Aging Boomers and the Impact on the Housing Market Over the Next Decade

The Baby Boomer generation comprises those born between 1946 and 1964, meaning this year, the youngest of the Boomers will turn 60. As older Boomers reach their golden years, the lifestyle choices they make will have a massive impact on the U.S. economy and the housing market, which is why Freddie Mac has been studying this cohort closely.

Given that the housing market is facing a shortage of available single-family homes, the housing decisions Boomers will make in the coming years will have an outsized impact. Some have warned of a “silver tsunami” as aging Boomers look to sell their homes, flooding the market with inventory. But as this analysis demonstrates, the tsunami is more like a tide, bringing a gradual exit that will mostly be offset by new entrants.

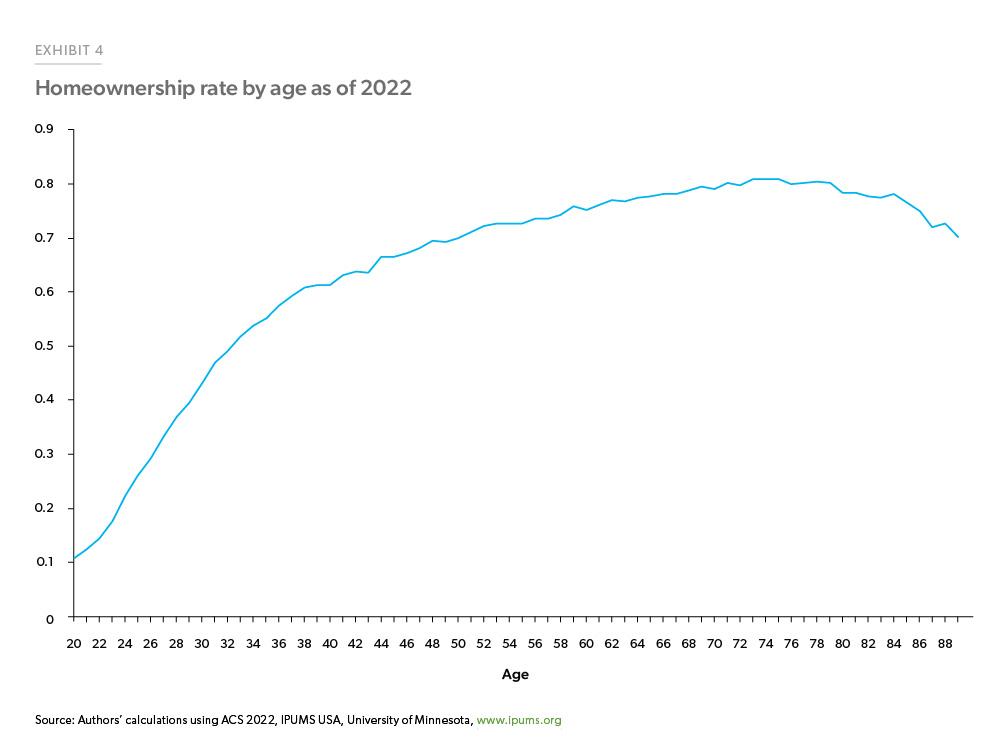

As of 2022 there were 69 million Boomers, accounting for 21% of the U.S. population, and 38% of total homeowner households. Boomers are overrepresented in the homeowner demographic because homeownership rates tend to increase as households age, gradually starting to decline as households age beyond age 75 (Exhibit 4).

