Housing Sentiment in the Third Quarter of 2022

Freddie Mac’s quarterly housing outlook pulse survey evaluates public sentiment on housing-related issues. In the third quarter of 2022, market confidence fell below 50% for the first time since tracking began in March 2020. As interest rates change, the likelihood of buying or refinancing a home has also decreased since last quarter.

We are keeping a pulse on the following four key areas of the housing market.

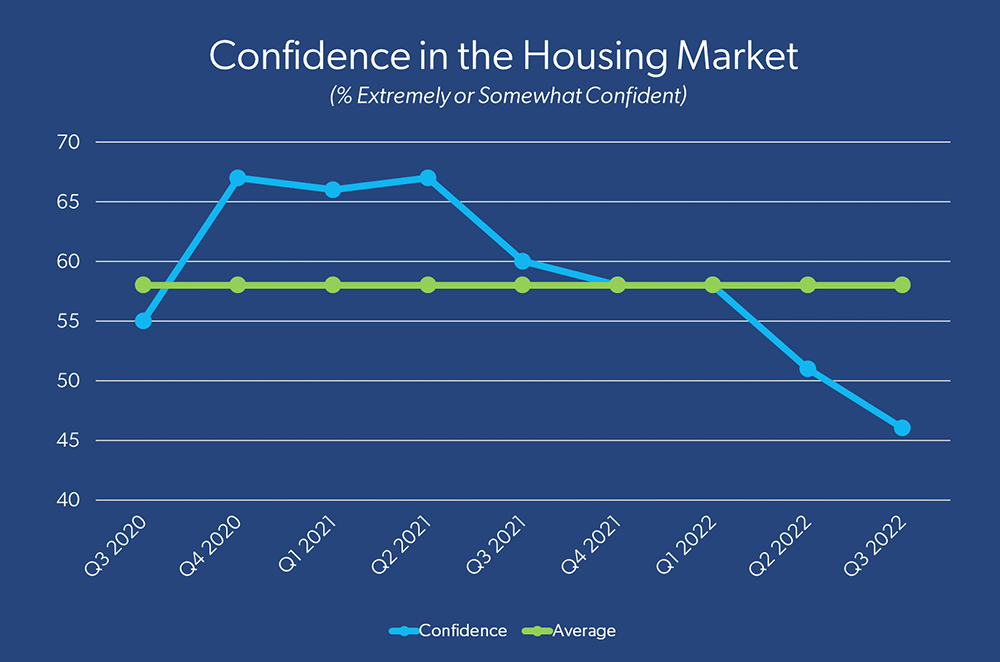

Market Confidence

- 46% are confident the housing market will remain strong over the next year. This is down 5 percentage points from last quarter.

Enlarge Image

Housing Affordability

- 60% of renters and 24% percent of homeowners spend more than 30% of their monthly income on housing.

Payment Concerns

- 48% are concerned about making housing payments. This is true for 62% of renters (a 6-percentage point decrease from last quarter) and 37% of homeowners.

Market Activity

- 19% are likely to buy a home in the next six months, a 5 percentage point decrease from last quarter.

- 16% of homeowners are likely to sell in the next six months.

- 16% of homeowners are likely to refinance in the next six months, a 7 percentage point decrease from last quarter.

Freddie Mac’s Market Insights team partners with Heart+Mind Strategies to field its housing outlook pulse survey. This survey, conducted online August 13-27, 2022, included 1,116 interviews. Quotas were used to ensure a representative population on age, gender, ethnicity and region.

Interested in more consumer research? Gain insights into the housing market from surveys of homebuyers, homeowners and renters in Freddie Mac Consumer Research.