First-Time Homebuyer Activity

First-time homebuyers are an essential and growing segment of the housing market. In this month’s spotlight, we delve into current first-time homebuyer trends.

Using Freddie Mac data, we show their increasing role in housing demand, a trend that should continue thanks to favorable demographics. We also explore the geographic preferences of first-time buyers, identifying the regions where their share has grown the fastest over the last five years. Finally, we consider headwinds that might hinder first-time homebuyer activity in the near future.

Recent first-time homebuyer trends

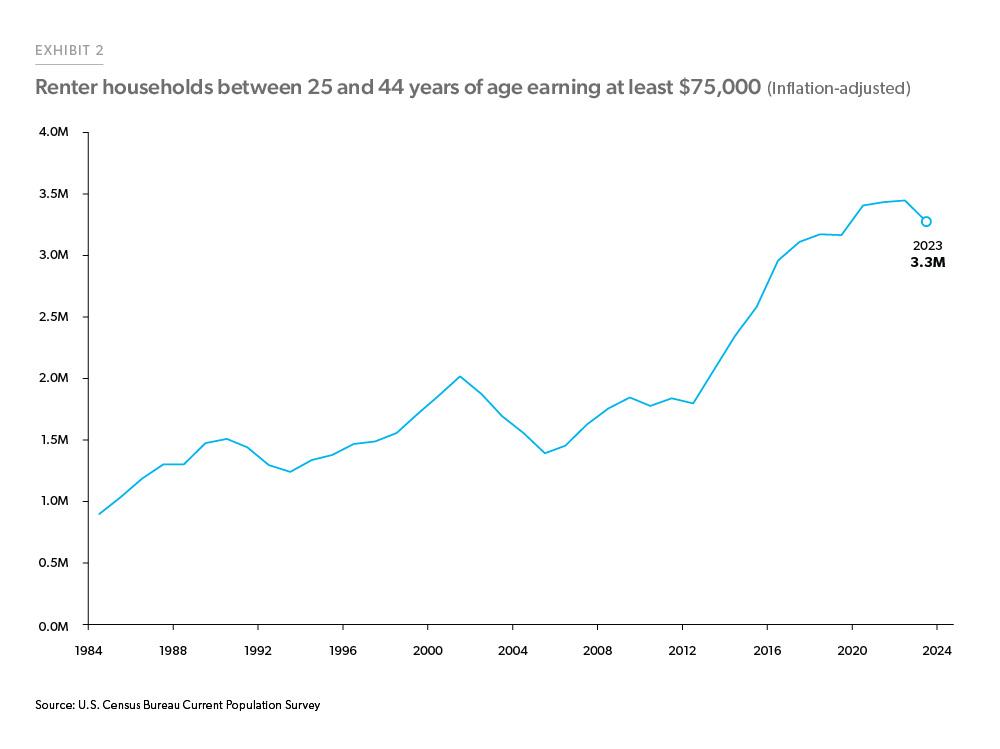

Millennials are now of prime homebuying age, and Gen Z’s oldest members are entering the workforce. These two cohorts will become the driving force in the housing market in the coming years and add to the pool of first-time buyers. Additionally, young adults who are renting are making more money now than in prior years, even after adjusting for inflation. Exhibit 2 shows renter households between 25 and 44 years of age with real (inflation-adjusted) earnings of at least $75,000. Since 2012, the number of potential first-time homebuyers has been rising substantially, and as of 2023, there were three million of these households.

