The 2024 Spring Homebuying Season: An Early Preview Using Mortgage Application Data

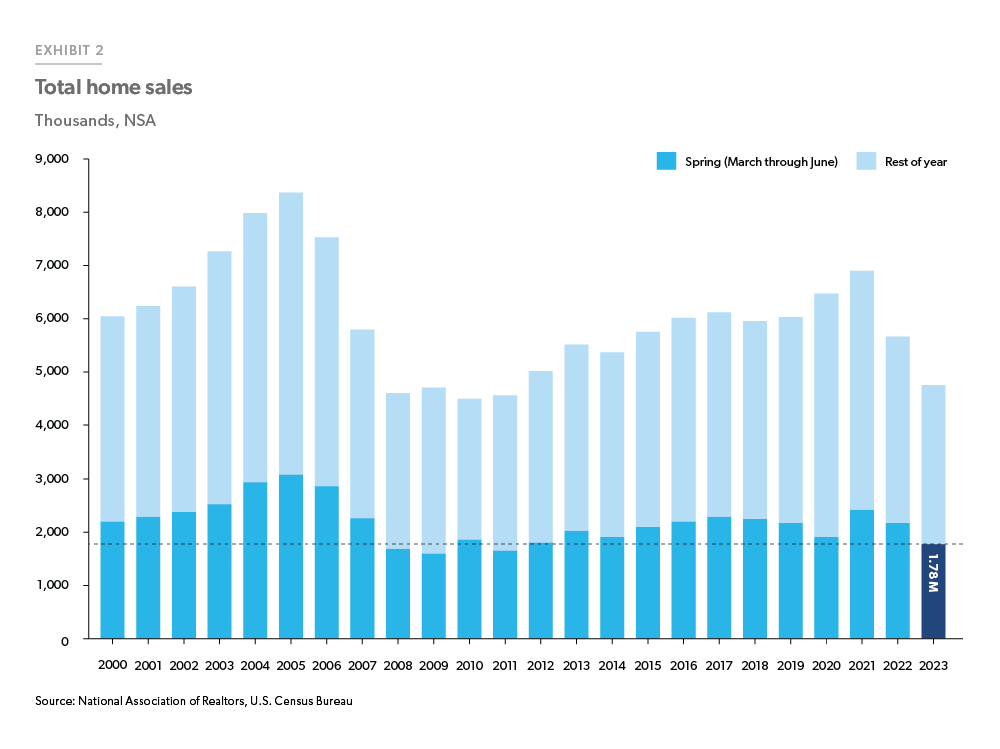

The 2023 spring homebuying season was indeed sluggish, as a large number of homebuyers sifted through tight housing markets within the high-rate, low-inventory environment. According to data from the National Association of Realtors (NAR) and the U.S. Census Bureau, 2023 had the lowest total home sales for the spring season (March through June) since 2011 (Exhibit 2). What about the 2024 spring homebuying season? Looking at our unique, real-time Loan Product Advisor® (LPA) data, we can get an early pulse of where the housing market is headed.

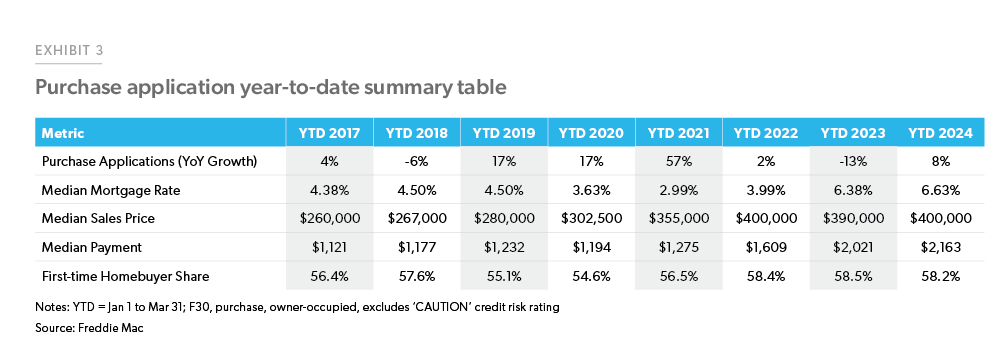

Overall, housing demand is making a healthy recovery compared to last year. As shown in Exhibit 3 (following page), year-to-date (through March 31st), purchase applications for 30-year fixed-rate purchase mortgages are up 8% from the same period last year, even as the median mortgage rate and median sales price have increased. First-time homebuyers continue to carry demand so far this year as they make up almost 6 out of 10 purchase applications. Nonetheless, the median payment (principal and interest) is up 7% from the same period last year, and that continues to be a significant headwind as affordability remains near historic lows.

