Credit Card, Auto and Mortgage Delinquencies

In this Spotlight, we analyze the post-pandemic performance of various consumer lending products, such as credit cards, auto loans and mortgages. In short, our analysis finds that mortgage loans continue to perform better than pre-pandemic averages while credit card and auto loans are performing worse. When we look at auto and credit card performance segmented by whether the borrower has a mortgage, we see that non-mortgage credit performance is better for mortgage borrowers than for non-mortgage borrowers.

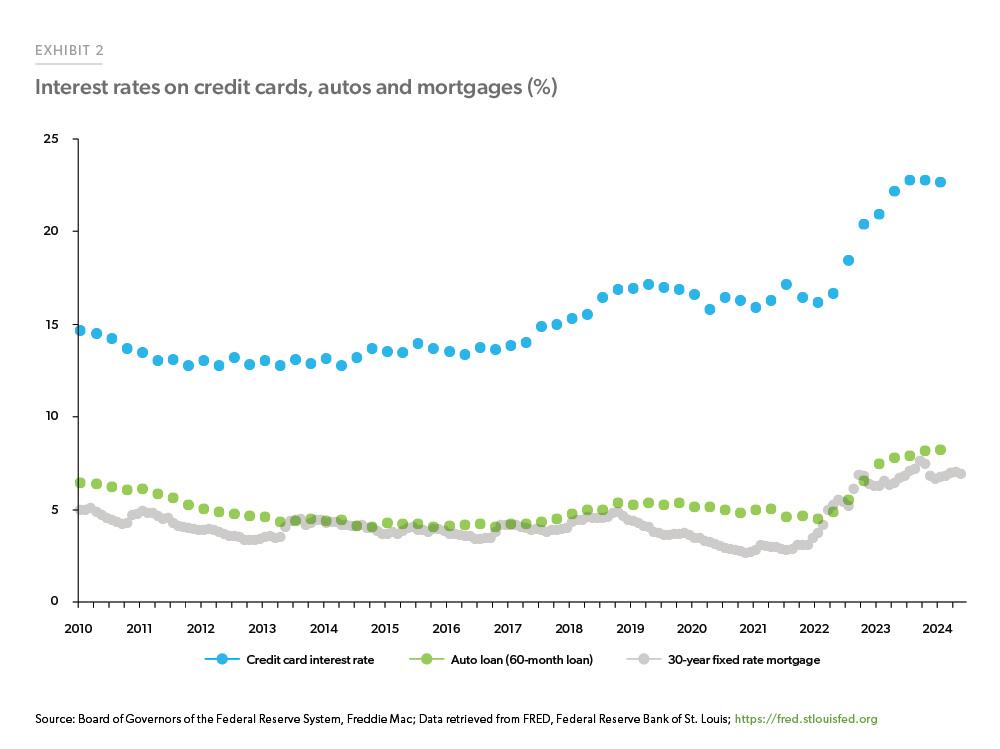

Consumer delinquencies were at historic lows during the pandemic – led by factors such as the fiscal stimulus, the historically low interest rate environment, forbearance programs put in place by the government, and pandemic related savings, which improved the health of consumer balance sheets. While the Federal Reserve cut the Federal Funds Rates to near 0% in March 2020 to support the economy during the pandemic, it began raising rates in 2022 to rein in inflation, which had increased to the highest levels in 40 years. As the Federal Reserve raised the Federal Funds target range from near 0% in March 2022 to 5.25%-5.50% by July 2023, interest rates on credit cards, autos and mortgages also increased. Exhibit 2 shows credit card interest rates increased from around 15% in 2022 to close to 23% in 2024. Rates on new auto loans for a 60-month term went up from 5% to 8% during the same period while 30-year fixed-rate mortgages went up from 3% to 7%.

