Housing Sentiment in the Second Quarter of 2022

Freddie Mac’s quarterly housing outlook pulse survey evaluates public sentiment on housing-related issues. In the second quarter of 2022, market confidence has reached its lowest point since the onset of the pandemic. In addition, with rising inflation affecting cost of living, we found there is increased concern about making housing payments — especially among renters.

We are keeping a pulse on the following four key areas of the housing market.

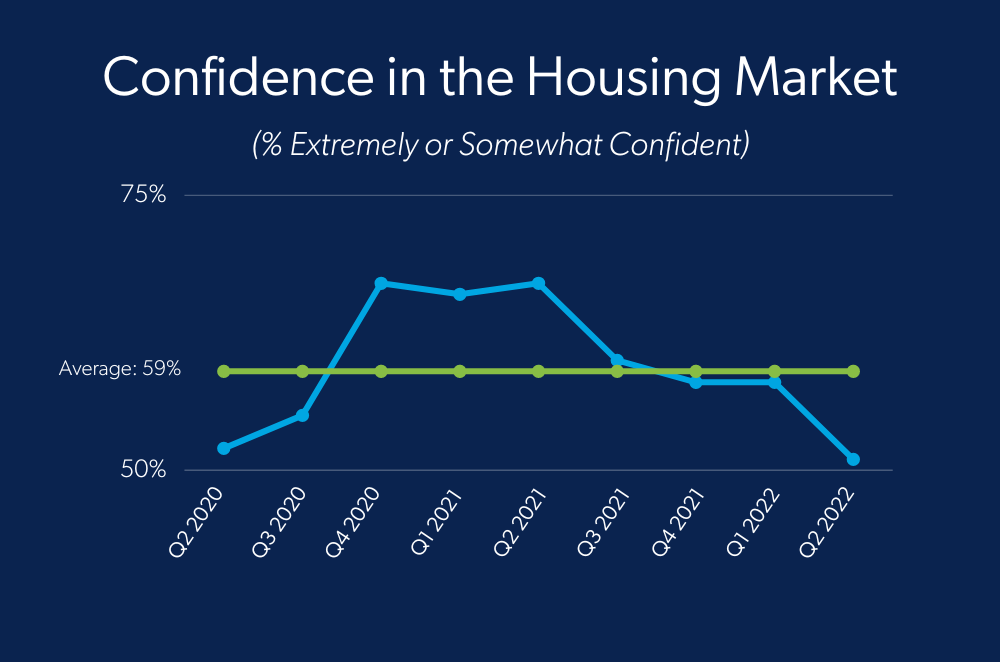

Market Confidence

- 51% are confident the housing market will remain strong over the next year. This is down 7 percentage points from last quarter.

Housing Affordability

- 56% of renters and 24% of homeowners spend more than 30% of their monthly on income on housing.

Payment Concerns

- 51% are concerned about making housing payments, up 4 percentage points from last quarter. This is true for 68% of renters (a 10-percentage point increase from last quarter) and 38% of homeowners (a 3-percentage point decrease from last quarter).

Market Activity

- 24% are likely to buy a house in the six months.

- 17% of homeowners are likely to sell in the next six months.

- 23% of homeowners are likely to refinance in the next six months.

Freddie Mac’s Market Insights team partners with Heart+Mind Strategies to field its housing outlook pulse survey. This survey, conducted online May 13-24, 2022, included 1,135 interviews. Quotas were used to ensure a representative population of age, gender, ethnicity and region.

Interested in more consumer research? Gain insights into the housing market from surveys of homebuyers, homeowners and renters in Freddie Mac Consumer Research.