Natural Disasters and Decision Making

Evidence from the Survey of Household Economics and Decision Making

Households in the U.S. and worldwide are grappling with more frequent and intense natural disasters.

This year alone, as of September 2024, there have been 20 confirmed weather/climate disaster events, each causing losses exceeding $1 billion. In 2023, nearly one out of five households reported being financially affected by natural disasters, according to the Survey of Household Economics and Decision Making (SHED). Almost two-thirds of those financially affected reported a loss of income/work disruption or property damage. Moreover, over a third of the survey respondents believe the likelihood that they will experience a natural disaster is higher five years from now.

As households face various financial and non-financial challenges during natural disasters, their response can considerably shape the future of real estate markets, particularly their location choice and housing protection against natural disaster risk. In this Spotlight, we analyze how households have responded to severe weather events, whether respondents have taken any actions against the risk and how it differs by their socioeconomic and demographic characteristics using the SHED. Below, we discuss three key takeaways from our analysis.

1. Natural disasters are likely to affect location choice, particularly among renters

People move homes for various reasons. While the overall move rate in the U.S. has declined over the years, the most often cited reason for moving is housing-related, such as wanting to own a home instead of renting, searching for cheaper housing and better neighborhoods, etc.1 As extreme weather events have become more common, households in the U.S. have increasingly been investigating other places in which to relocate. Our analysis of the SHED shows that in 2023, 1 in 7 households reported investigating other places to live because of natural disaster threats.

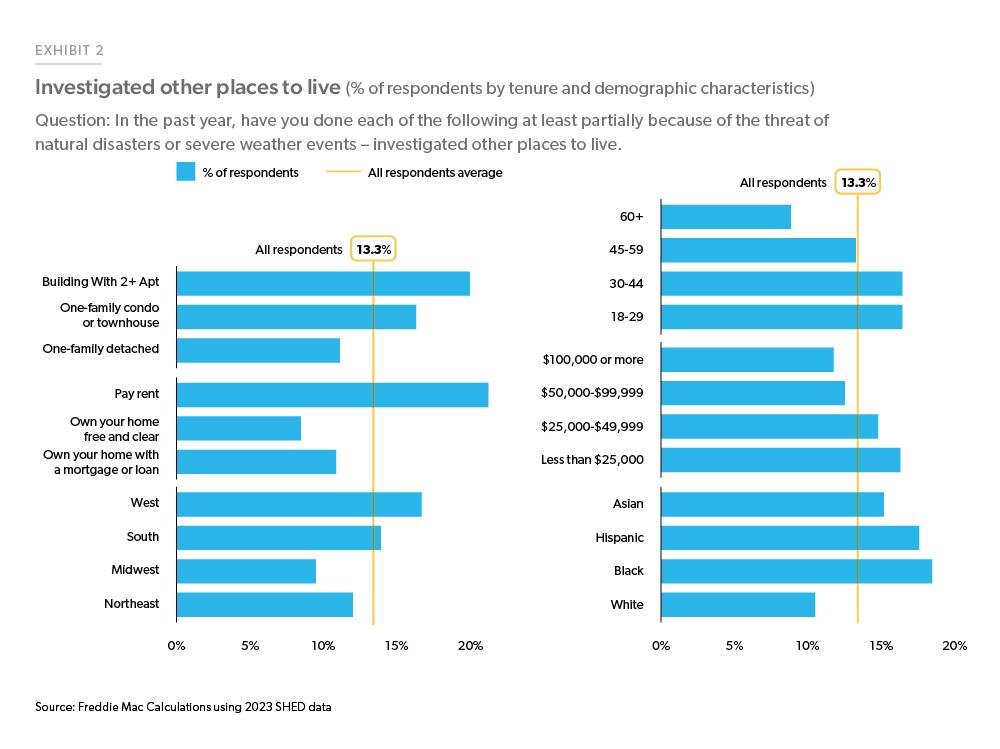

Exhibit 2 shows the share of respondents by housing type, tenure and demographic characteristics who reported that they investigated other places to live in 2023:

- One in five households currently live in buildings with 2+ apartments.

