Insights, Notes, Briefs & Spotlights

Insights and Research Notes are comprehensive research on current topics of importance to housing and the economy.

Research Briefs and Spotlights are more concise analyses of current topics of importance to housing and the economy.

Explore Research

-

Research Note | June 22, 2022

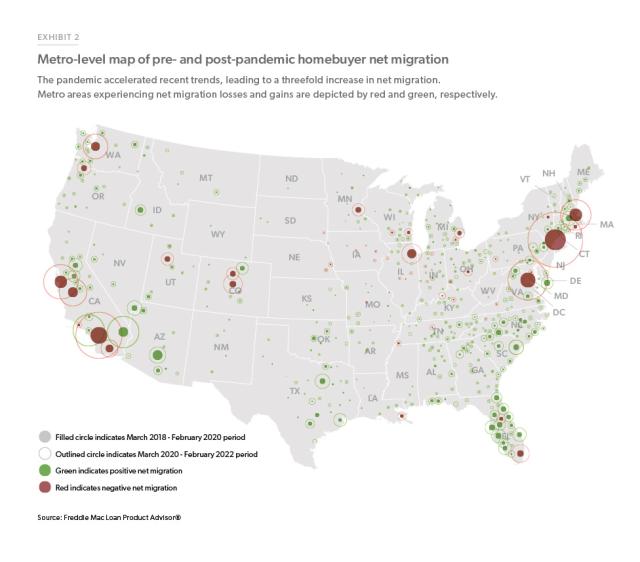

In Pursuit of Affordable Housing: The Migration of Homebuyers within the U.S.—Before and After the Pandemic

In this Research Note, the first of a three-part series on migration, we compare net migration of homebuyers across U.S. metropolitan areas ("internal migration") and explore the patterns of metro-to-metro migration flows. More

-

Research Note | June 9, 2022

What Drove Home Price Growth and Can it Continue?

Home prices, the best single indicator of whether market conditions favor buyers or sellers, jumped 33% nationally over the past two years. What is behind the strength of the housing market, and can it continue? More

-

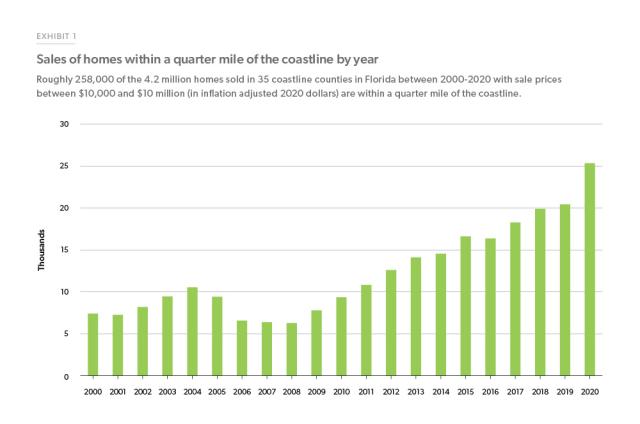

Research Brief | May 6, 2022

Homebuyers in Coastal Florida Are Not Factoring Sea Level Rise Risk into Home Prices

Our analysis showed that home prices in coastal Florida may not be taking into account the future risk of rising sea levels. More

-

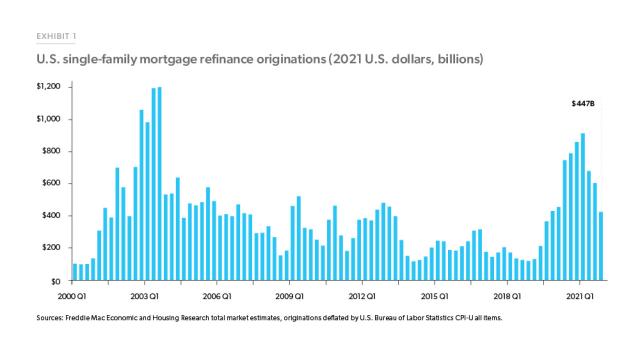

Research Note | April 25, 2022

Trends in Mortgage Refinancing Activity

This Research Note covers recent developments in the U.S. mortgage market. We review trends in mortgage refinancing activity, including a detailed look at payment savings and equity extraction through cash-out refinances. We also examine recent trends in mortgage origination discount points and fees and close with a discussion of heterogeneity in the mortgage market. More

-

Research Note | March 16, 2022

Sea Level Rise and Impact on Home Prices in Coastal Florida

In this Research Note, we assess whether primary homebuyers and residential market investors in coastal Florida consider the future risk of rising sea levels when making a home purchase decision and whether they pay less for homes they deem at risk. More

-

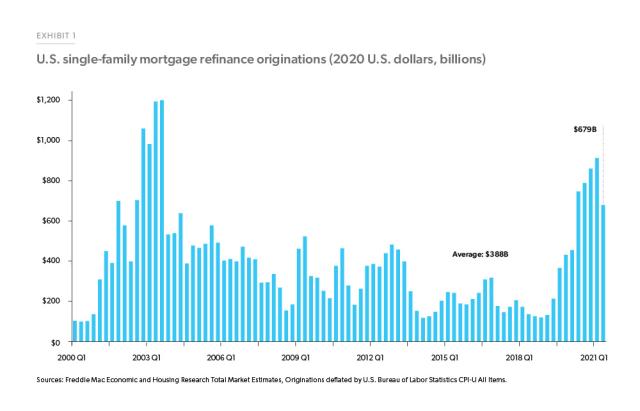

Research Note | October 29, 2021

Refinance Trends in the First Half of 2021

In the first half of 2021, homeowners continued to take advantage of the low mortgage rates and increased home equity to refinance their properties, reducing their monthly payments and extracting equity through cash-out refinances. More