Do Families and Others Play a Role?

For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment.

Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down. Also, over 30% of renters and nearly 25% of existing renters and existing homeowners don’t know how much lenders require. If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.

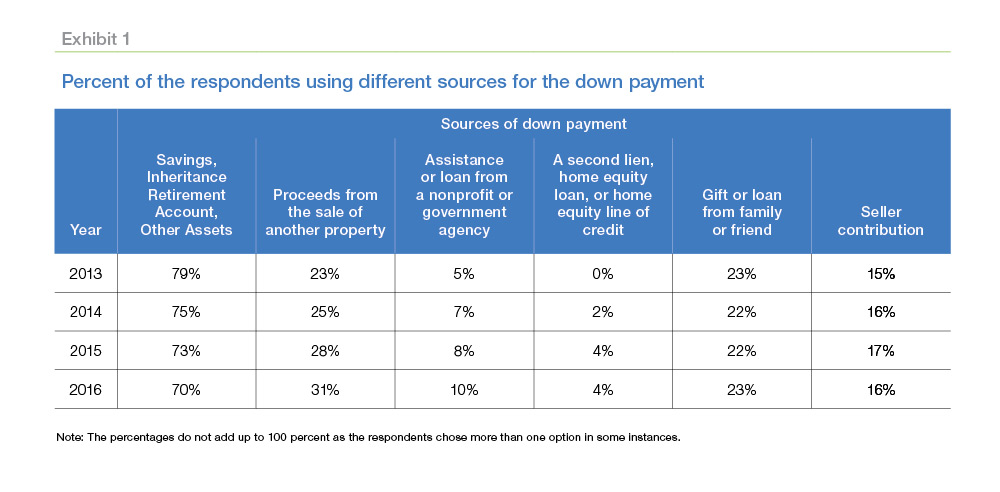

With these perceptions in mind, we were also interested in where the down payment funds have come from in recent years. Many prospective homebuyers believe that the down payment needs to come from personal savings, but this is not true. The down payment can come from several different sources, including assistance from government or non-governmental organizations, gift money from family and friends, seller contributions, or proceeds from a previous sale.

We used the National Survey of Mortgage Originations (NSMO) and our own internal data to

find out how families and others play a role in borrowers qualifying for a mortgage through down payments and co-signing. The primary findings on how homebuyers used various sources to make a down payment in 2016 versus prior years include:

- 70% of homebuyers used savings/inheritance/other assets or retirement monies, down from 79% in 2013.

- 31% of homebuyers used proceeds from the sale of another property, up from 23% in 2013.

- 10% of home buyers used assistance or a loan from a nonprofit or government agency, up from 5% in 2013.

- The share of homebuyers who used a gift or loan from family and friends has been constant since 2013 at nearly 25%.

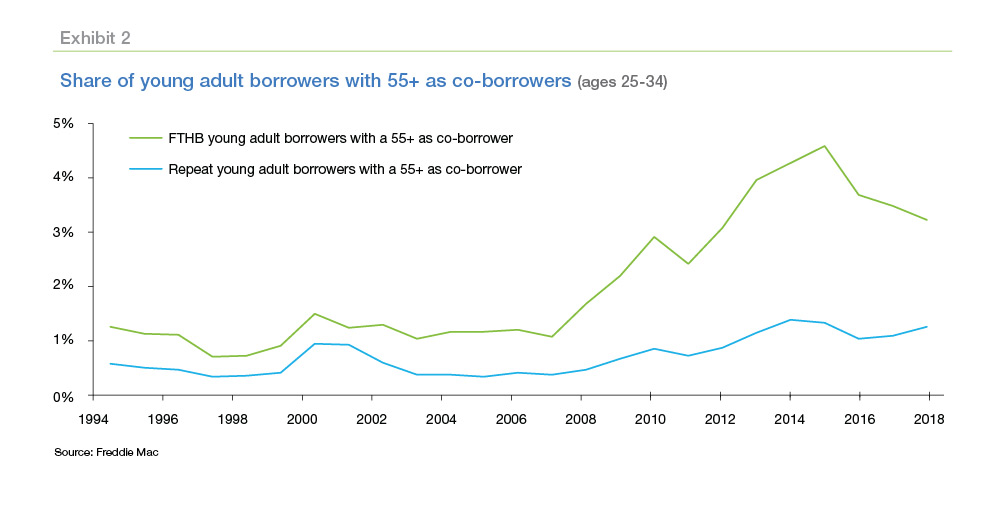

- The share of young adult borrowers aged 25-34 with a co-borrower aged 55+ has increased since 1994 in Freddie Mac’s Portfolio of purchase loans.

