More Borrowers Pay Discount Points, But It May Not Be Worth It

Declining affordability led borrowers to pay more discount points to buy down rates, but our research suggests it may not be worth it.

Mortgage rates, as measured by Freddie Mac’s PMMS®, increased significantly in 2023 compared to the record lows of the past few years. On October 26, 2023, the average 30-year fixed-rate mortgage stood at 7.79%, a 23-year high. Since then, mortgage rates have moderated but remain high by recent historical standards. These higher mortgage rates led many borrowers to make the decision to pay points in order to lower the rate when purchasing a house or refinancing an existing mortgage. During the low interest rate environment, few borrowers opted to pay discount points when obtaining a mortgage, but as rates started creeping up in the early 2022, we saw more borrowers paying discount points to lower their rate.

Using Freddie Mac closing data, we examined how often borrowers pay discount points and how many points they pay. For this analysis, the points we are focusing on are for permanent interest rate reductions throughout the life of the loan.1 To that end, we looked at a borrower profile that roughly matches our PMMS® population: mortgage for a home purchase or refinance of a one-unit, single-family owner-occupied property with a fully amortizing 30-year fixed-rate mortgage. We further restricted our sample to borrowers with conforming loans, and with credit scores 740 or above and a loan-to-value (LTV) ratio between 75 and 80 (inclusive).

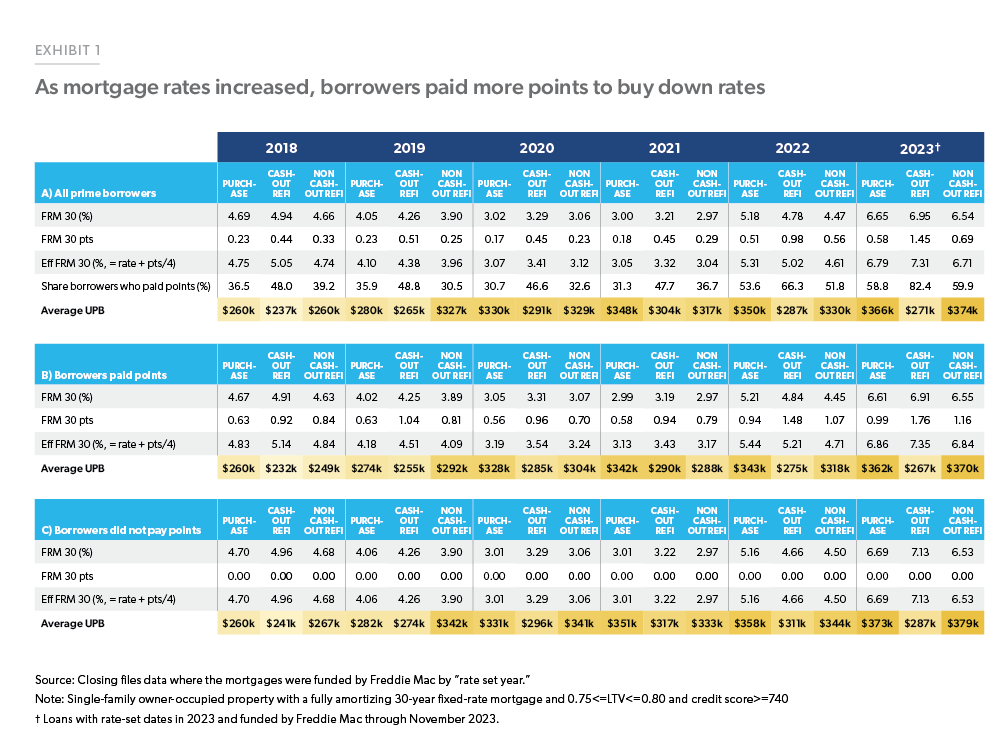

We found that the share of borrowers who paid discount points increased in 2023 (Exhibit 1). For example, about 58.8% of purchase mortgage borrowers paid discount points in 2023, compared to 31.3% and 53.6% of purchase borrowers in 2021 and 2022 respectively. The share paying discount points was higher for noncash- out and cash-out refinance borrowers, 59.9% and 82.4%, respectively. Also, conditional on paying points, refinance borrowers tended to pay much higher points: 0.99 points for purchase borrowers compared to 1.16 and 1.76 points for non-cash-out and cash-out refinance borrowers, respectively.

