Refinance Originations Trends Through Q2 2024

Higher mortgage rates since 2022 have dampened refinance activity.

Given that the average mortgage rate on outstanding loans as of Q1 2024 was at 4.1% and mortgage rates at the end of Q2 2024 were at 6.9%, homeowners have little incentive to refinance.1 However, homeowners may still choose to refinance for reasons other than to lower their mortgage rate, such as extracting equity through cash-out refinances, extending the loan term or refinancing to cancel private mortgage insurance payments.

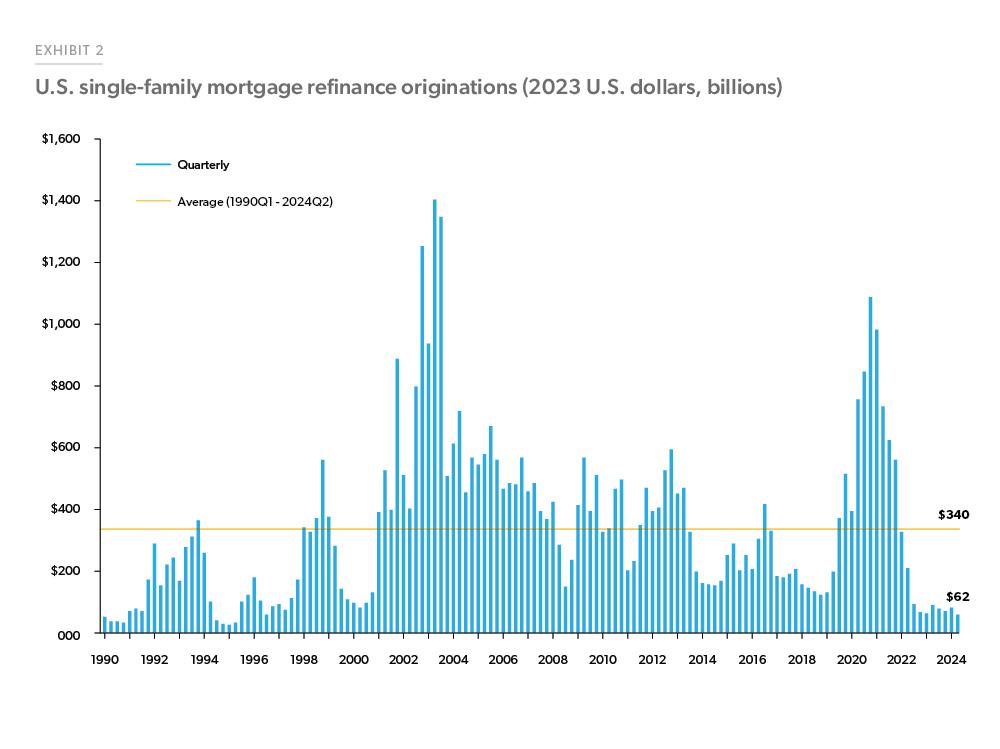

Exhibit 2 shows first-lien refinance originations since 1990 in inflation-adjusted 2023 dollars. The quarterly volume in Q2 2024 at $62 billion is the lowest since Q3 1996 and the volume in the first half of 2024 ($147 billion) is the weakest since the first half of 1995.