- One in five are renter households.

- Nearly one in five are Black households.2

Notably, a larger share (around 16%) of respondents aged 18-44 investigated other places to live, which is almost double the share of respondents above 60 and suggests that younger households are more prone to relocate due to the threat of natural disasters. Interestingly, those earning less than $50,000 in household annual income and a larger share of households in the West investigated other places to live in 2023. While there has been a notable rise in drought and longer wildfire seasons in the West, the larger share of renters in this region offers more flexibility for more households to relocate. For example, according to the SHED, in the West, 31% of respondents were renters, as contrasted with the Midwest, South and Northeast where 23%, 25% and 29% of respondents were renters respectively. Similarly, a large share of those earning less than $50,000 were renters, and in 2023, 45% of the respondents ages 18-29 and 34% ages 30-44 were renters.

2. Households impacted by natural disasters are more likely to improve property to reduce risk

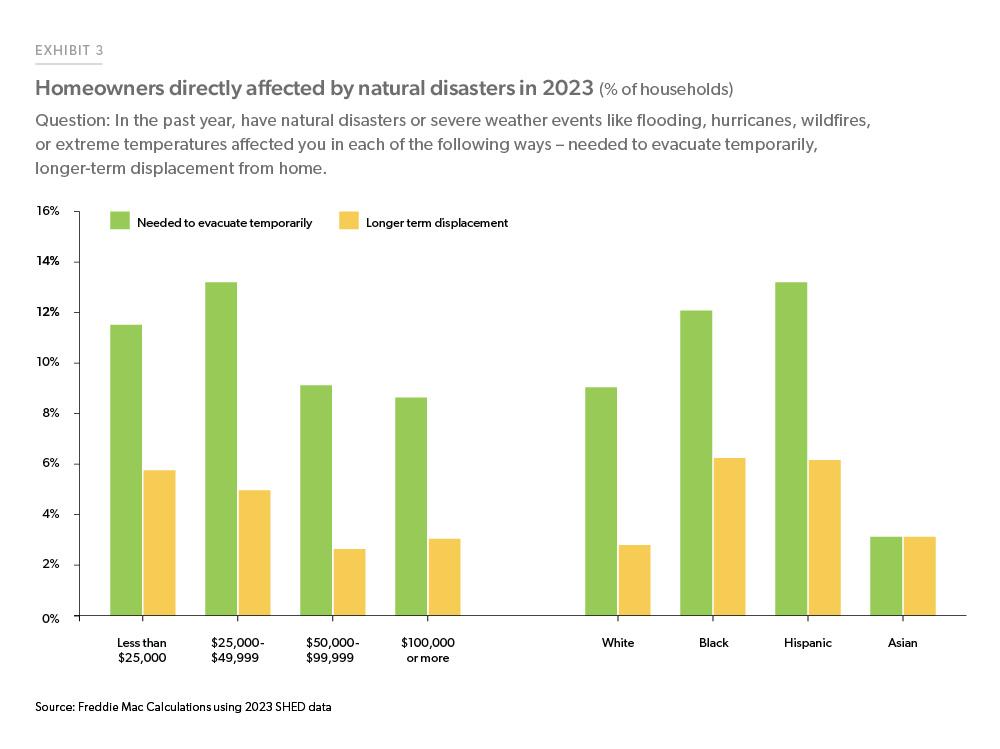

It’s important to note that some households are at a greater risk of experiencing adverse impacts of natural disasters than others. The SHED reveals a significant contrast in the financial impact of natural disasters on different income groups and ethnicities. For instance, in 2023, according to the SHED, one in four households earning less than $25,000 was financially affected by a natural disaster, compared to nearly one in six for those earning over $50,000. Similarly, 16.8% of Whites were financially affected, while the share for Blacks was 20.5%, for Hispanics was 23.3%, and for Asians was 22.2%. In addition to being financially affected, a larger share of low-income households and minorities needed to evacuate temporarily or were displaced for longer term due to natural disasters in 2023. Exhibit 3 shows that 12-13% of respondents earning less than $50,000 and a similar share of Black and Hispanic respondents needed to evacuate temporarily due to natural disaster in 2023.

