Insights, Notes, Briefs & Spotlights

Insights and Research Notes are comprehensive research on current topics of importance to housing and the economy.

Research Briefs and Spotlights are more concise analyses of current topics of importance to housing and the economy.

Explore Research

-

Spotlight | December 20, 2024

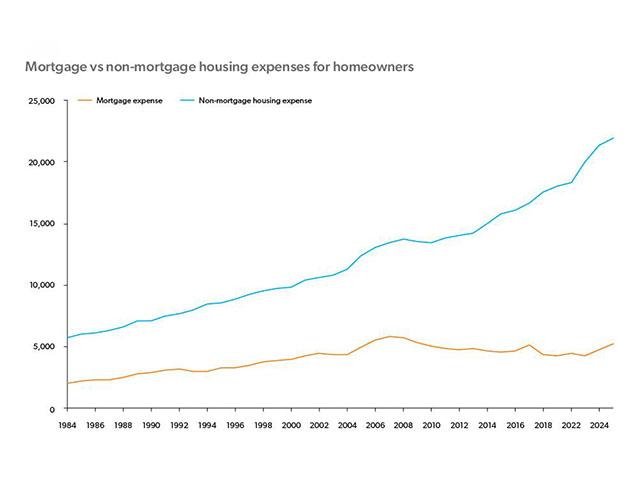

Homeowner vs. Renter Spending in an Era of Rising Housing Costs

Homeowners locked into low mortgage rates have shielded themselves from rising interest rates and house prices, whereas renters do not have the same advantage. More

-

Spotlight | November 26, 2024

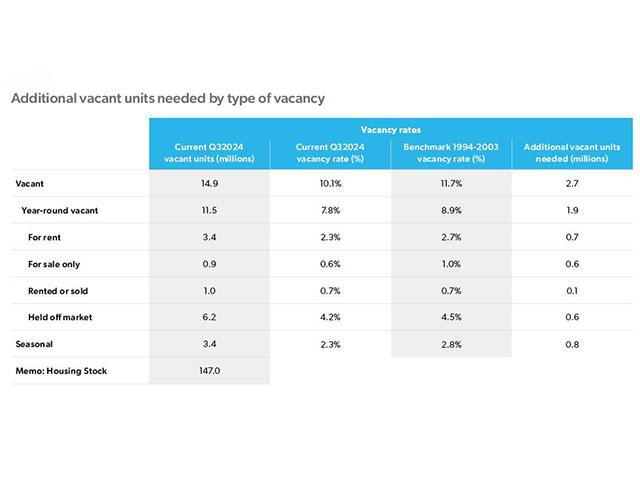

Housing Supply: Still Undersupplied by Millions of Units

The housing market continues to be plagued by a shortage of units for rent and for sale. We estimate the housing shortage is 3.7 million units as of 3Q24. More

-

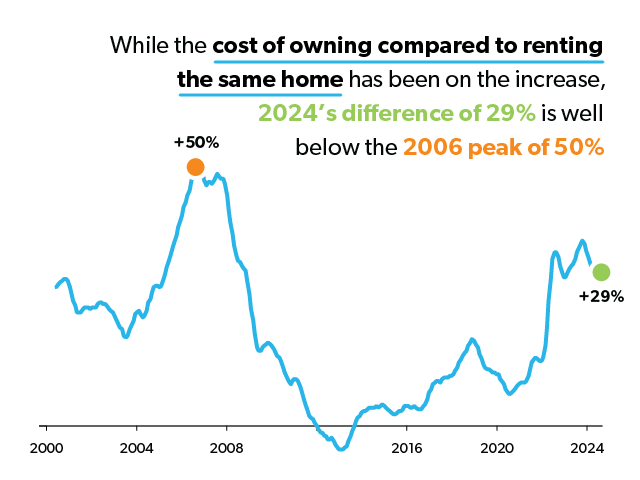

Research Note | November 12, 2024

The Decline in Relative Housing Affordability and the Impact on Homebuyer Search Behavior