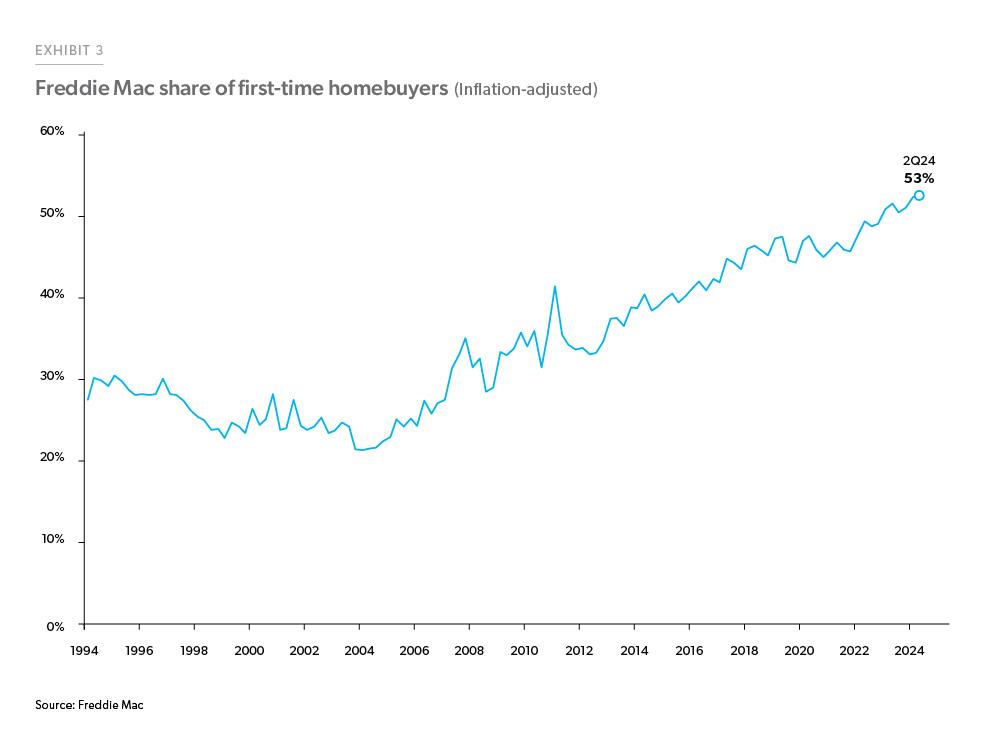

Indeed, these favorable demographic and economic tailwinds are helping first-time homebuyers become a more significant presence in the housing market. Using Freddie Mac-funded loan data, we can examine the historical share of conventional conforming loans that went to first-time homebuyers. Exhibit 3 shows that the share of first-time homebuyers has consistently been growing since 2004, from around 20% of funded loans to over 50% as of the second quarter of 2024.

One possible explanation for the recent increase in the share of first-time buyers is that repeat buyers are less active in the market due to the mortgage lock-in effect. From 2018 through 2022 the share of first-time homebuyers was steady at around 45% of funded loans. That share increased in 2023 and 2024 as the rate lock-in effect chilled the home resale market. However, even if the entirety of the increase from 2022 through 2024 was due to the rate lock effect, first-time homebuyers would still represent a significant share of all activity. And if the rate lock-in effect persists, then that underscores the importance of first-time homebuyers as one of the few sources of growing housing demand in the current environment.

Where is the first-time homebuyer share increasing?

Using our Freddie Mac data, we can also examine states which have seen the most activity with respect to first-time homebuyers. Overall, we see consistent growth in the share for most states; however, states in the Northeast and Midwest have relatively higher shares of first-time homebuyers, especially in recent years.

Exhibit 4 shows how much the first-time homebuyer share of Freddie Mac-funded loans has increased from 2019 to the most recent four quarters, ending with the second quarter of 2024. The map suggests that the first-time homebuyer share is growing faster in areas with moderate or slower home sale activity. Conversely, retiree destinations where repeat buyers are abundant, like Arizona and Florida, saw lower first-time homebuyer share increase over the last five years.

Potential headwinds for future first-time homebuyers

While there is tremendous demand potential from these cohorts, there are headwinds which might hinder first-time buyer activity in the near term. In this section we identify three of the most pressing issues affecting first-time buyers.