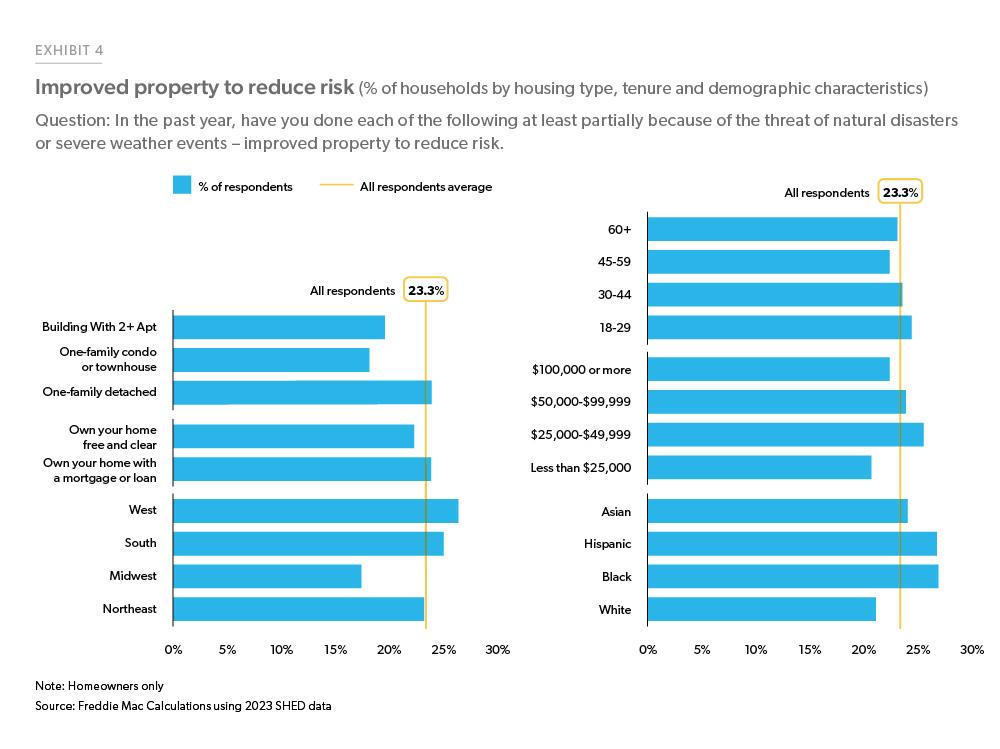

One of the ways to prepare for future natural disaster risk is by investing in improving the property to reduce risk. Among the homeowners, we find that in 2023, 23.3% of homeowners made some improvements to their property to reduce risk, a jump from 17.6% of homeowners who made improvements in 2022 (Exhibit 4). We also find connection between experiencing natural disasters and investing in property improvements. For example, those earning $25,000-50,000 were among the larger shares evacuated temporarily or displaced for longer term due to natural disasters and a larger share of the same population improved the property to reduce risk compared to other income categories. Similarly, almost three out of ten Hispanic and Black households, who were among the larger share that were evacuated temporarily or displaced longer term, improved their property to reduce risk compared to their counterparts.

