Refinance Trends

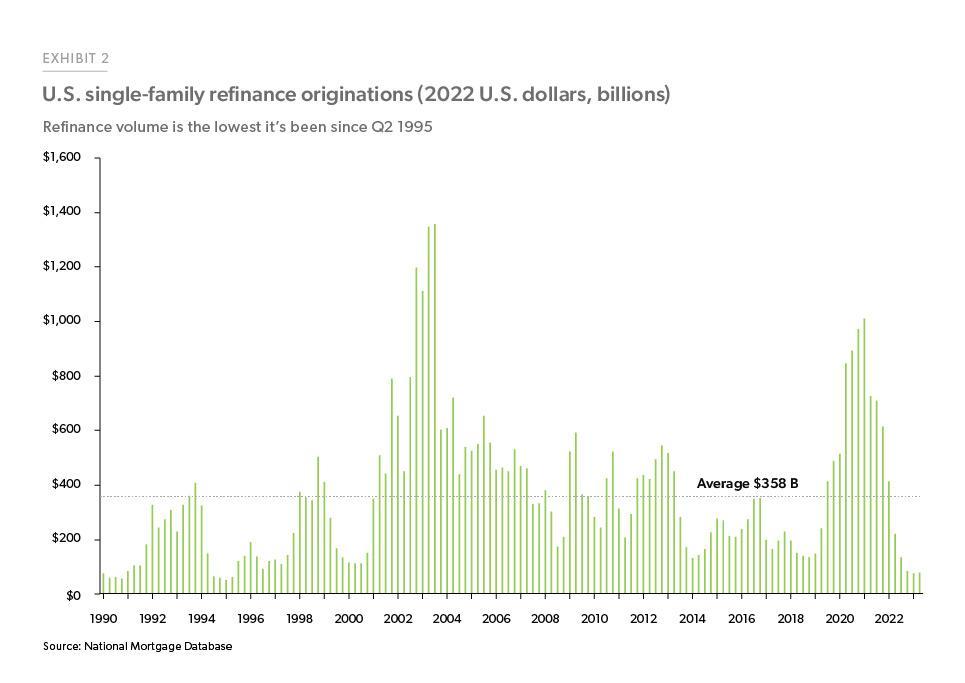

Refinance origination activity in 2023 has been at the lowest level in almost 30 years.

In the first and second quarters of 2023 there were only $75 and $80 billion, respectively, in mortgage refinance originations nationally, the lowest quarterly volumes since 1995 (see Exhibit 2, which is adjusted for inflation). The decline in refinance activity is a direct result of higher mortgage interest rates. Since most homeowners locked-in low rates relative to current market rates, relatively few people can lower their rate now by refinancing. However, some borrowers are still opting to refinance to cash out home equity or to lengthen their loan term, as we will discuss next.