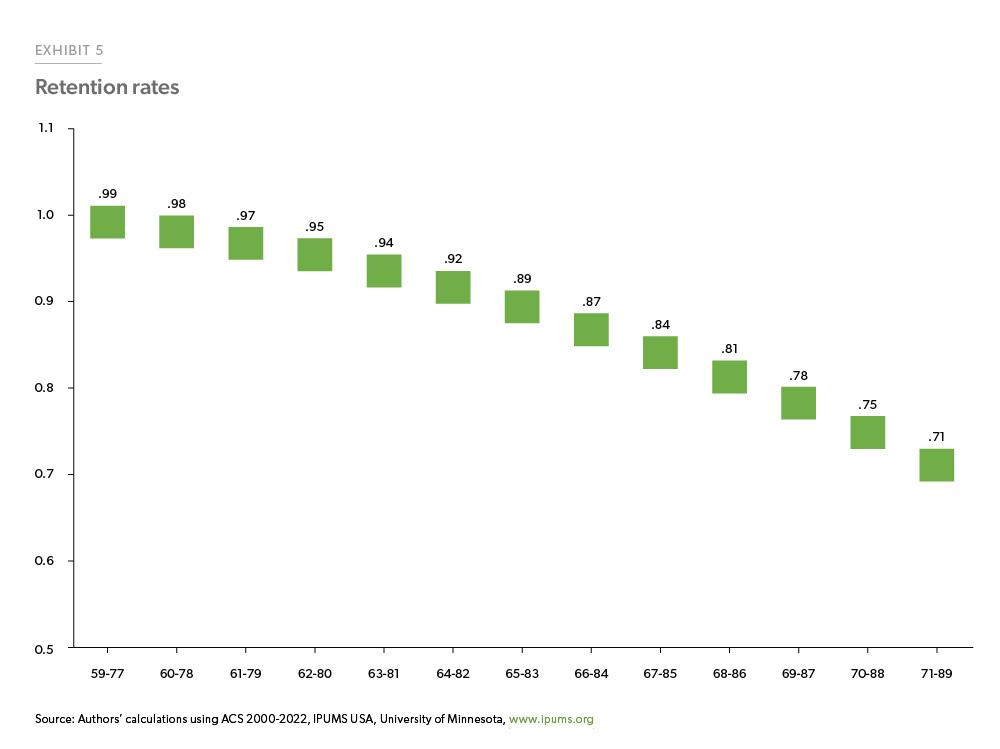

If Boomers follow the pattern of earlier generations and experience declining homeownership rates as they enter their late 70s, how many fewer Boomer homeowner households would that mean? We estimate the number of Boomer homeowner households over the next few years by using the homeowner retention rate concept.1 The retention rate is the share of the number of homeowners in a birth cohort at the end of a period to the number of homeowners in the same cohort at the beginning of the period. Using the American CommunitySurvey (ACS), we estimate the retention rates of the Boomers as they age, assuming that they behave like previous generations.2

As of 2022, Boomers were between 58-76 years of age. By 2035, these Boomers will be between the ages of 71 and 89. We estimate the retention rates of these age cohorts as they age over the period from 2000-20223 (Exhibit 5).

