Hispanic Homeownership Gap Declines to the Lowest Level in 20 Years

Since the mid-1960s, the racial-ethnic makeup of the U.S. population has dramatically changed with an influx of immigrants from several different areas around the globe, including Latin America.1

Today, Hispanics represent the largest share of immigrants in the U.S., representing 22 million out of 49.6 million or 44% of the foreign-born population.2 The rate of U.S. homeownership has generally increased over time, but Hispanic households continue to lag non-Hispanic Whites (Whites) in homeownership attainment due to various socio-economic and linguistic challenges.

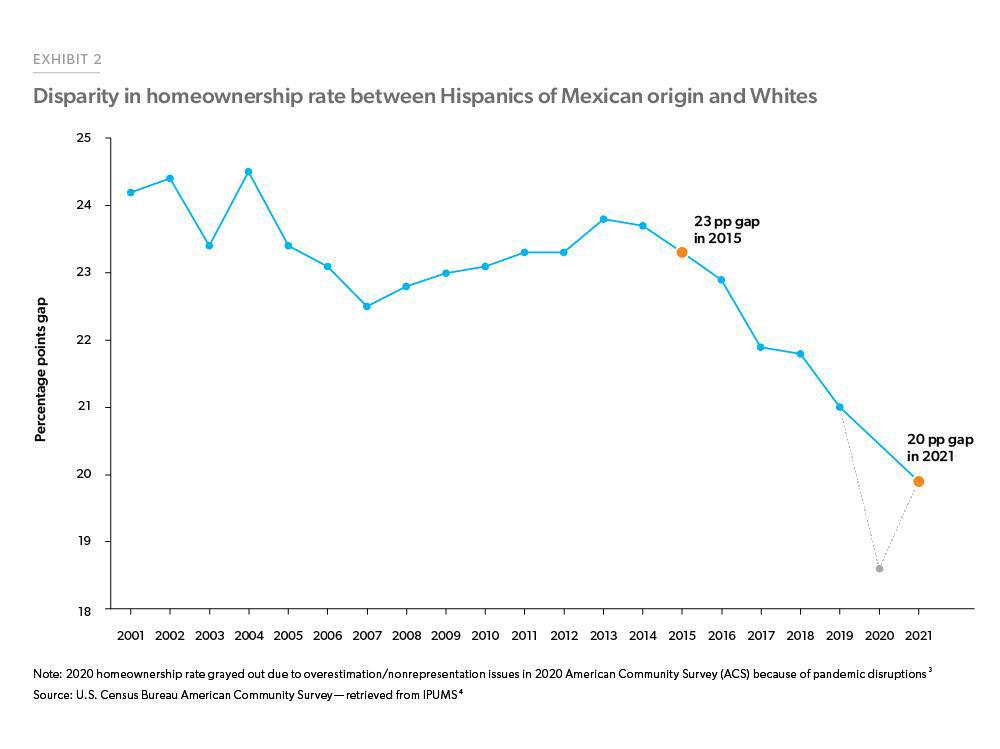

In 2017, we wrote an Insight about the challenges Hispanic families face in attaining homeownership. We focused on Hispanics of Mexican origin, since they represent the largest subgroup of Hispanics in the U.S at 62% of the Hispanic population and are the largest immigrant subgroup. Exhibit 2 shows the disparity in homeownership rate between Hispanics of Mexican origin and Whites.

In our previous study, we found that in 2015, there was a 23 percentage point gap in the homeownership rate between non-Hispanic Whites and Hispanics of Mexican origin. Our analysis suggested that over 80% of this gap can be attributed to differences in age, immigration attributes (such as foreign-born/ first generation, English language proficiency, citizenship status), income and employment, education, geographic location and marital status. Back in 2015, Hispanics of Mexican origin were younger and we therefore projected that as this booming population grew older and were provided opportunities to overcome some of their existing challenges, their homeownership rate would rise.

