Low Mortgage Rates, Strong Labor Market Fueling Housing Market

The recent decline in mortgage rates stem from the on-going global trade disputes and weakening global economy, which have led to a drop in long term interest rates in most countries. Despite the negative impacts of trade and the deteriorating global economy, the domestic U.S. economy continues to grow and the three-year low in mortgage rates has poised housing to reaccelerate.

As a result, we expect a significant increase in refinance originations in upcoming quarters. Going forward, the combination of low mortgage rates, a tight labor market, and strong consumer confidence will offset declining business sentiment. These factors will set the stage for continued improvement in the housing market heading into the fall.

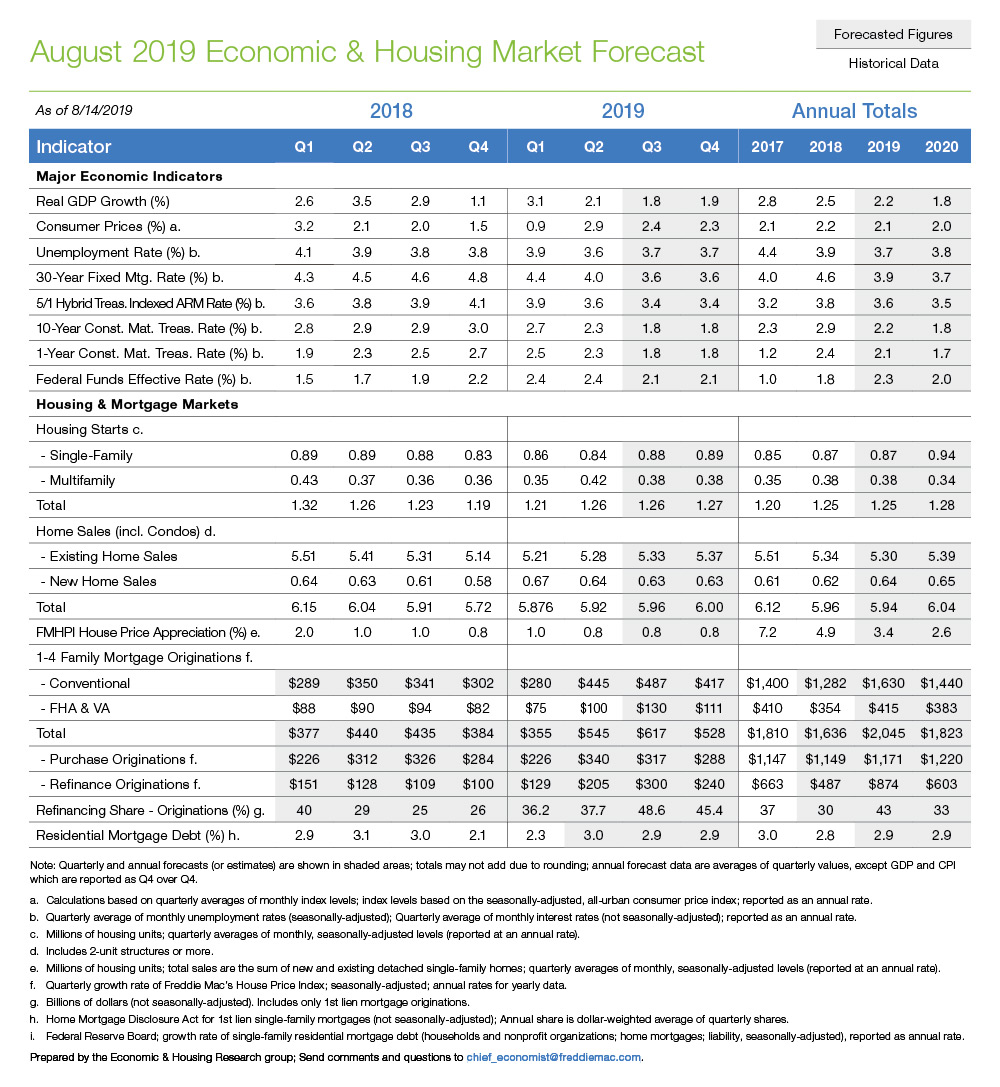

The lasting impact of trade tensions will have some visible impact on the second half of 2019 and early 2020. Without the short-term effects of tax cuts and fiscal stimulus we saw in 2018, for the full year 2019, we forecast slower growth of 2.2%, and further decelerating to 1.8% in 2020.