In this analysis, we use actual, detailed transaction data on rents, home prices, and mortgage payments for individual homes and borrowers to produce a new relative affordability measure. More

-

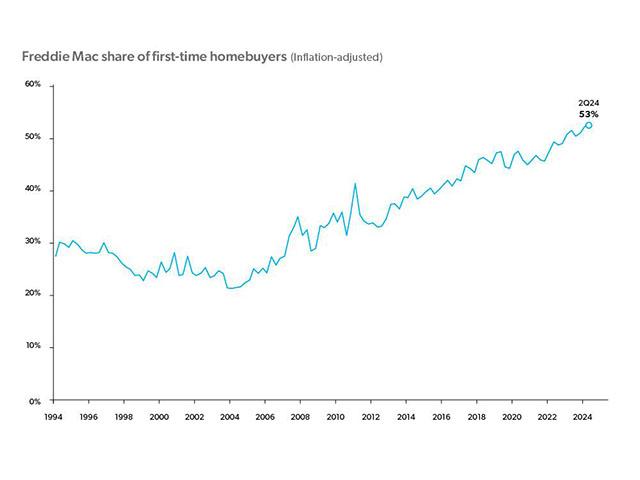

Spotlight | October 18, 2024

First-Time Homebuyer Activity

First-time homebuyers are increasingly driving demand in the housing market. However, they face headwinds in affordability, supply and overall economic conditions. More

-

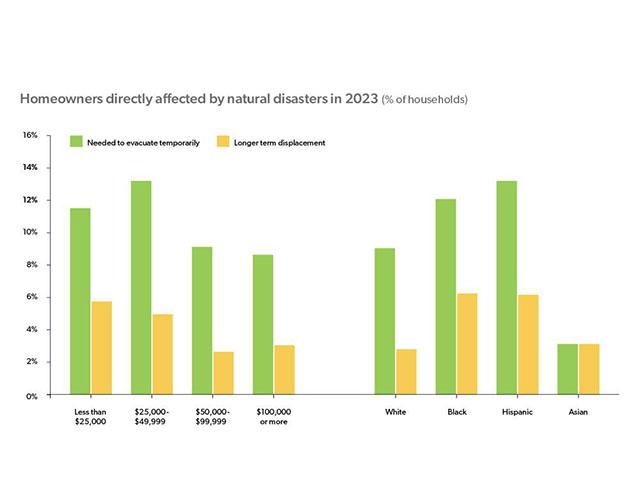

Spotlight | September 23, 2024

Natural Disasters and Decision Making

For renters, the threat of natural disasters is likely to affect location choices; whereas homeowners are more likely to invest in improving homes to reduce risk. More

-

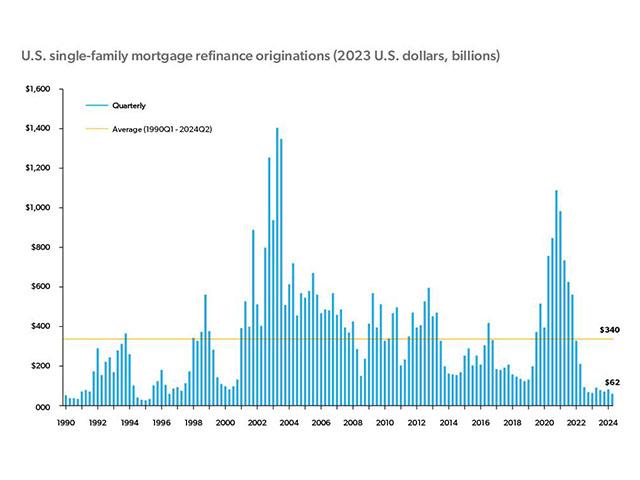

Spotlight | August 20, 2024

Refinance Originations Trends Through Q2 2024

Quarterly refinance volume in Q2 2024 was $62 billion, the lowest since Q3 1996. Refinance volume in the first half of 2024 was the weakest since the first half of 1995. More