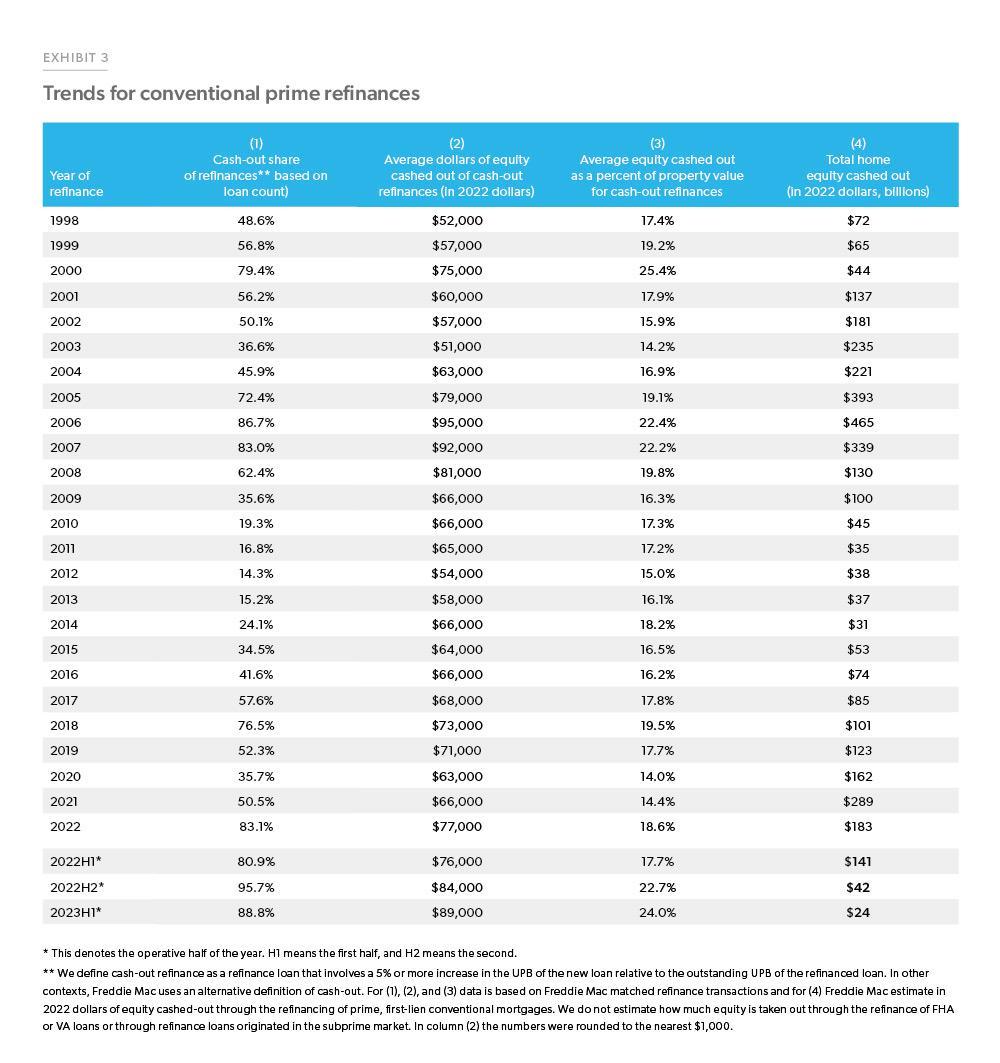

In the first half of 2023, nearly nine out of ten conventional refinance originations were cash-out refinances demonstrating just how few rate-and-term refinance borrowers exist in the current market. The faster pace of decline in the rate-and-term refinance originations is pushing up the cash out refinance share even as the overall refinance volumes decline.

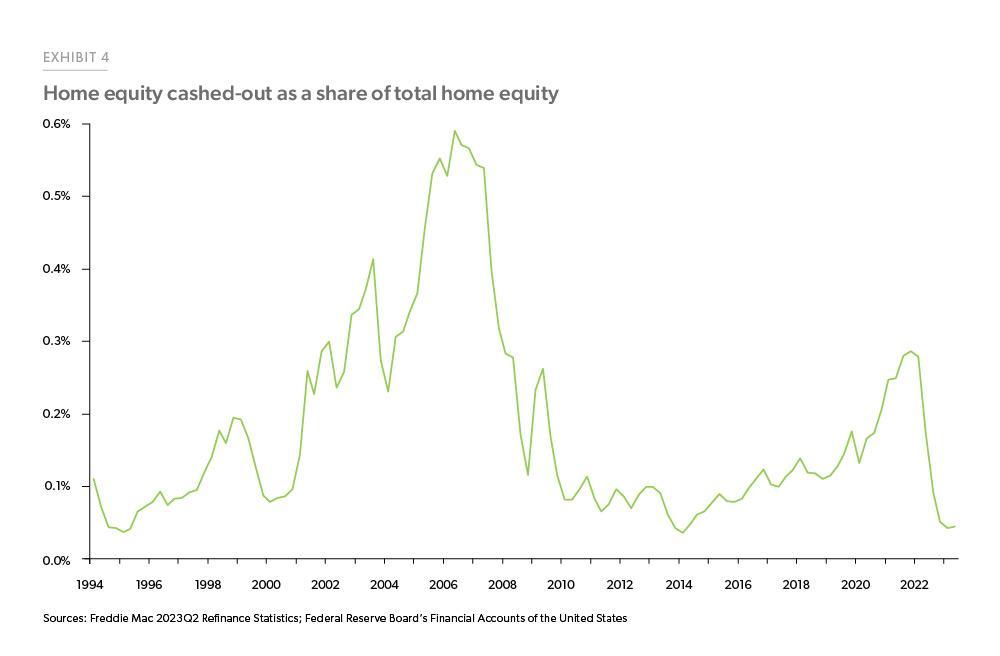

Exhibit 3 shows trends in conventional cash-out refinance activity over time. During this period, the average cash-out refinance borrower extracted $89,000 in equity in 2022 dollars, representing 24% of the property value. However, since refinance activity is down, the total is only $24 billion in aggregate dollars in the first half of 2023, down from $141 billion in the first half of 2022. As a share of total home equity, aggregate equity cashed out represented only 0.04% in the first and second quarters of 2023, down from 0.28% and 0.17% in the first and second quarters of 2021 respectively (see Exhibit 4). Historically the highest equity extraction share was 0.59% in the second quarter of 2006, more than ten times as much equity extraction as in 2023.