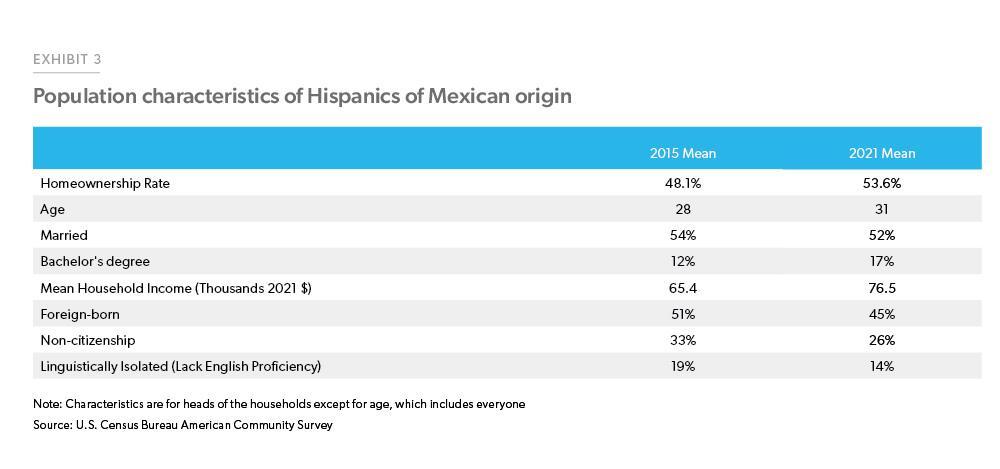

As National Hispanic Heritage Month gets underway, we’ve revisited our previous research and updated it with the latest available data. Homeownership rates among Hispanics of Mexican origin increased from 48.1% in 2015 to 53.6% in 2021, while those among non-Hispanic Whites increased from 71.4% to 73.6% during the same period.5 The homeownership gap between non-Hispanic Whites and Hispanics of Mexican origin declined to 20 percentage points as of 2021, the lowest gap in 20 years. There are improvements in several factors contributing to homeownership among Hispanics of Mexican heritage. For example, Exhibit 3 shows that as a large portion of this population is aging, their incomes have also increased, including improvements in immigration attributes.