1. Affordability

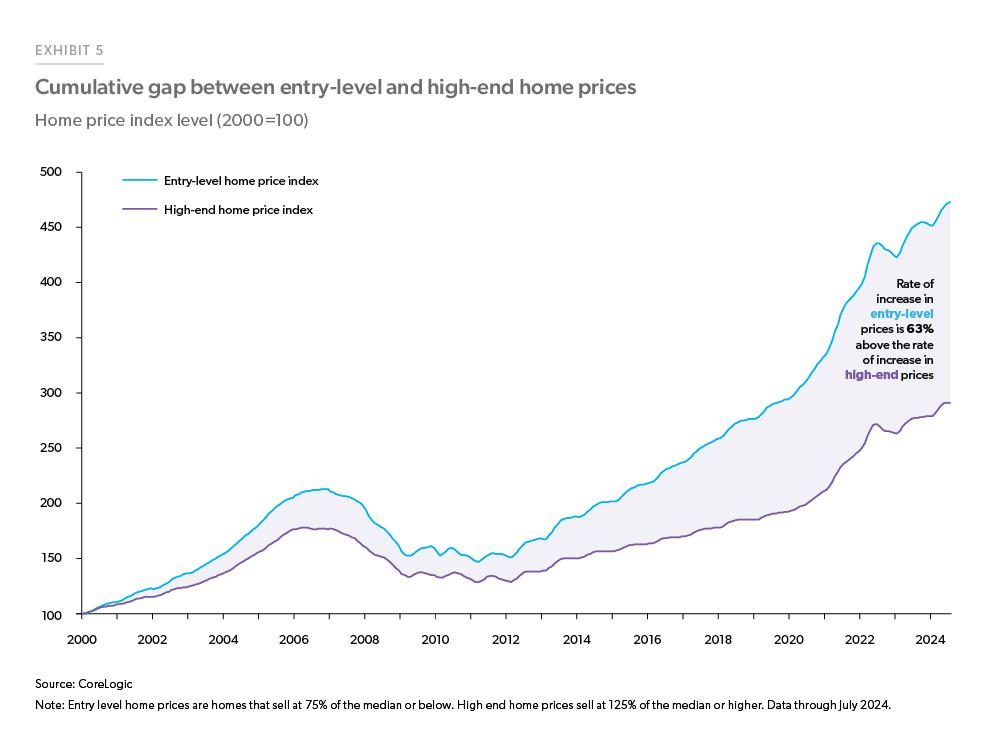

People attempting to buy their first home today must navigate an environment of higher mortgage rates and house prices. Even though mortgage rates are back to averaging under 6.5% in recent weeks, many who bought their starter homes before the 2022 mortgage rate increases have little incentive to sell to the incoming cohorts of new buyers. More importantly, starter home price appreciation has exceeded other appreciation in the other segments of the housing market. Exhibit 5 shows the cumulative gap in house price appreciation between entry-level homes (defined as homes that sell at 75% of the median or below) versus high-end homes (defined as homes that sell at 125% of the median or higher). Between January 2000 and July 2024, cumulative entry-level prices grew 63% more than high-end home prices. Less affordable housing is acutely felt by those seeking to buy their first homes, especially those without substantial wealth at their disposal.

2. Supply

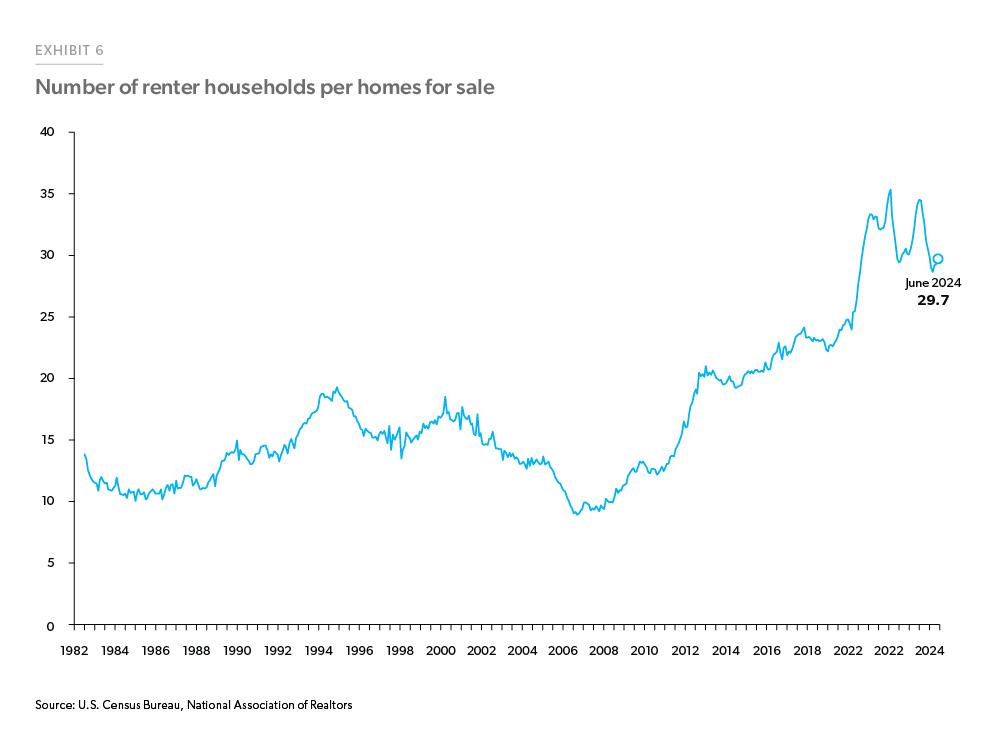

We can’t bring up affordability issues without discussing the lack of supply in the housing market. The supply deficit has its roots in the lack of residential construction post-Great Financial Crisis and was exacerbated due to a surge in demand during the pandemic. Exhibit 6 shows the number of renter households per homes for sale. The number of renters per homes for sale has been trending up since 2006, rising from less than 10 to above 30 renter households per home available. Therefore, not only do people seeking to buy their first home have to navigate an expensive market, but they also have to compete with more first-time buyers as supply continues to trail demand.

3. Tougher economic conditions

The Federal Reserve’s tight monetary policy has helped ease inflation over the last few years. However, higher interest rates (among other factors) have also contributed to higher unemployment. The U.S. unemployment rate increased half a percentage point from 3.7% in January 2024 to 4.2% in August. Renter households, especially, are seeing a faster acceleration in the unemployment rate than homeowner households. This trend is something to consider in the context of future first-time homebuyer activity, as many future buyers are currently renting. Exhibit 7 shows that the renter unemployment rate has increased from about 5% to over 6% since 2023. On the other hand, the unemployment rate of owner-occupied households has remained relatively flat. There could be disproportionate impacts on first-time homebuyer activity if labor conditions were to tighten and renters are the first to feel the pinch.

Throughout the country, we see the perseverance of first-time homebuyers as they navigate through stubbornly complex market dynamics. That’s why Freddie Mac continues to work closely with lenders and community organizations to help people achieve their personal housing goals. For example, we offer a variety of customized loan products to help first-time buyers overcome housing challenges and become homeowners. In the second quarter of 2024 alone, we financed approximately 200,000 primary home purchases, 53% of which were for first-time homebuyers. We’ve also launched an innovative platform to help potential buyers work with their lender to find down payment assistance programs. These are just some of the ways we are working to Make Home Possible.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Caroline Cheatham, Finance Analyst