It is interesting to note, however, that the interest rate differential between borrowers who pay discount points and those who do not pay discount points is very small. Through November 2023, the average effective rate on purchase loans for borrowers who did not pay discount points was 6.69% versus 6.86% for those who did pay points. This result seems to suggest that paying discount points may not be worth it from the consumers’ point of view. Indeed, some academic research2 has shown that in many circumstances paying discount points can be a poor financial decision. However, while our tabulation shows that borrowers who do not pay points generally receive lower mortgage rates compared to similar borrowers who do pay points, we do not control completely for borrower observed and unobserved attributes. Therefore, we cannot say with certainty that for any particular borrower, the relationship between discount points paid and interest rate is negative.3

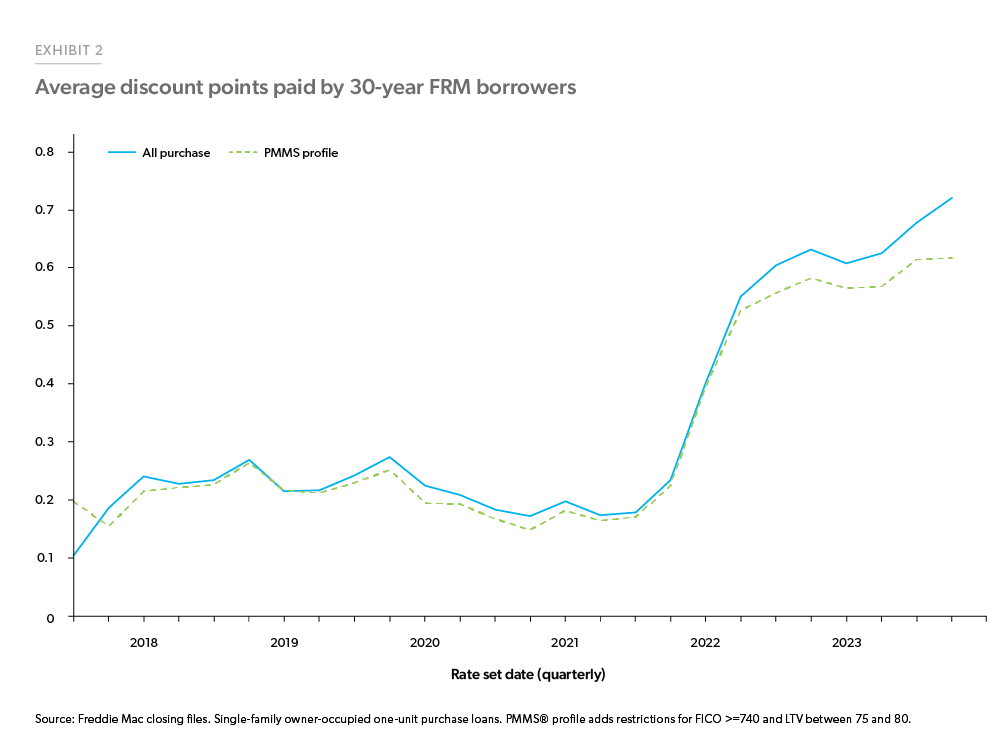

Exhibit 2 compares the quarterly average discount points paid by Freddie Mac borrowers (home purchase, owner occupied, one-unit properties). From 2018 through 2021, borrowers that matched the PMMS® profile, (borrowers with origination LTV between 75 and 80 and FICO score 740 or higher) paid about the same average amount of points compared to all purchase borrowers. Starting in 2022 and continuing through 2023, higher credit quality borrowers tended to pay fewer points compared to all borrowers. In 2023, borrowers that matched the PMMS® profile paid on average about 0.06 less points or about 10% less compared to all purchase borrowers.

Prime borrowers who do not pay discount points on average have higher incomes and are obtaining higher loan balances when purchasing a home compared to borrowers who pay points. For example, in 2023 the average loan amount for purchase loans with points paid at origination was $360,000, compared with an average loan amount of $370,000 for mortgages where the borrowers did not pay points. In 2023, the average annual income of a “no discount points” borrower was $148,000, higher than the $140,000 average annual income for borrowers who paid points.