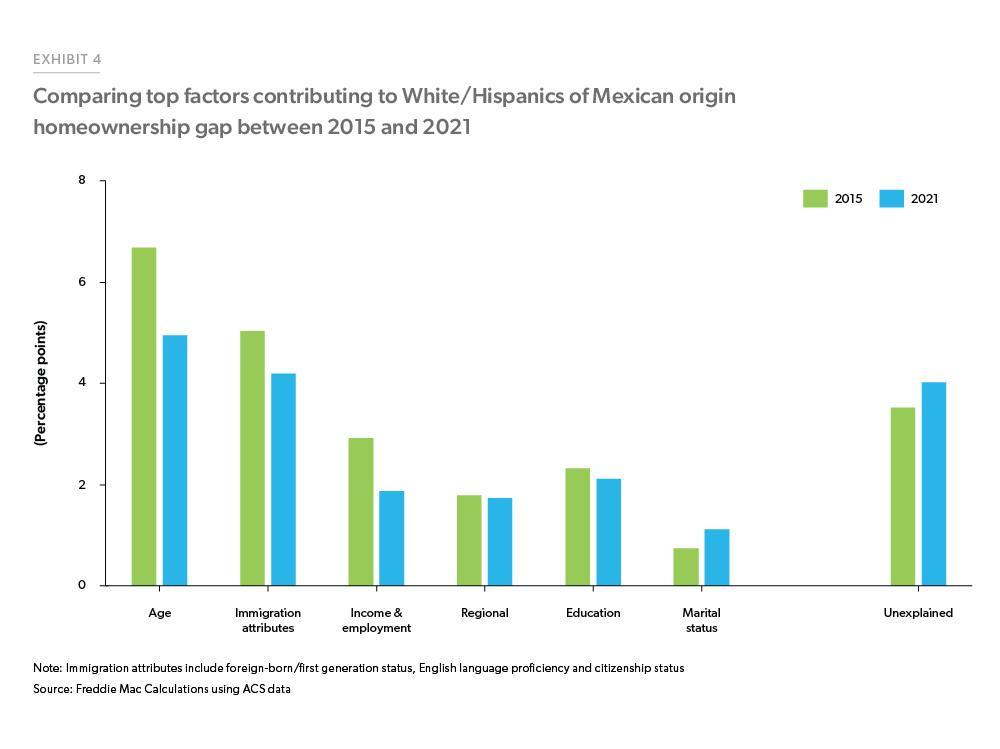

In Exhibit 4, we compare the top factors likely contributing to the homeownership gap in 2015 vs. 2021, ranked in order of importance in a regression analysis.6 The factors accounting for the gap are still the same, though their contribution to the gap has shrunk. Among the factors contributing to the homeownership gap, age is still the most influential factor. Specifically, in 2015, the contribution of age to the homeownership gap was 6.7 percentage points (almost 30% of the 23 percentage points gap is explained by age), but in 2021, as Hispanics of Mexican origin grew older, the contribution of age to the homeownership gap declined to 4.9 percentage points (almost 25% of the 20 percentage points gap is explained by age).

A combination of immigration-specific attributes are the next most influential factors, accounting for 4.1 percentage points of the White/Hispanics of Mexican origin homeownership gap in 2021. This is also a reduction from 2015, accounting for over 5 percentage points of the gap. Improved income, education, and employment status for Hispanics of Mexican origin has helped to narrow the overall homeownership gap.

Our results conform with the consensus in the past studies that homeownership prospects increase with age, income, education, employment, and marital status. Our analysis suggests that almost 45% of the homeownership disparity is explained by age, income and education. This means that the sizable homeownership gap will decrease as the population of Hispanics of Mexican origin ages and their income and education levels grow over time. However, there are other unobserved factors not captured in our analysis that might still drag homeownership rates down, including access to opportunities to grow income and attain higher education, low housing inventory in the market, credit availability, etc.

Additionally, since Hispanics are primarily first-time homebuyers,7 pre-purchase education and counseling can help Hispanic first-time homebuyers navigate the home buying process. While the number of second-generation Hispanics is growing, linguistic isolation remains an obstacle contributing to this homeownership gap. Freddie Mac recently launched the Spanish version of its award-winning financial education curriculum, CreditSmart®. This free resource offers interactive, personalized, self-paced learning to Spanish-speaking consumers and raises awareness around the benefits of homeownership.

Footnotes

- Pew Research Center has demonstrated how the face of immigrants has changed over time (http://www.pewresearch.org/fact-tank/2015/10/07/a-shiftfrom- germany-to-mexico-for-americas-immigrants/)

- Hispanics are those who identify themselves as being of Spanish-speaking background and trace their origin or descent to Mexico, Puerto Rico, Cuba, Central and South America and other Spanish-speaking countries.

- https://www.jchs.harvard.edu/blog/defining-use-caution-how-were-navigating-new-census-bureau-data

- 4. Steven Ruggles, Sarah Flood, Ronald Goeken, Josiah Grover, Erin Meyer, Jose Pacas and Matthew Sobek. IPUMS USA: Version 12.0 [dataset]. Minneapolis, MN: IPUMS, 2022. https://doi.org/10.18128/D010.V12.0

- Homeownership rate among all Hispanics (of any race/origin) increased from 45.3% in 2015 to 50.6% in 2021 (According to ACS)

- To quantify these impacts, we estimated a regression relating the probability of homeownership to factors shown in previous research to influence homeownership rates. We then applied Oaxaca-Blinder decomposition technique to determine the impacts. Details of the regression analysis and a comparison to prior research by others appear in the appendix of our previous article.

- In a NAHREP top producer survey, 41% said that most, if not all, of their Latino buyers in 2022 were first-time homebuyers: https://nahrep.org/downloads/2022-state-of-hispanic-homeownership-report.pdf

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Lalith Manukonda, Finance Analyst