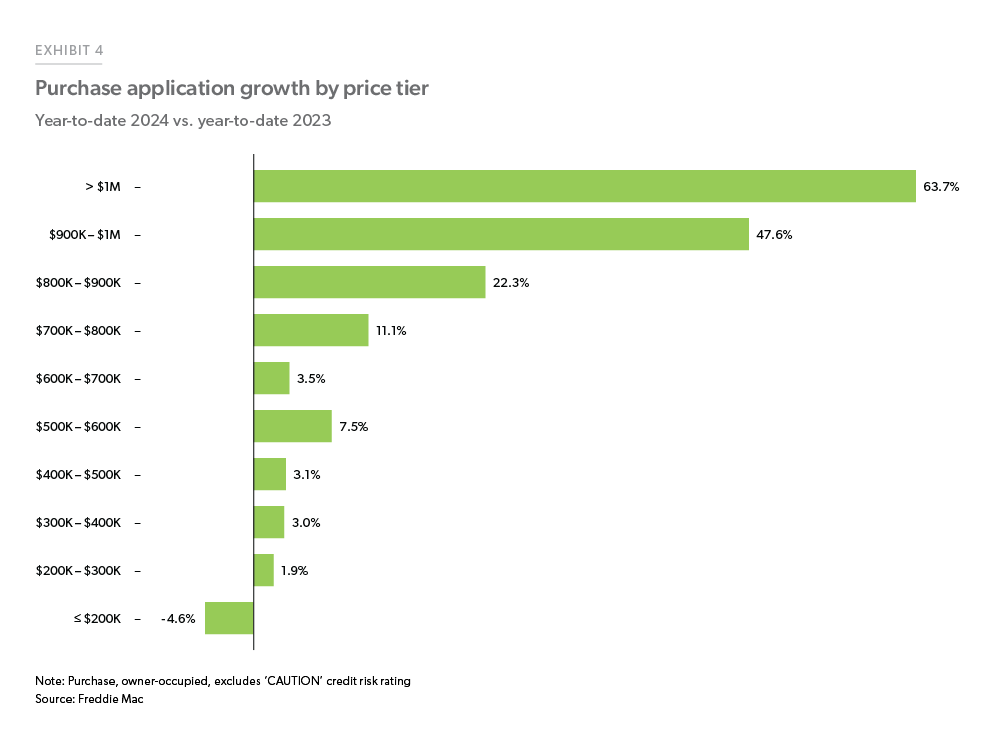

What is driving increased demand this year? If we break out purchase applications by sales price groups, we see that purchase applications for higher-priced homes have rebounded more in the first three months of 2024 than lower-priced homes from the same period last year (Exhibit 4).

Furthermore, there is significant growth in purchase demand for homes with sales prices above $800,000. Given the current lack of inventory, it appears that people have no choice but to search in the higher price points for their homes and those at the margin are priced out.