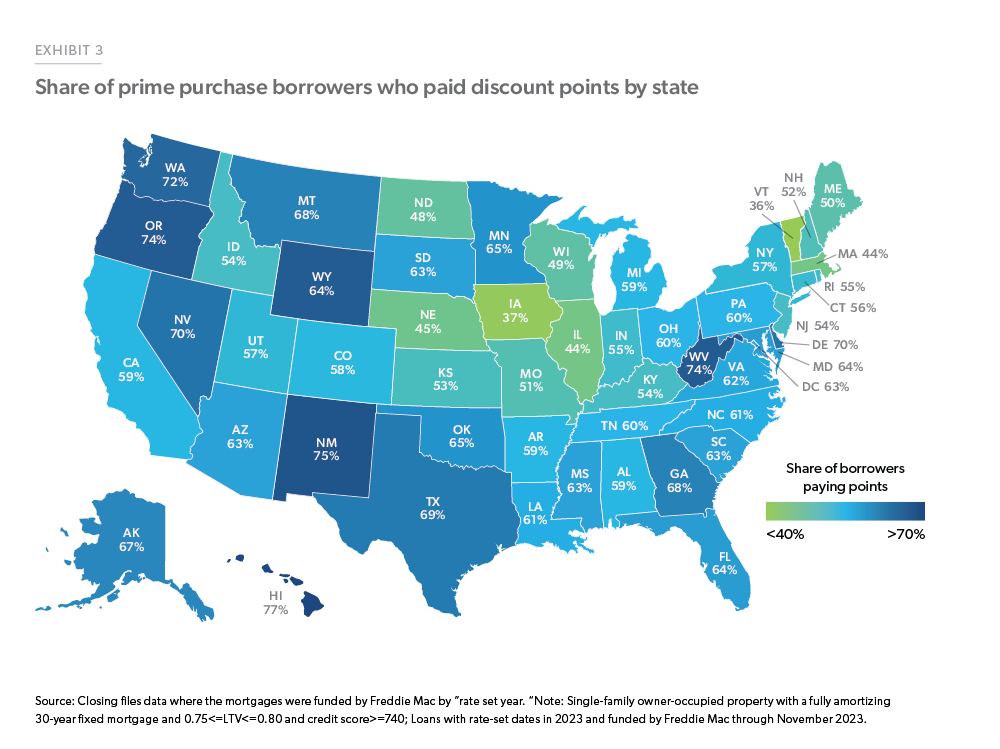

Our analysis on the closing files data shows that there is a difference in borrower behavior across the U.S. when it comes to paying discount points and origination fees. For example, in 2023 over 70% of prime purchase borrowers in HI, NM, WV, OR, WA, and DE paid discount points when closing on their mortgage while less than 50% of borrowers paid discount points in VT, IA, MA, IL, NE, ND, and WI. Exhibit 3 below shows the breakdown by state in 2023.

Our analysis shows that mortgage borrowers in 2023 were more willing to pay discount points than in previous years, and that the likelihood of paying points was greater for lower credit quality borrowers compared to the high-quality mortgage borrowers captured in our PMMS® profile population. We also saw that borrowers in the Midwest were less likely to pay points compared to borrowers in the Pacific and Mountain West. If interest rates stabilize in 2024, it will be interesting to observe whether borrowers opt to pay fewer points, or if the recent uptick in paying discount points is a more permanent shift in the mortgage market.

Footnotes

- For an analysis of temporary buydowns see our previous Research Brief: https://www.freddiemac.com/research/insight/20230731-temporary-mortgage-rate-buydown-activity-spiked-in.

- See for example: Agarwal, S., Ben-David, I. and Yao, V., 2017. Systematic mistakes in the mortgage market and lack of financial sophistication. Journal of Financial Economics, 123(1), pp. 42-58.

- For a more detailed analysis see: Mota, N., Palim, M. and Woodward, S., 2022. Mortgages are still confusing… and it matters—How borrower attributes and mortgage shopping behavior impact costs. Fannie Mae Working Paper. https://www.fanniemae.com/media/45841/display

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Lalith Manukonda, Finance Analyst