Temporary Mortgage Rate Buydown Activity Spiked in Late 2022, Now Becoming Less Common

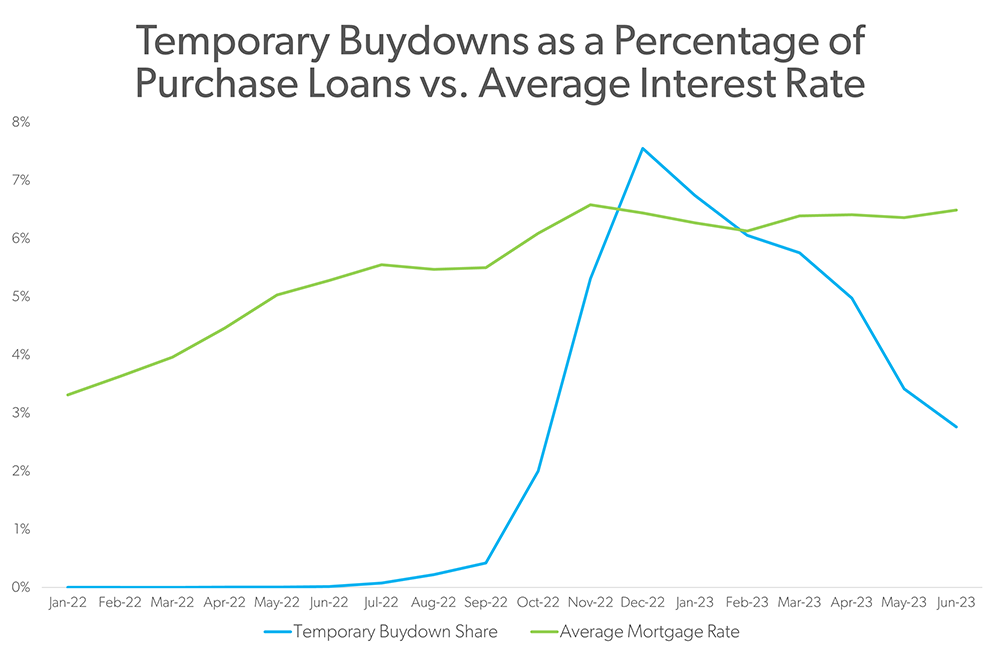

As mortgage rates began to increase in the second-half of 2022, temporary mortgage rate buydowns increased in popularity, possibly explaining some of the surprising strength of home buying demand as rates remain elevated in 2023.1 According to Freddie Mac data on purchase, 30-year fixed-rate, conforming and owner-occupied mortgages, temporary buydown mortgages comprised 2.8% of Freddie Mac funded loans in June 2023, up from near zero a year ago but down from a peak of 7.6% in December 2022. However, given the cost, the share of lenders offering these loans and their geographic concentration, temporary rate buydowns remain a niche market and seem unlikely to be a meaningful source of additional homebuyer demand.

A temporary rate buydown is a mortgage that allows homebuyers to reduce their interest rate for a limited period. The size of the reduction and length depends on the type of mortgage. For example, nearly two out of three recent temporary rate buydowns are a “2-1”, where homebuyers pay 2 percentage points less in the interest rate the first year, 1 percentage point less the second year and the full rate after that. Other types include a “3-2-1,” a “1-0” and a “1-1.” No matter the type of buydown, lenders must qualify the homebuyers at the full interest rate.

Our research is based Freddie Mac funded loans between January 2022 to June 2023 with the following criteria: purchase, 30-year fixed-rate, conforming and owner-occupied.2

Trends in Temporary Mortgage Rate Buydowns

In the second half of 2022, the share of temporary buydowns spiked when average mortgage rates climbed over 6% for the first time since 2008. Though the surge in temporary buydowns has since abated somewhat, the increase in buydowns may signal a willingness by homebuyers to pay more over the life of their loan to lower their monthly payments in the short term, at least for the first several years of their mortgage.

There may be a trade-off, however. Freddie Mac research based on the data from June 2022 to June 2023 shows that homeowners with temporary buydown options received interest rates that were 15 basis points higher on average. This implies that by choosing the buydown option, borrowers may end up paying slightly more money throughout the life of the mortgage, depending on when they refinance or move. This trade-off isn’t surprising since the lower initial payments need to be made up by either higher upfront charges, a higher rate, or both.