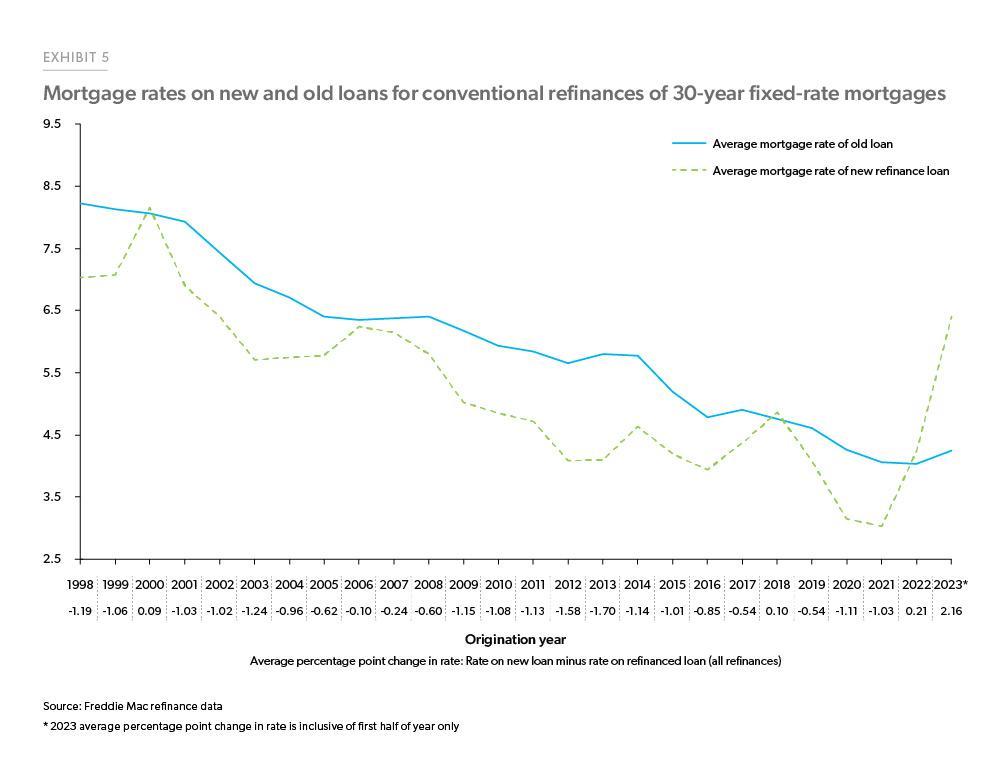

Borrowers who do opt to cash out or otherwise refinance their loan are paying a much higher interest rate on their new loan. Exhibit 5 (following page) shows the average rate on the loans out of which borrowers refinanced and the rate on their new loan if both loans were 30-year fixed-rate mortgages. During the first half of 2023, the average rate on a new refinance loan was 6.4% vs 4.2% for the old loan—an increase of more than two percentage points. These higher rates resulted in an average increase of $591 in monthly principal and interest payments for borrowers who refinanced.

One way that borrowers can help mitigate the effects of higher interest rates is to extend the term on their loan, since that extends the payments over a longer period. Extending the term results in more interest payment over the life of the loan but has the benefit of reducing the required monthly payment. In the second quarter of 2023, 23% of refinance borrowers lengthened their term, up from 11% a year prior and the highest share since the third quarter of 2008.

As mentioned earlier, we expect the average 30-year fixed-rate mortgage to remain elevated in the 6-6.5% range at least through the first quarter of next year, leading to a further decline in the aggregate refinance volume. Offsetting mortgage rate headwinds somewhat is the record high aggregate homeowner equity, which was over $28 trillion as of the first quarter of 2023, with the aggregate ratio of home equity to the value of housing stock at 70%.1 This large pool of untapped home equity could help some homeowners, for example to payoff higher-rate debt, finance a home renovation, purchase a new vehicle, update home appliances, or pay medical bills. Therefore, we expect most refinances for an extended period of time to be cash-out refinances.

Footnote

- According to the latest data from the Federal Reserve Board’s Financial Accounts of the United States.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ralph DeFranco, Macro Housing Economics Senior Director

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Professional