3. A small share of households purchased additional insurance because of the threat of natural disasters

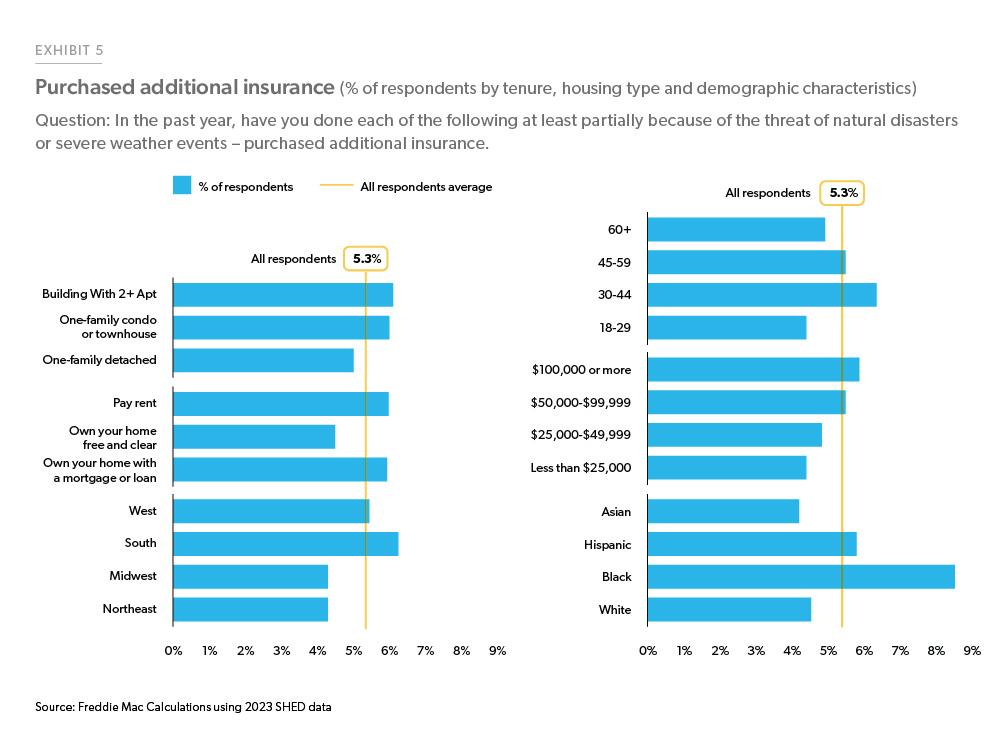

Homeowners insurance provides financial protection against physical damage to a property. While homes with mortgages are required to hold homeowners’ insurance, additional insurance offers additional protection in the event of a natural disaster. We find that only 5% of the households in 2023 bought additional insurance, which was unchanged from 2022. Beliefs about future natural disaster risk should play a significant role in an individual’s decision making around purchasing additional insurance to protect against the risk. As expected, we find that a larger share of those who believe that the chance they will experience a natural disaster is higher five years from now purchased additional insurance. Despite this belief, the affordability of homeowners insurance is a significant hurdle, as we discussed in a previous Spotlight, which examines the impact of rising insurance costs on households’ ability to protect themselves against natural disaster risks.

With respect to the decision to buy additional insurance, homeowners with a mortgage are more likely to buy additional insurance as compared to homeowners who own their homes free and clear. Renters are as likely as homeowners with a mortgage to buy additional insurance, as shown in Exhibit 5. Unsurprisingly, higher income households are more likely to buy additional insurance, which protects them more than low-income households. Young households seem to protect themselves more with additional insurance. Interestingly, a larger share of minorities, particularly Black households, bought additional insurance in 2023 compared to White households.

In summary, more people today are concerned about natural disaster risk and believe the likelihood they will experience a natural disaster is higher five years from now. Households can take several measures to safeguard themselves and protect their home against future natural disaster risks. Households can either relocate to safer places, improve the property they currently live in, or buy additional insurance for more financial protection (among other measures). Our analysis shows that renters are more likely to consider relocating due to the threat of natural disaster, highlighting the critical factor of younger age and renter flexibility in relocation decisions. On the other hand, homeowners proactively improve their properties to reduce future natural hazard risk. While not a large share, both homeowners with mortgages and renters can benefit from additional insurance coverage. Overall, flexibility to relocate, direct impact from natural disasters, and beliefs about future risks are motivating factors in preparing against future natural disaster risks.

Footnotes

- https://www.census.gov/library/stories/2023/09/why-people-move.html

- For reference, black households comprised of 12.1 % of the total households surveyed in 2023.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Caroline Cheatham, Finance Analyst