When Rates Are Higher, Borrowers Who Shop Around Save More

As mortgage rates remain higher than in recent years, homebuyers can potentially save $600-$1,200 annually by applying for mortgages from multiple lenders, according to new research by Freddie Mac.

To understand how, Freddie Mac researchers used the organization’s Loan Product Advisor® (LPA) tool to look at the daily dispersion of mortgage interest rates on mortgage applications for similar borrower profiles over time.

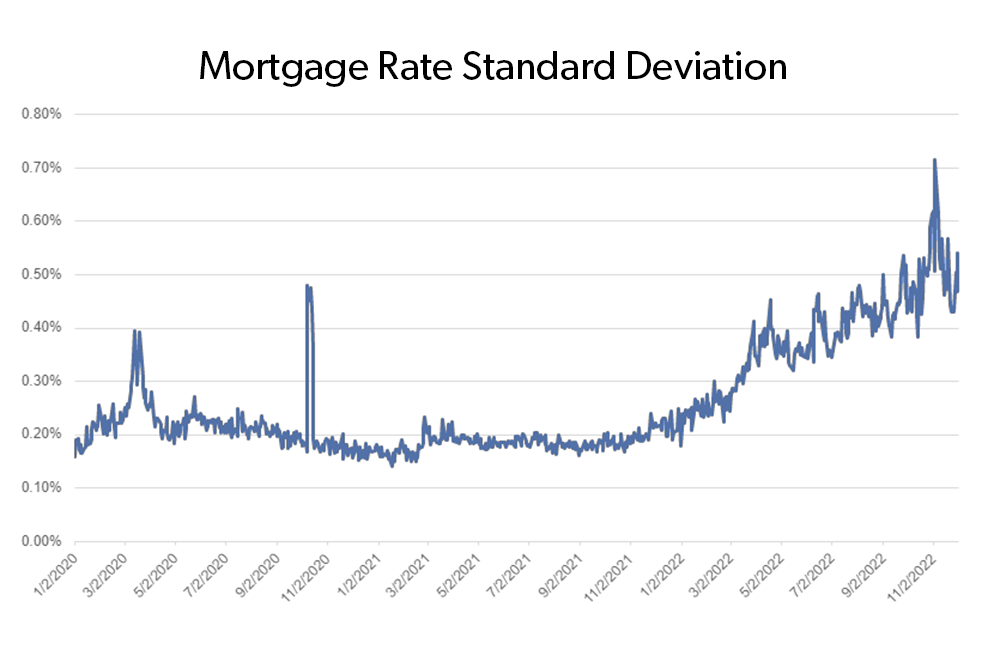

Mortgage Rate Dispersion More Than Doubled in 2022

Using LPA data, researchers can see the dispersion (or variability) in mortgage rates for similar mortgage applications submitted to Freddie Mac by different lenders on the same day. Put simply: when there is a wider array of mortgage rates offered, similar borrowers may receive notably different rates based on the lender.

For instance, between 2010 and 2021, when mortgage rates peaked at 5.21%, borrowers who applied with two different lenders reduced their mortgage rate by an average of 10 basis points. During the first 11 months of 2022, when the average mortgage rate increased at its fastest pace in 40 years and surpassed 7%, the average reduction in rate doubled, to 20 basis points.

Our researchers filtered the data between 2010 and 2022 to find the mortgage rates for specific loan applications that comprised the following:

- 30-year fixed-rate, conventional purchase loan.

- FICO score greater than or equal to 740.

- Loan-to-value ratio between 75% and 80%.

- Loan amount between $250,000 and $350,000.

From that sample, our researchers measured the normally distributed mortgage rate data using standard deviation — where 68% of the data lies within ±1 standard deviation from the average and 95% of the data lies within ±2 standard deviations. They found that rate dispersion in 2022 more than doubled the previous 11-year average.

- Between 2010 and 2021, the average mortgage rate dispersion was less than 20 basis points (or 0.2%).

- In 2022, the average mortgage rate dispersion accelerated throughout the year and averaged about 50 basis points (or 0.5%) in October and November.