What sources of funds do homebuyers use for the down payment?

To determine the different sources homebuyers have used to come up with a down payment, we analyze a component of the National Mortgage Database (NMDB) called the NSMO. The survey is jointly funded and managed by the Federal Housing Finance Agency (FHFA) and Consumer Financial Protection Bureau (CFPB). A random sample of about 6,000 mortgages per quarter is drawn for NSMO from loans newly added in NMDB, and the borrowers are sent a survey questionnaire. The survey asks about their source of down payment on their recent purchase of a home. For our analysis, we use the NSMO survey data for mortgages originated from 2013 through 2016.

Exhibit 1 presents the percentage of respondents that used the listed sources for their down payments. There are overlapping sources of funds for a down payment, so the totals do not sum to 100. However, the overlapping is minimal. The dominant source is savings or other assets including retirement funds and inheritance. Excluding this dominant source, around 85% of respondents used only one funding source for the down payment. In 2016, 70% of respondents used savings and other assets, down from 79% in 2013. Proceeds from another sale is another popular source for down payment. Moreover, since 2014, homebuyers have started using second lien or home equity loans or HELOCs for the down payment on their new purchases. While the survey does not disclose whether the respondent is a repeat-buyer or a first-time homebuyer, it is very likely that homebuyers who are using the latter two sources are repeat-buyers. The growth in home prices in recent years have given existing homeowners more equity in their homes to put towards a subsequent purchase.

Notably, assistance or a loan from a nonprofit or government agency to pay for a down payment has increased since 2013. While 5% of homebuyers used such assistance for a down payment in 2013, the share grew to 10% in 2016. Traditionally, people have used gift monies from family and friends to pay for the down payment. The share of homebuyers who have used this funding source has stayed the same since 2013 at nearly 25%.

How are families supporting a homebuyer alternatively?

A large percentage of homebuyers depend on family support—financial or otherwise. A family can support a homebuyer by co-signing for a mortgage or listing themselves as a co-borrower. Combining income with a co-borrower allows borrowers to qualify for a higher loan amount.

Exhibit 2 provides the percentages of first-time and repeat homebuyers aged 25-34 (young adults), with a co-borrower aged 55+ since 1994. To gather this data, we identified all Freddie Mac purchase loans with a co-borrower between 1994 and 2018. Then, we analyzed the age profiles of the borrowers and co-borrowers and identified all of the young adult borrowers who listed an individual aged 55+ as a co-borrower on their application. We found that the share of young adult borrowers with a co-borrower aged 55+ has increased since 1994.

In 1994, the share of young adult repeat-buyers who listed co-borrowers aged 55+ was 0.6%, but in 2018, the share reached 1.2%, suggesting a modest increase in family support provided by

co-signing mortgages, perhaps to help the borrowers qualify for certain loan amounts. Family support as a co-borrower seems to be even more important for first-time homebuyers. This is illustrated by the fact that the share of young adults who listed co-borrowers aged 55+ is higher among first-time homebuyers. While 1.3% of young adults who were first-time homebuyers listed 55+ as co-borrowers in 1994, the share increased to 3.2% in 2018. It is notable that the share of young adult first-time homebuyers who depend on co-borrowers aged 55+ rose after the recession and has not declined much since. The share of first-time homebuyers who listed co-borrowers aged 55+ is even higher in high cost markets in the West. For instance, 7.2% of first-time homebuyers in the San Jose metro area listed 55+ as their co-borrowers, and 5% of first-time homebuyers listed 55+ as co-borrowers in the San Francisco metro area in 2017.

Conclusion

It is important to note that down payments can come from different sources and do not have to come only from personal savings. Regardless, two-thirds of consumers used their personal savings or investments for their down payment in recent years in our analysis of the NSMO data, and roughly the same number of those planning to purchase a home in the next three years say they will as well.

Apart from helping with down payments, one other way families are helping fulfill the homeownership dream of young adults is by co-signing the mortgage loan to help borrowers qualify for a mortgage, especially among first-timers. The percentage of young adult homebuyers with family co-borrowers remains small.

While many prospective homebuyers may prefer to put 20% down, last year the median down payment on a house was 13% for buyers overall, and 7% for first-time buyers according to the National Association of Realtors. For those who couldn’t save for the entire down payment, they turned to family and others for assistance.

The findings suggest a real opportunity for the mortgage industry to educate borrowers about low down payment products and sources of down payment assistance beyond personal savings. Doing so may help more first-time homebuyers realize the dream of homeownership sooner.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Senior Macroeconomic Housing Economist