The Below-Median Income Homeownership Rate Is Surging

At Freddie Mac, we strive to make home possible, and as part of our mission, we develop research and analysis that helps identify relevant housing trends. June is National Homeownership Month and accordingly, this month’s special topic looks at homeownership rates broken out by income level and the surprising trend that has emerged in recent years.

The Census Bureau’s Housing Vacancy Survey unexpectedly shows that the below-median family income homeownership rate has sharply increased from 48% to 53% since 2016.

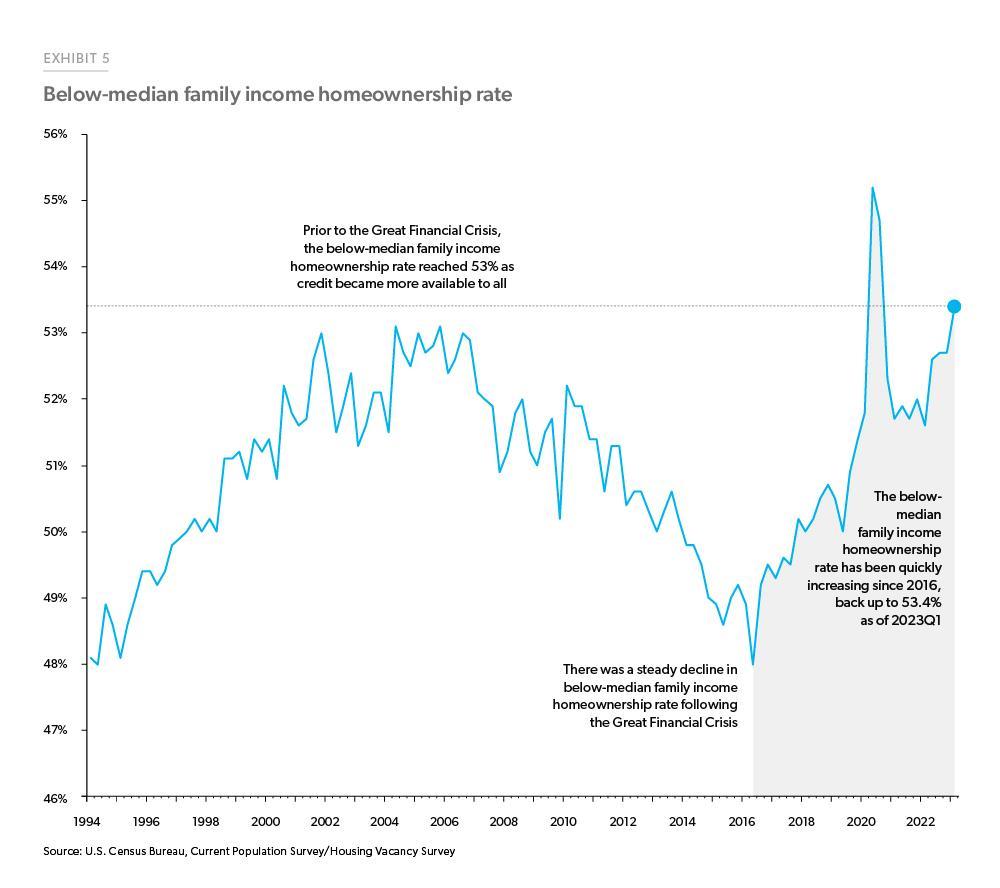

The homeownership rate measures the proportion of total occupied housing units that are owner-occupied (versus renter-occupied). The Census Bureau’s Housing Vacancy Survey shows an unexpected trend in the homeownership rate for households with a family income less than the median family income. Exhibit 5 shows that the below-median family income homeownership rate has sharply increased since 2016 from 48.0% to 53.4% as of the first quarter of 2023.

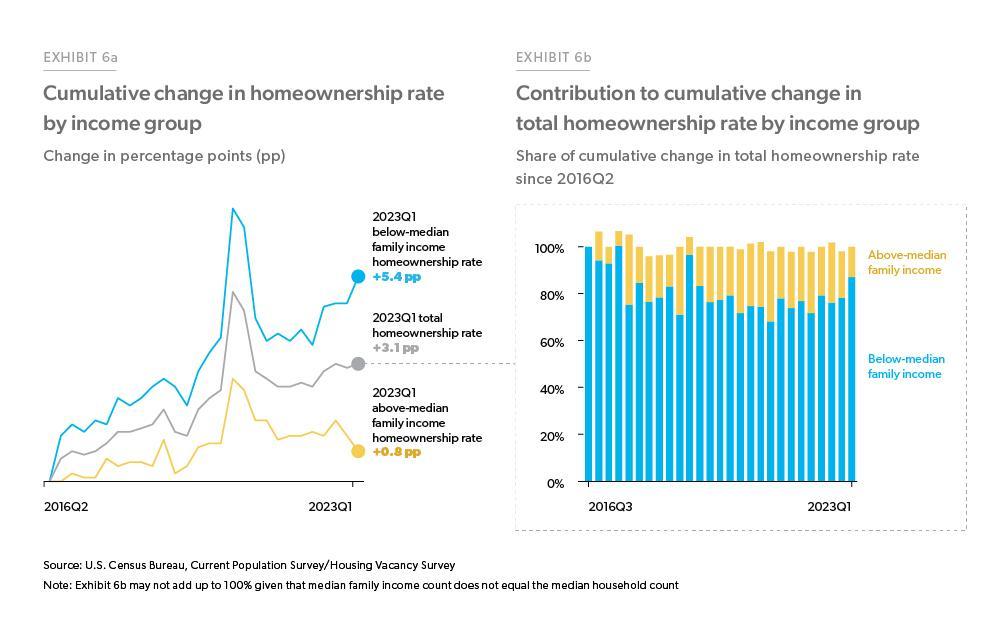

Conversely, the homeownership rate for owner-occupied households with a family income higher than the median family income has grown at a much softer pace than the below-median family income homeownership rate. Exhibit 6a shows that since the second quarter of 2016, the below-median family income homeownership rate has increased 5.4 percentage points while the above-median family income homeownership rate has only increased 0.8 percentage points.

Furthermore, the overall increase in the total homeownership rate since 2016 has been driven mainly by the strong growth in the below-median family income homeownership rate. Exhibit 6b shows that since the second quarter of 2016, the growth in the below-median family income homeownership rate accounted for at least 70% of the cumulative growth in the overall homeownership rate in each subsequent quarter. As of the first quarter of 2023, 87% of the 3.1 percentage point increase in the overall homeownership rate since 2016 can be attributed to the growth in the below-median family income homeownership rate.

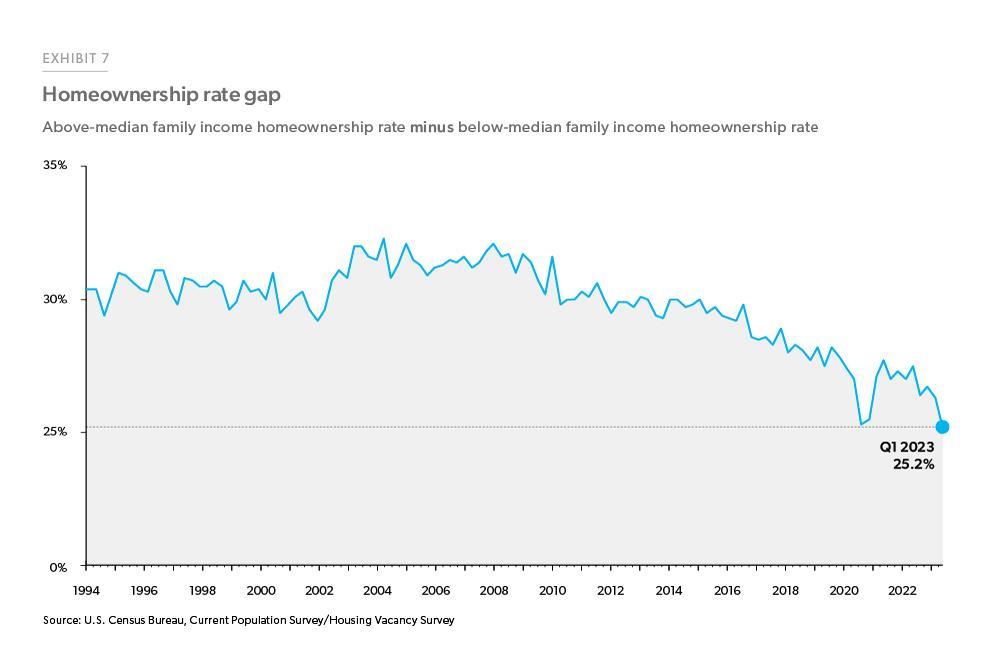

The homeownership rate gap between above-median and below-median family income households has shrunk over the last couple of years and has generally been trending down over the past decade as the growth in the below-median family income homeownership rate continues to outpace the above-median family income homeownership rate growth. Exhibit 7 shows the gap steadily decreasing since after the Great Financial Crisis and more so in recent years. As of the first quarter of 2023, the gap stands at 25.2%, the smallest gap since the start of the series.

The strong growth in the below-median family income homeownership rate may seem unexpected given the strong house price growth since the pandemic and more recently, the jump in borrowing costs. Nonetheless, below-median family income households are overcoming constraints and finding ways to become homeowners even within a less affordable environment — an encouraging sign as we continue to celebrate National Homeownership Month.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Rama Yanamandra, Macro & Housing Economics Manager

Ajita Atreya, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Brandon Recto, Analyst