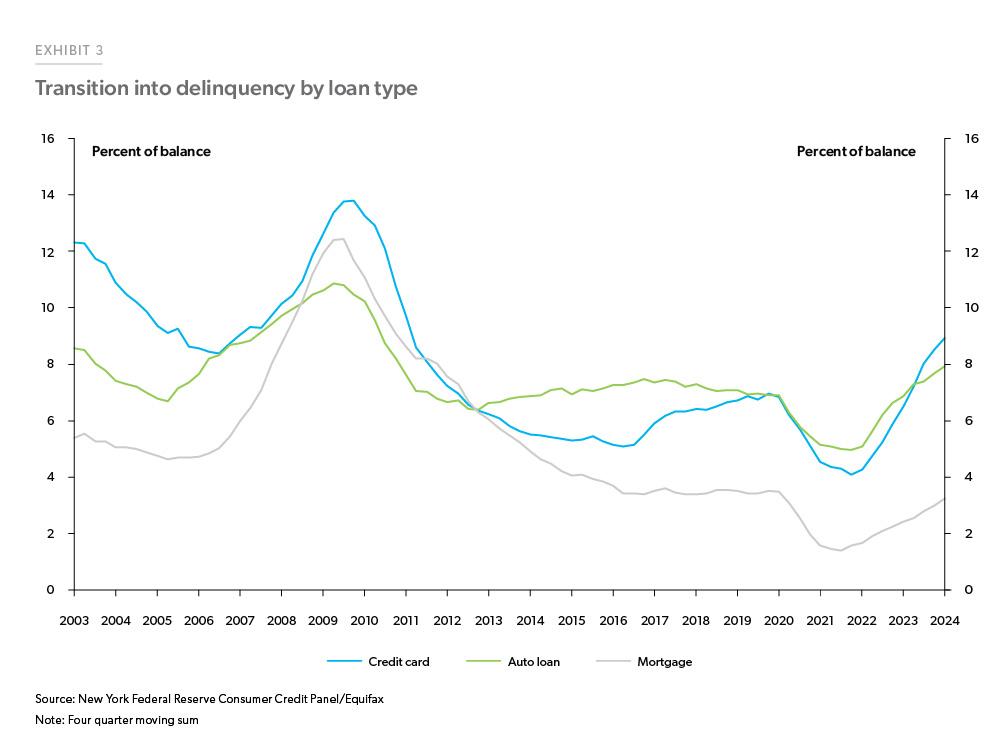

As stated above, during the pandemic, low interest rates, forbearance programs and fiscal stimulus pushed consumer delinquency rates near historic lows. As interest rates increased, forbearance programs ended, and excess pandemic savings were depleted, delinquency rates increased. At first, the increases were consistent with a normalization, or return to pre-pandemic average levels. However, as financial conditions have tightened, delinquency rates for some consumer loans have exceeded their pre-pandemic averages. Exhibit 3 plots the transition into 30+ days delinquency by loan type. Delinquency rates on credit cards and autos declined during the pandemic. But with the reversal of the factors mentioned above, delinquency rates started to rise in Q1 2022 and are now at levels above the pre-pandemic average.1 The largest increase in delinquencies has been for credit cards, up from 4.1% during Q4 2021 to 8.9% by Q1 2024. Auto loan delinquencies went up from 4.9% to 7.9% during the same time. The average delinquency rate for credit cards during the pre-pandemic period was 6.2% while that for auto loans was 7.2%.

For mortgages, while there has been a moderate rise in mortgage delinquencies, they remain below pre-pandemic levels. Mortgage delinquencies rose from 1.4% during Q3 2021 to 3.2% by Q1 2024. The pre-pandemic average mortgage delinquency rate was 3.5%. While delinquencies have risen modestly, delinquency rates on conventional mortgages are the lowest as compared to FHA/VA delinquencies, per the Q1 2024 MBA delinquency survey.

Part of the reason mortgages have performed better than auto and credit cards is because 92% of U.S. household mortgages have fixed rates,2 while most auto and credit card debt is variable rate. Thus, while interest rate on new mortgages increased as shown in Exhibit 2, the average rate on all outstanding mortgage debt increased much less.

Mortgage performance has also been better than credit card and auto debt because mortgage borrowers are generally in a much better financial situation than non-mortgage borrowers (primarily renters). Renters tend to be younger; the median age of a renter was 31 years old as compared to the median age of a homeowner at 42 years old. Renters also tend to have lower incomes compared to homeowners, around 61% of the renters have incomes equal to or less than 80% of the area median income.3,4 While nearly one-in-four homeowner households (19.7 million) are considered cost burdened (i.e. those who spend more than 30% of household income on housing and utilities) as of 2022, half of all renter households (22.4 million) are considered cost burdened.5