The cost to cover the difference in rates is normally paid upfront by the borrower, builder, seller, or other interested parties. These products have been especially popular in the financing of new homes, since home builders—who generally partner with mortgage company affiliates—can simultaneously negotiate the sale price and the mortgage.

Enlarge Image

Source: Freddie Mac Funded Loan data

The analysis above is based on funded loans. We also found broadly consistent results in loan application data, both our own and from a vendor with data on wholesale loan applications.

A Niche Market for Temporary Mortgage Rate Buydowns

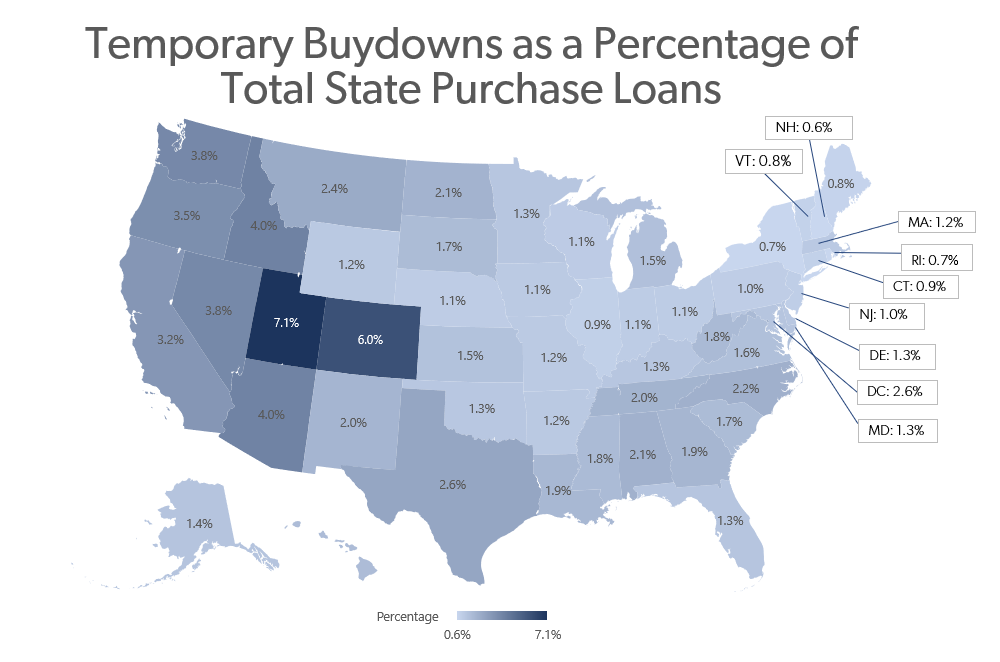

According to Freddie Mac researchers, temporary buydowns are concentrated among a few non-bank lenders. In fact, between June 2022 and June 2023, 12 lenders are responsible for 80% of all temporary buydowns.

Our researchers also looked at the geographical distribution of temporary buydowns funded between June 2022 and June 2023 by taking the number of temporary buydown loans divided by total loans across states. We observed a higher share of temporary buydowns out west, particularly in Utah, Colorado, Idaho and Arizona. Perhaps this is because of the mix of lenders or higher shares of new home sales in the region.

Enlarge Image

Source: Freddie Mac Funded Loan data

Given the limited volume and the requirement that borrowers need to qualify at the full rate, temporary buydowns seem unlikely to be a meaningful source of additional buyer demand.

– Bomin Kim, Macro & Housing Economics Manager

As we previously reported, variation in mortgage rates across lenders has been higher than usual over the past year. While buydowns are one potential factor impacting this spread in available rates, we don’t think they are the dominant story. That is because when we control for discount points in closing data, we still see an increase in the dispersion of rates. Similarly, we noticed a widening in the distribution of posted rates on lenders’ websites.

The fact remains: Temporary rate buydowns have fallen in recent months. However, our research shows that in higher-rate environments, temporary buydowns provide some marginal demand and relief to buyers and sellers.

For more insights from Freddie Mac’s research team, visit Research Insights, Notes & Briefs.

-

Footnotes

1. Even as total sales and listings are down (as existing homebuyers are loath to give up their low mortgage rate to switch homes) demand has remained strong for the homes that do get listed.

2. Temporary buydowns were more volatile, and roughly half as common in 15-year mortgages. Also, buydowns are far less common on non-owner-occupied properties.