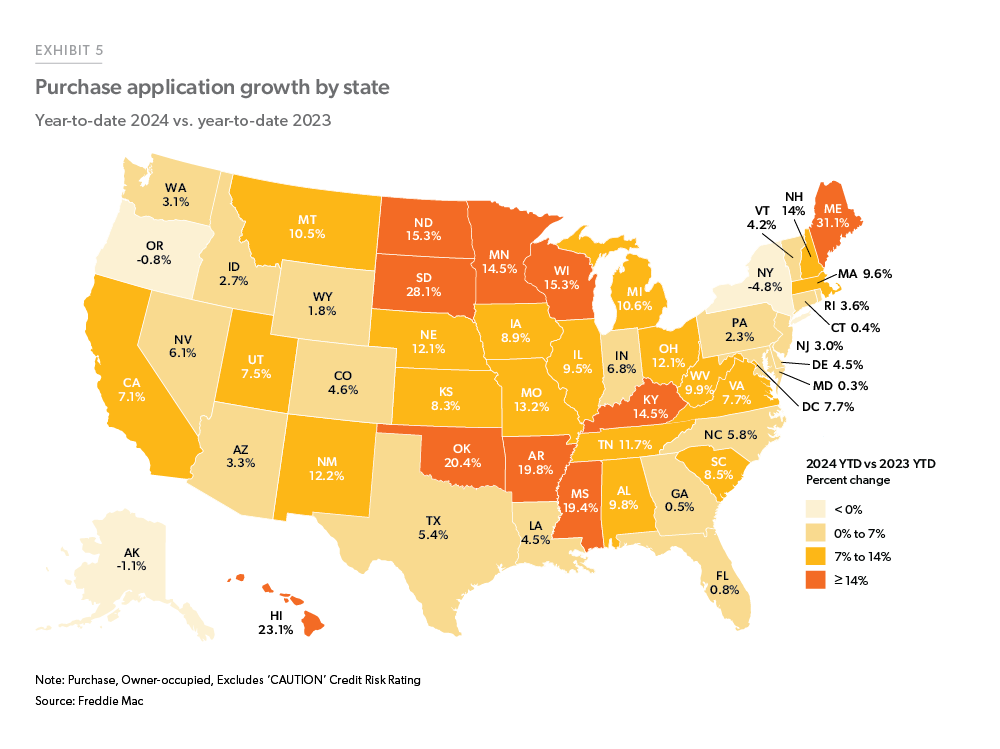

We can also look at where housing demand is growing. Geographically, purchase demand growth is spread throughout the country, but the most considerable growth is coming out of midwestern and southern states such as South Dakota, Mississippi, Arkansas, and Oklahoma. However, some markets that led demand in previous years (e.g. Florida and Arizona) appear to be moderating, implying that the rate lock-in effect and high home prices are starting to take their toll on these hot markets (Exhibit 5).