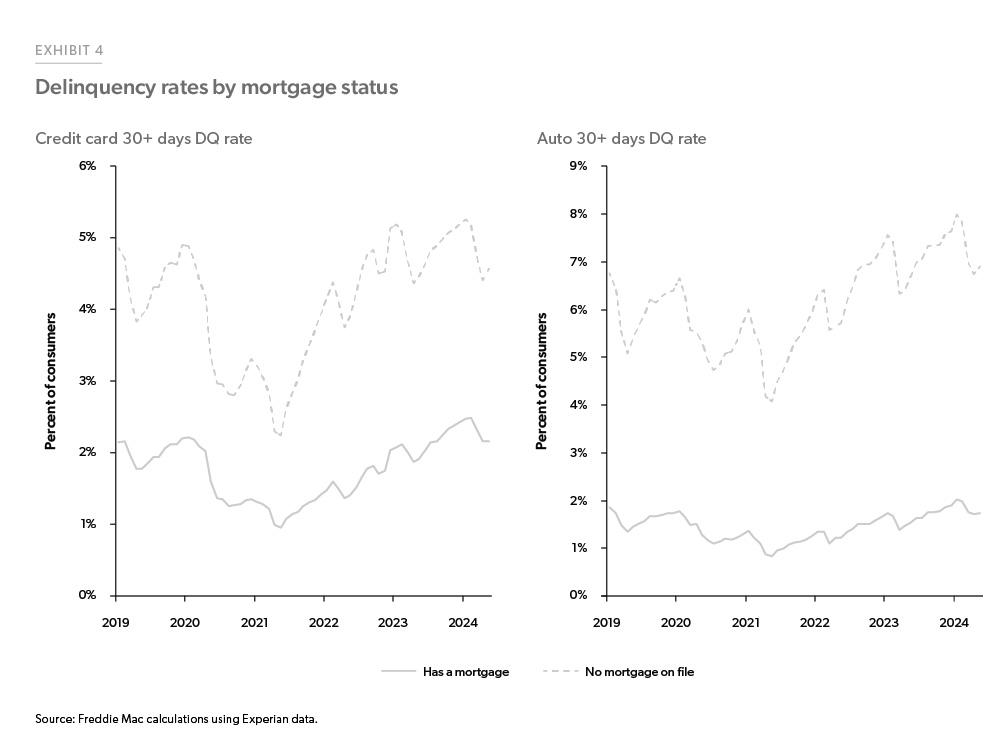

Using Experian data to track delinquency rates by their mortgage status, we find that delinquencies have been rising across the board (Exhibit 4). For those consumers with a mortgage, the share with a credit card delinquency increased from 1.0% in May 2021 (the trough) to 2.2% by May 2024, while those with auto delinquency increased from 0.8% in May 2019 to 1.7% in May 2024. On the other hand, for those consumers without a mortgage, the share with a credit card delinquency increased from 2.2% in May 2021 to 4.6% in May 2024 while the share with an auto delinquency increased from 4.1% to 6.9% during the same period. Thus, the share of consumers with delinquencies is higher for those with no mortgage on file, the majority of which are renters, than for those with a mortgage.

To conclude, our analysis reveals that delinquencies have been rising across the board for credit cards, autos and mortgages, although mortgage delinquencies remain below their pre-pandemic average. And with respect to mortgage status, we find that delinquency rates have risen more for those without a mortgage on file than for those with a mortgage. Rising rates have been hurting many consumers, but renters are feeling the impact of these rising rates more so than homeowners.

Footnotes

- We define the pre-pandemic period as the period from 2016Q1-2019Q4.

- https://www.stlouisfed.org/on-the-economy/2024/feb/which-households-prefer-arms-fixed-rate-mortgages

- Based on our analysis of CPS ASEC 2023 (Sarah Flood, Miriam King, Renae Rodgers, Steven Ruggles, J. Robert Warren, Daniel Backman, Annie Chen, Grace Cooper, Stephanie Richards, Megan Schouweiler, and Michael Westberry. IPUMS CPS: Version 11.0 [dataset]. Minneapolis, MN: IPUMS, 2023. https://doi.org/10.18128/D030.V11.0)

- The Federal Reserve also find similar results in their analysis of different groups of credit card users. https://libertystreeteconomics.newyorkfed.org/2023/11/credit-card-delinquencies-continue-to-rise-who-is-missing-payments/

- The State of The Nation’s Housing 2024 (Harvard.Edu)

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Kristine Yao, Macro Housing Economics Director

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior