Housing and Economic Research

Original research and analysis on housing trends, the economy and the mortgage market

U.S. Economic, Housing and Mortgage Market Outlook – April 2024

Housing demand is on the rebound, but with mortgage rates still averaging 6.8%, many prospective homebuyers continue to be priced out of the market.

Read MoreU.S. Economic, Housing and Mortgage Market Outlook – April 2024

-

Outlook | March 20, 2024

U.S. Economic, Housing and Mortgage Market Outlook – March 2024

While the U.S. economy remains robust, inflation pressure continues, which could keep mortgage rates higher for longer. More

-

Outlook | February 26, 2024

U.S. Economic, Housing and Mortgage Market Outlook – February 2024

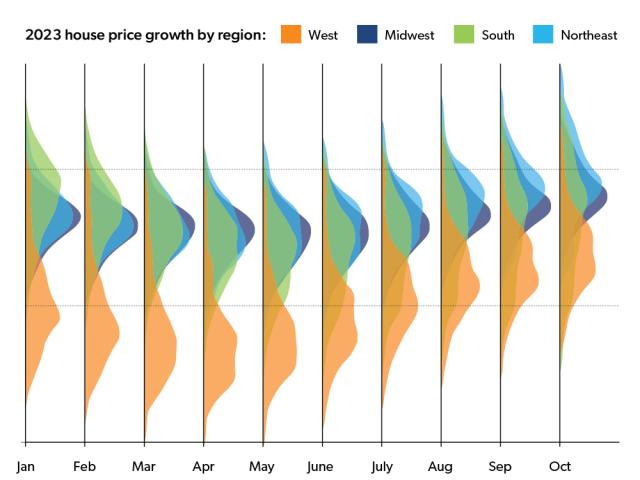

The housing market continues to feel the impact of higher mortgage rates with home sales at multi-decade lows and starts declining over 2023. Robust demand and a lack of supply have led to a reacceleration in house prices. More

-

Outlook | January 22, 2024

Economic, Housing and Mortgage Market Outlook – January 2024

While the economy continues to expand and added 2.7 million jobs in 2023, signs point to a normalization in the labor market as job growth is expected to moderate in 2024. More

-

Outlook | December 20, 2023

Economic, Housing and Mortgage Market Outlook – December 2023

Bolstered by resilient consumer spending and investment, the U.S. economy expanded in 2023, defying expectations of a recession. More

-

Outlook | November 21, 2023

Economic, Housing and Mortgage Market Outlook – November 2023

Economic growth remained strong in Q3, primarily due to solid consumer spending. We expect the economy to slow down as the full impact of higher interest rates is felt. More

-

Outlook | October 20, 2023

Economic, Housing and Mortgage Market Outlook – October 2023

The U.S. economy continues to grow at a pace closer to long-term trend as the labor market and consumer spending remain strong. More