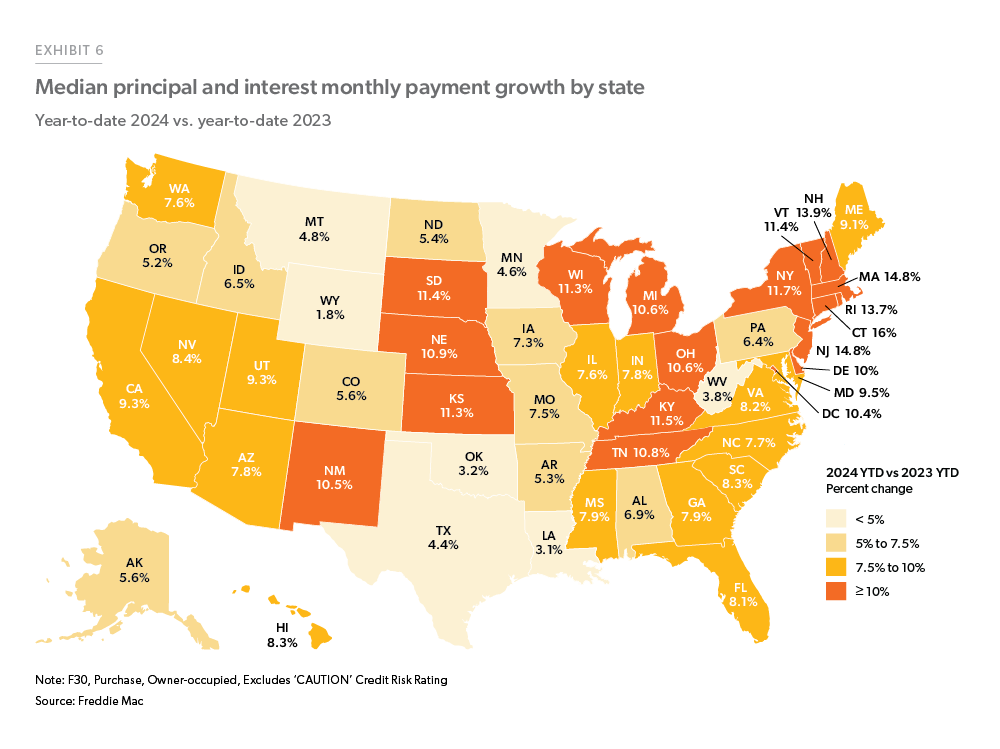

The affordability issue remains a primary concern in the housing market and poses significant risks to demand. Using our LPA data, we can track how monthly payments (principal and interest) have increased over the same period last year. Exhibit 6 breaks out the growth in median principal and interest payments geographically. The markets that show the highest payment growth are in the midwestern and northeastern regions. These potential homebuyers will have to pay out significantly more money every month compared to last year.

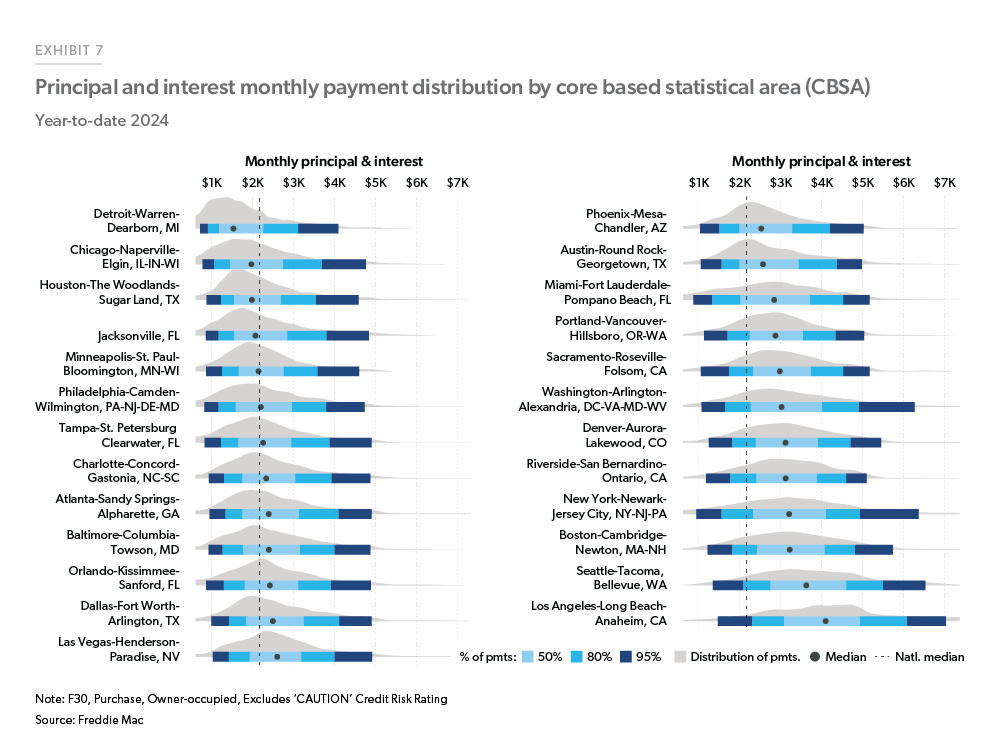

We also looked at how the principal and interest paid by borrowers vary by metro. Specifically, we looked at 25 of the largest housing markets to understand how spread out a typical payment within the market has been in the first three months of 2024.1 Exhibit 7 (following page) shows that markets like Detroit, Minneapolis, and Houston have somewhat narrower distributions of payments, whereas metros like New York, Washington D.C., and Los Angeles have broader distributions. The wider distribution means those housing markets are much more heterogeneous even within their respective metro limits.

This year’s spring homebuying season has started strong. Looking at our internal application data, we see demand has improved from last year despite the challenging homebuying environment. However, there is still much uncertainty related to broader affordability problems and how that will impact real estate transactions. Nonetheless, demand for homes seems unabated so far in the first three months of 2024, and that momentum may very well continue throughout the spring homebuying season.

Footnotes

- Top 25 markets with the most F30 purchase applications in LPA year-to-date.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Jessica Donadio, Finance Analyst