Insights, Notes, Briefs & Spotlights

Insights and Research Notes are comprehensive research on current topics of importance to housing and the economy.

Research Briefs and Spotlights are more concise analyses of current topics of importance to housing and the economy.

Explore Research

-

Research Brief | March 2, 2023

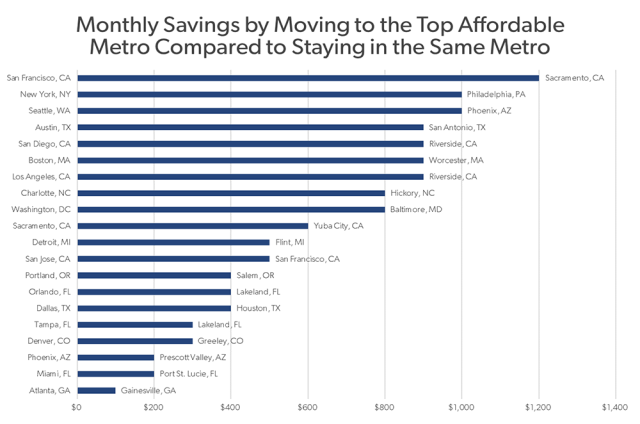

In Today’s Housing Market, Renters Have More Financial Incentive to Migrate to More Affordable Metros than Homeowners

First-time homebuyers’ incentives to move from a high-cost metro to a more affordable area are significantly higher in a higher interest rate environment, but existing homeowners have more incentive to stay put. More

-

Research Brief | February 16, 2023

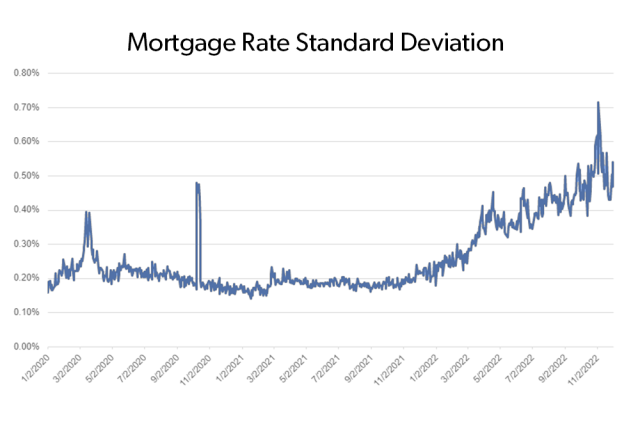

When Rates Are Higher, Borrowers Who Shop Around Save More

As mortgage rates remain higher than in recent years, homebuyers can potentially save $600-$1,200 annually by applying for mortgages from multiple lenders. More

-

Research Note | December 7, 2022

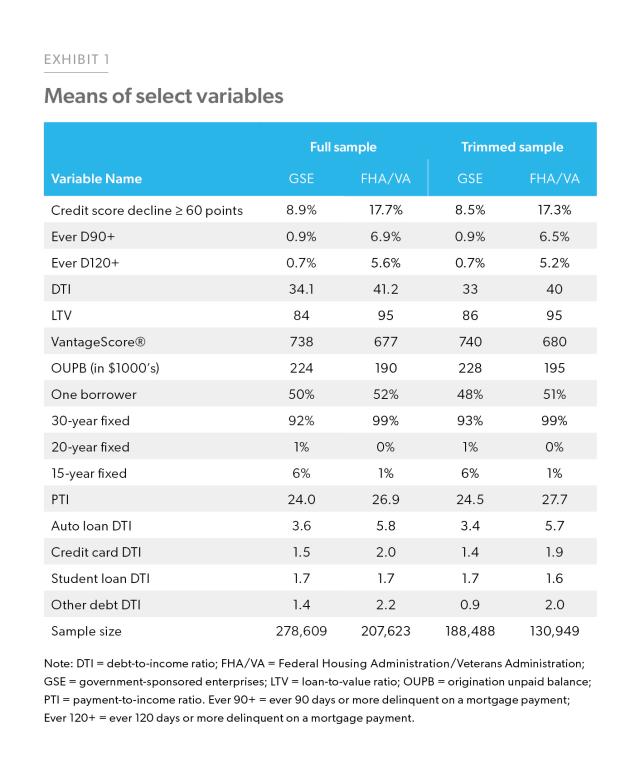

The Drivers of Financial Stress and Sustainable Homeownership

This analysis explores the drivers of financial stress among first-time homebuyers. Identifying the factors leading to household financial stress is important to understanding what makes homeownership sustainable. More

-

Research Note | November 9, 2022

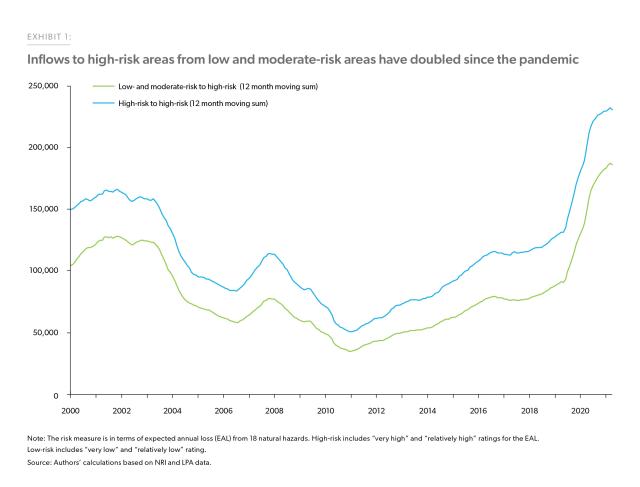

Migration to Environmentally Risky Areas: A Consequence of the Pandemic

The pandemic amplified the exodus from large, expensive metro areas to smaller, more affordable destinations. Many such desirable destinations that are farther from the cities are not only less costly but are also closer to natural amenities. Natural amenities, however are often associated with environmental risks and moving closer to these amenities can also mean increased exposure to various natural hazards. More

-

Research Note | November 3, 2022

Freddie Mac’s Newly Enhanced Mortgage Rate Survey Explained

To ensure that Freddie Mac’s Primary Mortgage Market Survey® continues to provide high-quality information on the mortgage market, we are making new enhancements to our methodology. More

-

Research Brief | September 8, 2022

Co-Borrowing Is on the Rise for First-Time Homebuyers

An increasing percentage of young first-time homebuyers are relying on support from older generations, including their parents, to afford a home. More