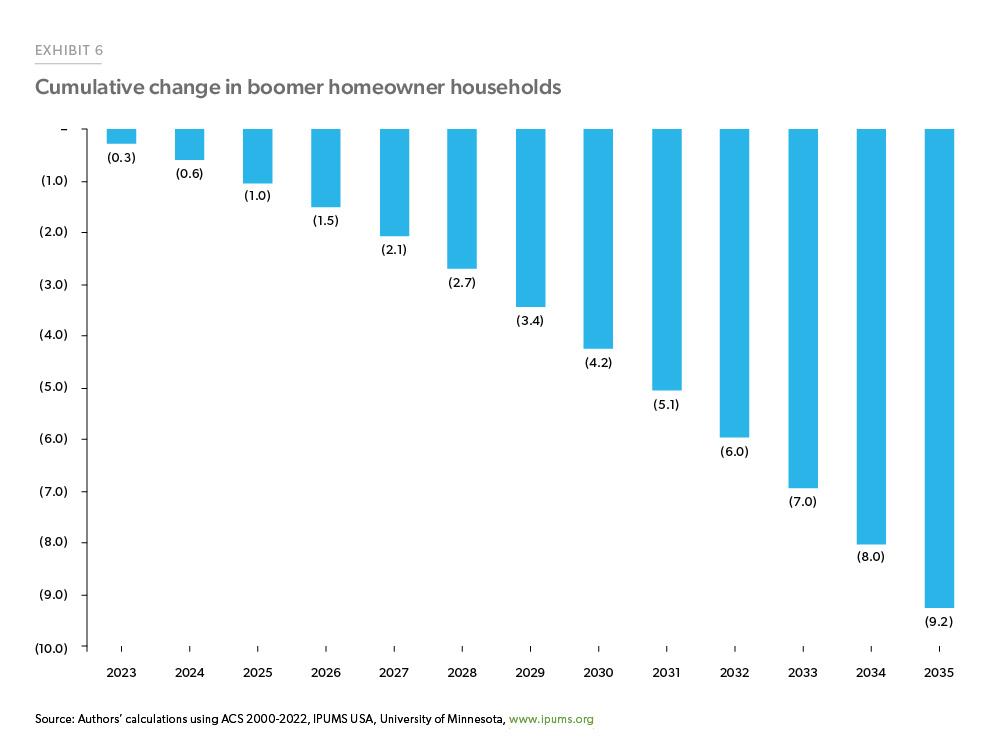

Applying these retention rates to the Boomer households as of 2022, we estimate the number of Boomer households each year through 2035. We find a gradual decline in the number of Boomer households over time from around 32 million in 2022 to 23 million by 2035 as the oldest Boomers reach ages close to 90. Per this estimate, there will be 9.2 million fewer Boomer homeowner households by 2035 (Exhibit 6). Using this method, the projected decline in homeowner households accelerates in the 2030s as the majority of Boomers will be in their 70s or 80s. Over the next five years, the decline is more modest, and we only see a reduction of 2.7 million households by 2028. In this sense, the silver tsunami is more like a tide, with a gradual reduction phasing in over several years. While the number of people aging out of homeownership will increase in the coming years, it is more of an upward sloping trend than a disruptive spike.4

However, it is possible that we may see a different outcome. The estimates based on historical retention rates may be too negative. Retention rates have been increasing over time as health outcomes for older Americans improved and life expectancy has increased. If instead of the historical average retention rate, we used the retention rates for the most recent cohorts as of 2022, the cumulative decline in Boomer households by 2035 would be closer to one million less than what we presented in Exhibit 6.

Relatedly, while age will inevitably catch up with us all individually, the population as a whole is renewed by younger generations. In addition to the natural growth from population, there is still a large latent demand for housing. In our October 2023 Outlook, we presented estimates showing that there were as many as two million potential additional households in the Millennial generation. Along with increases from Gen Z, total housing demand over the next few years is likely to continue to increase even as the Boomers continue to exit the market. Over at least the next five years, we expect the increase in the young adult homeowner households to more than offset the decline in Boomer homeowner households.5

Freddie Mac has been studying the Baby Boomer generation for years in an attempt to better understand how their decisions have and will impact the housing market. In addition to this data driven analysis, we’ve also published consumer survey results outlining this cohort’s perceptions and plan to release more research later this year.

Footnotes

- Dowell Myers and Patrick Simmons. “The Coming Exodus of Older Homeowners.”; Dowell Myers. 2011. “Attrition of Homeownership in California in the 2000s: Now Seeking Generational Replacements.” University of Southern California, Sol Price School of Public Policy.

- Steven Ruggles, Sarah Flood, Matthew Sobek, Daniel Backman, Annie Chen, Grace Cooper, Stephanie Richards, Renae Rogers, and Megan Schouweiler. IPUMS USA: Version 14.0 [dataset]. Minneapolis, MN: IPUMS, 2023. https://doi.org/10.18128/D010.V14.0

- For example, the 58–76-year-olds of 2000 were 59-77 in 2001, 60-78 in 2002, etc. So, to compute the retention rates, we take the ratio of the 59-77 homeowner households in 2001 to the 58-76 homeowner households in 2000.

- For an more in-depth analysis, please see Research Institute For Housing America Special Report Who Will Buy the Baby Boomers’ Homes When They Leave Them?

- To calculate whether increases in young adult homeownership will be sufficient to offset the projected declines in Boomer homeowners, we apply the retention rates of young adult (25–43-year-old) homeowner households following the same method as applied to Boomers. Using this method, we find that the increases from young adult households are more than the projected decreases from Boomer households through at least 2030.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior