Insights, Notes, Briefs & Spotlights

Insights and Research Notes are comprehensive research on current topics of importance to housing and the economy.

Research Briefs and Spotlights are more concise analyses of current topics of importance to housing and the economy.

Explore Research

-

Spotlight | January 22, 2024

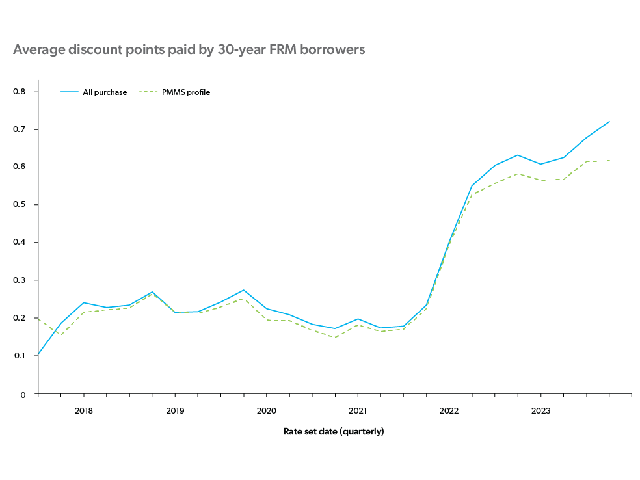

More Borrowers Pay Discount Points, But It May Not Be Worth It

Facing higher borrowing costs, borrowers are paying more discount points to buy down their mortgage rate, but they may not be getting the benefit. More

-

Spotlight | December 20, 2023

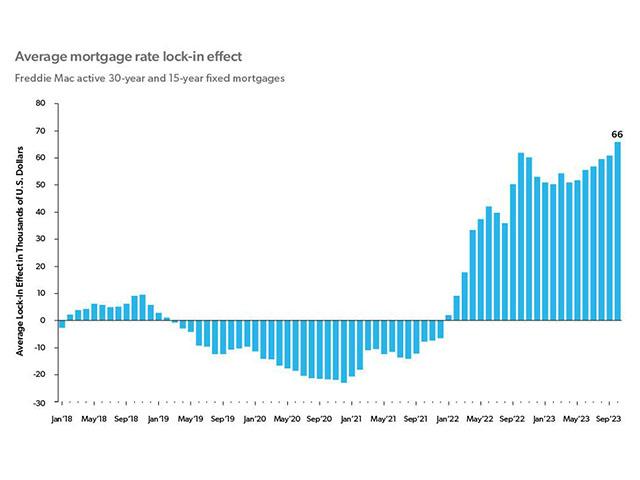

The Year in Review: Top Three Trends of 2023

Our recap of 2023 spotlights the three key trends that defined the year: resilient consumers, the rate lock-in effect and a rebound in house prices. More

-

Spotlight | November 21, 2023

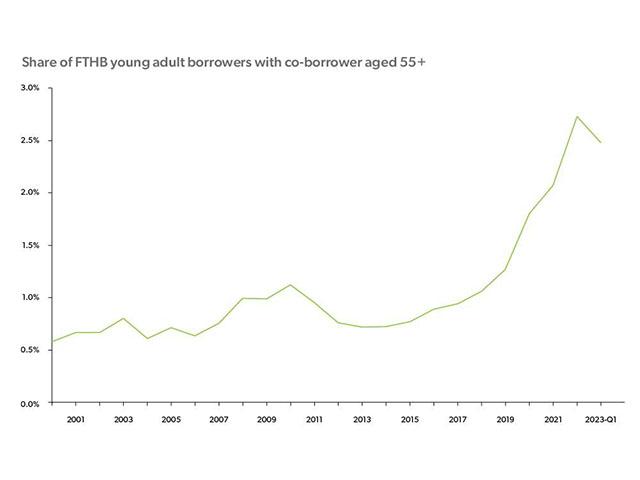

Young Adult Homebuyers are Cracking the Homeownership Code

Despite affordability challenges, young adult first-time homebuyers have been a dominant driver of the housing, getting help from co-borrowers aged 55+. More