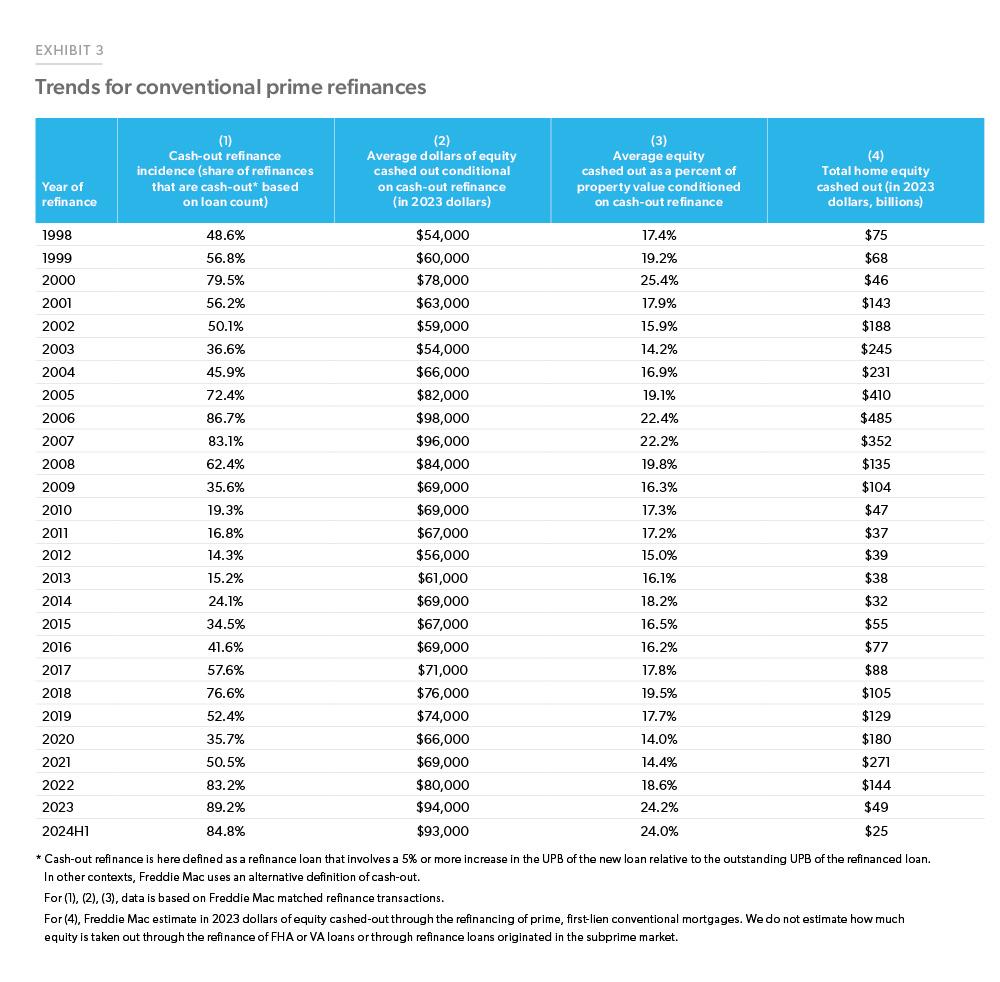

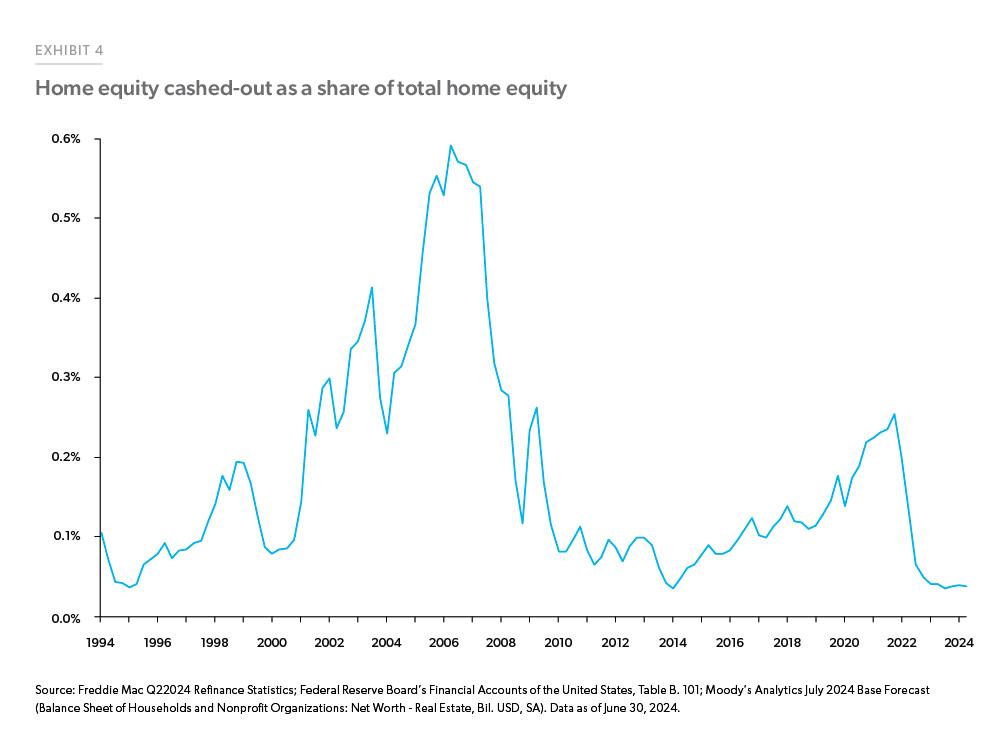

In the first half of 2024, around 85% of conventional refinance originations were cash-out refinances. This shift is largely due to higher rates, which have reduced the number of rate-and-term refinances and are pushing up the share of cash-out refinances, even as total refinance volumes remain low. Exhibit 3 shows the trends in conventional cash-out refinance activity over time. As of the first half of 2024, an average of $93,000 was extracted as cash-out, accounting for 24% of the average total property value. However, the total equity cashed out was only around $25 billion dollars during the first half of 2024. For 2023, the total amount of cash-out refinance was $49 billion, down from $144 billion in 2022, and well below the $485 billion that was extracted in 2006. Given the rise in home equity, the total equity cash-out remains low at around 0.04% as of Q2 2024. Cash-out equity has remained at this level for a year and a half (Exhibit 4).

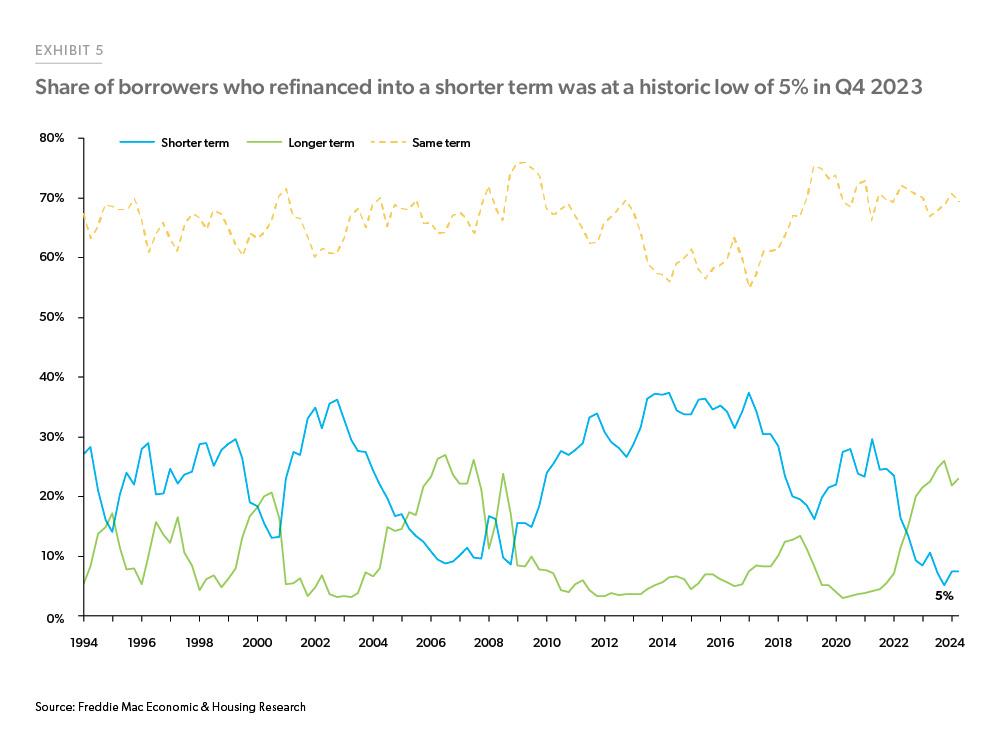

Exhibit 5 shows borrowers’ loan term choices from Q1 1994 through Q2 2024. In the last year and a half, there has been a noticeable shift in borrowers’ preferences. Fewer borrowers are choosing to refinance into a shorter-term mortgage with many borrowers now opting to refinance into the same term mortgage or increase their term to lower their monthly payments. Among the borrowers who refinanced in the first two quarters of 2024, 8% reduced their loan term, a slight increase from the historical low of just 5% during Q4 2023. In terms of mortgage rates, borrowers who refinanced in 2023 and early 2024 saw an increase of 2.4 and 1.9 percentage points, respectively.

Refinance volumes remain low for now due to high mortgage rates but the anticipated Fed rate cuts in the second half of the year should ease mortgage rates in the second half of 2024 and further into 2025. This easing of mortgage rates should help boost refinance volumes in 2025 after remaining fairly flat in 2024. While rates have been a barrier to refinances, record high home equity, which was at around $33 trillion as of Q1 2024, should continue to support cash-out refinances.

Footnotes

This refinance analysis is through to Q2 2024 and does not capture the recent declines in mortgage rates.

- NMBD Aggregate Statistics on Outstanding Mortgage Loans

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ralph DeFranco, Macro Housing Economics Senior Director

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior