Millennial Household Formation — Potential for Another 2 Million Households

Where does the Millennial generation stand in forming households? And how many more households can this generation form?

There are 72 million Millennials in the United States, which makes them the largest cohort in history. You may recall articles from the mid-2010s about how some Millennials were living in their parents’ basement and achieving life stages at a slower rate than previous generations.1 In 2018, Freddie Mac published research on young adult household formation and the reasons why this generation has lower rates of household formation in comparison to previous generations.

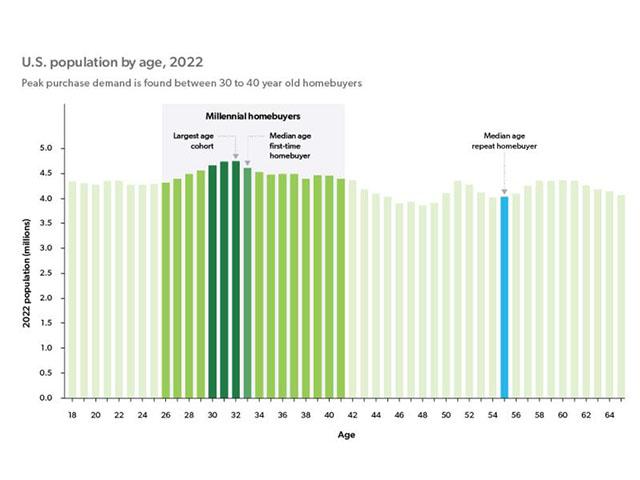

In the five years since we wrote that article, Millennials have aged to the point where previous generations reached their peak of new household formation. The oldest Millennial is now 41 years old, while the youngest Millennial is about 26 years old. Age demographics have been favorable with the number of people near the peak first-time homebuyer age ramping up for the last 15 years and with more potential left.

For Millennials who want to form independent households and buy a house, they face many challenges. The biggest among them are housing costs, as discussed in our previous research. Income and employment also contributed to the gap compared to prior generations, followed by a delay in marriage. Yet despite these challenges, Millennial household formations have increased, and the largest generation is now driving housing demand. Household formation of this generation got a push during the pandemic from the need for more space combined with the low interest rate environment. In fact, Millennial household formation has increased by 7.4 million since 2018.

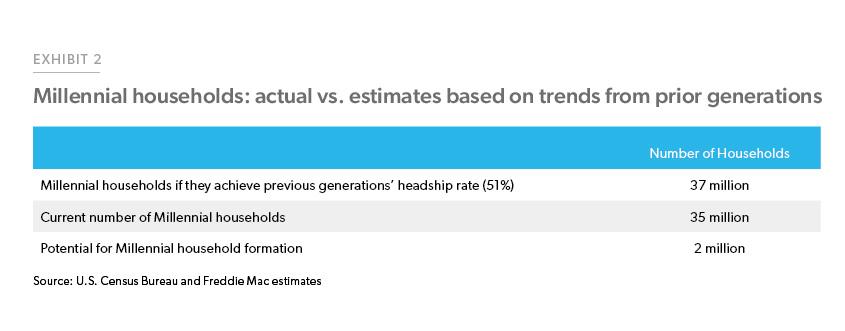

One way to estimate it would be to compare the headship rate (rate of heading a household or the share of population that is head of a household) of Millennials to Gen Xers and Baby Boomers when they were 26-41 years old. Boomers were between the ages of 26 and 41 in 1987 and Gen Xers in 2006. The headship rate of both Boomers and Gen Xers was 51% at that point in their lives. If Millennials had formed households at the same rate as Boomers and Gen Xers when they were the same age, then there would be an additional 2 million households in the U.S. today, as shown in Exhibit 2.

The preceding analysis suggests that not only is there potential for new households to form, but for these younger households that have formed to move into homeownership, as the homeownership rates of young adults is low. This implies that there are two main drivers of future housing demand: those that form new households and those that become homeowners. At Freddie Mac, we offer a variety of customized loan products to help Millennials overcome housing challenges and become homeowners. In the second quarter of 2023 alone, we helped 372,000 families buy, refinance, or rent a home. This was more than a 40% increase over the first quarter and includes 102,000 first-time homebuyers (many of whom are Millennials). That represents more than 51% of the owner-occupied homes we helped finance, a historic high.

Note: On October 27, 2023, estimated potential Millennial household formation was revised down from a previous version of this Spotlight.

Footnotes

- We define Millennials as those between 26 and 41 years of age as of Dec 2022.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Lalith Manukonda, Finance Analyst