-

Spotlight | October 20, 2023

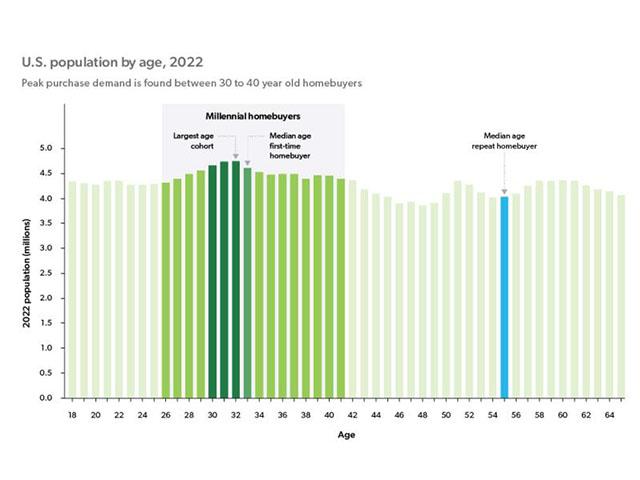

Millennial Household Formation — Potential for Another 2 Million Households

Millennials are not forming households at the same rate and age as Boomers and Gen Xers. If they had, there would be 2 million more households today. More

-

Spotlight | September 21, 2023

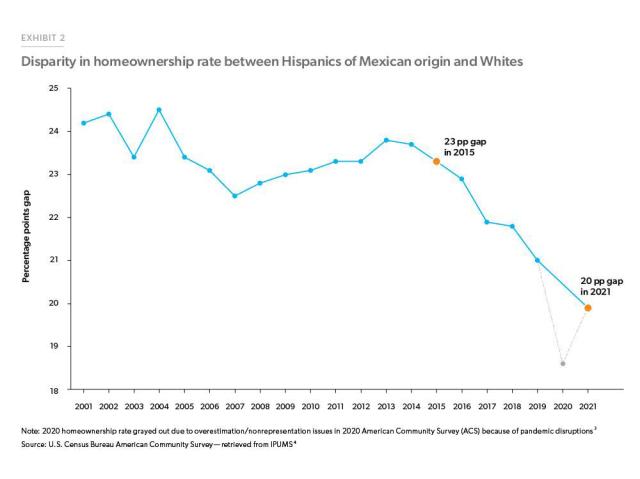

Hispanic Homeownership Gap Declines to the Lowest Level in 20 Years

The homeownership gap between Whites and Hispanics of Mexican origin declined to the lowest level in 20 years. More

-

Spotlight | August 17, 2023

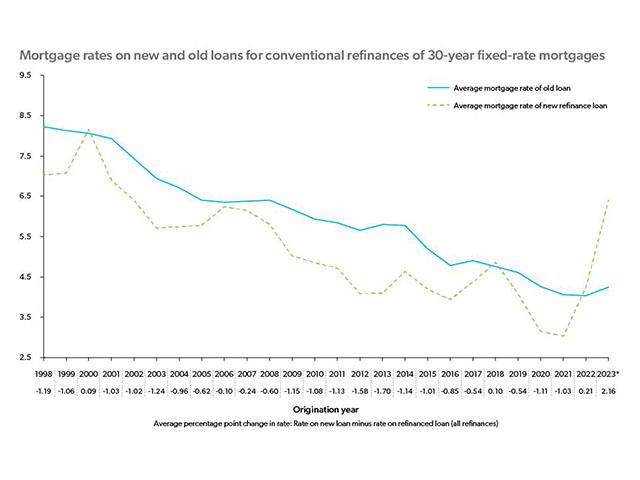

Refinance Trends

Exhibit 2: U.S. Single-Family Refinance Originations - Bar chart of single-family refinance originations in 2022 US dollars. Average refinancing originations from 1990 to 2023 were 358 billion dollars per year. Higher mortgage rates mean refinance origination activity in 2023 has been at the lowest level in almost 30 years. More