The increase in rate dispersion means that consumers with similar borrower profiles are being offered a wide range of mortgage rates. In the context of today’s rate environment, although mortgage rates are averaging around 6%, many consumers that fit the same borrower profile could have received a better deal on one day and locked in a 5.5% rate, and on another day locked in a rate closer to 6.5%.

— Genaro Villa, Macro and Housing Economics Professional, Freddie Mac

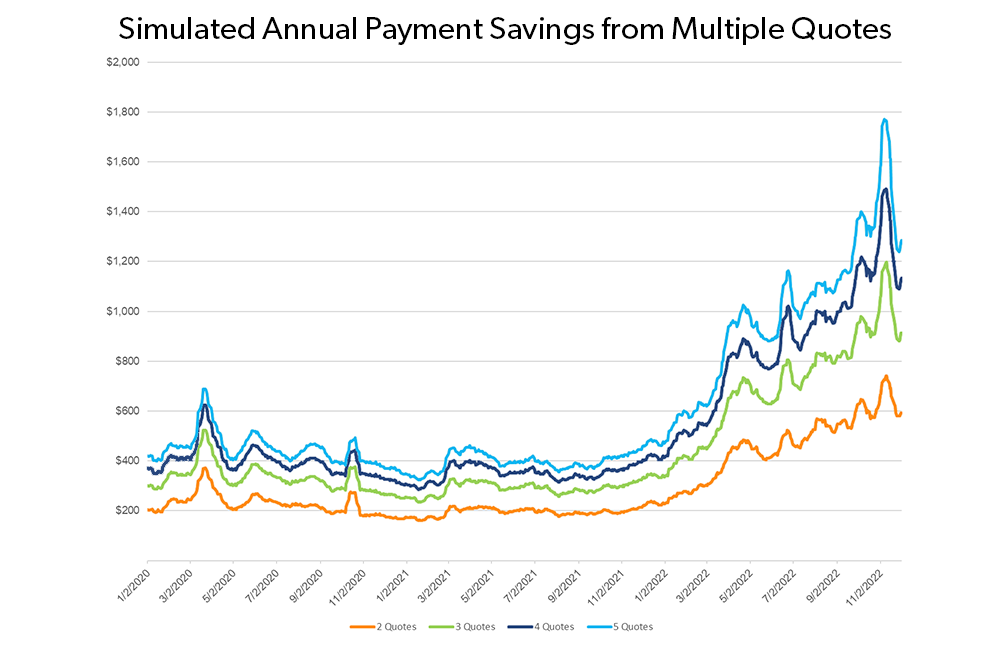

How Rate Dispersion Translates to Savings

To determine the projected savings borrowers can attain from shopping additional lenders, our researchers ran a rate quote simulation using the filtered data for each day stretching back to 2010.

In the simulation, researchers randomly drew 500 rates from the sample and averaged the results. They then randomly drew two rates, kept the smaller of the pair, and averaged the results. This process was repeated for three, four and five rate draws.

Between 2010 and 2021, the exercise found that borrowers who shopped with two different lenders reduced their mortgage rate by an average of 10 basis points. In 2022, the average reduction doubled to 20 basis points. These rate reductions translate to potential savings on interest payments, which increase as a borrower applies to additional lenders.

In high interest months of October and November 2022, borrowers who received:

- Two rate quotes could have saved as much as $600 annually.

- At least four rate quotes could have saved more than $1,200 annually.

“Another way to look at the cost savings is from a cumulative perspective,” Villa said. “Borrowers who received as many as five rate quotes during the second half of 2022 could have potentially saved more than $6,000 over the life of the loan, assuming the loan remains active for at least five years. That makes a difference.”

As the below graphs show, the average annual savings from obtaining additional rates have increased significantly in the past year compared to the previous 11 years.

Graph shows a 10-day moving average of annual principal and income savings based on daily loan average.

Borrowers who don’t shop for rates may receive lower-than-average rates, but our findings indicate that mortgage applications from multiple lenders can be especially beneficial when there is high dispersion among rates. There is some credit score risk when applying for several mortgages in a short span, but ultimately a borrower must decide if those risks outweigh the savings from lower payments.

For more insights from Freddie Mac’s research team, visit Research Insights, Notes & Briefs.