The declining trend in gasoline prices as well as wage stagnation lead us to predict that consumer price inflation will remain at 2.4% and 2.3% in the third and fourth quarters of 2019, respectively. Our yearly consumer price forecast remains unchanged at 2.1% in 2019, before edging down to 2.0% in 2020.

Despite fears of an economic slowdown, the U.S. labor market stands firm. Unemployment claims are approaching their lowest levels since the early 1970’s. Job openings also remain higher than unemployment claims for an impressive sixteen consecutive months. There has been little change in workers’ willingness to change jobs, while at the same time, businesses are holding on to their workforce in a tight labor market. This continued strength in the labor market supports our forecast of a strong unemployment rate of 3.7% in the third and fourth quarters of 2019. Our full year 2019 forecast remains at 3.7%, before modestly increasing to 3.8% in 2020.

Mortgage rates to remain low for foreseeable future

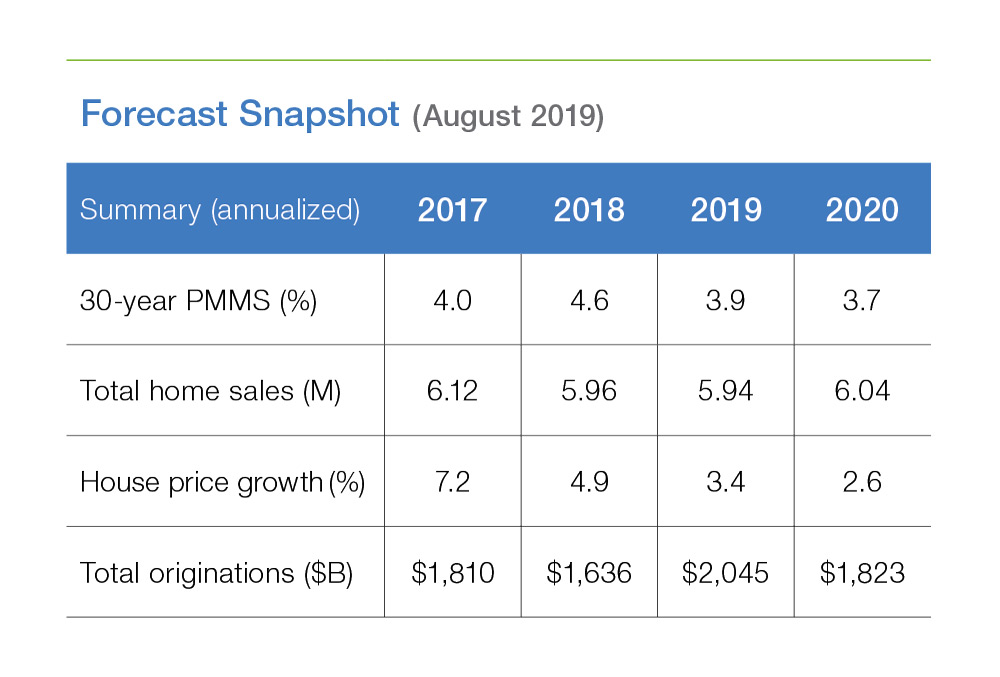

Over the past few months, the increased global uncertainty has put downward pressure on interest rates. Long-term government bond yields around the world have plummeted, dropping below zero in many European countries. Denmark, one of the few countries outside of the United States with a 30-year fixed-rate mortgage, saw its mortgage rate fall as low as 0.5%. While we are not projecting the 30-year fixed-rate mortgage in the United States to come anywhere close to that rate anytime soon, the mortgage rate trend in Denmark provides an example of the enormous downward pressure on long-term interest rates around the world. Thus, we have adjusted our quarterly forecast for the 30-year fixed-rate mortgage to remain around 3.6% through the second quarter of 2020. We project the annual average to be 3.9% in 2019, before sinking to 3.7% in 2020.

We expect mortgage rates to follow Treasury yields with the 30-year fixed-rate mortgage averaging 4.1% in 2019, before increasing modestly to 4.2% in 2020.

Anticipating more possible interest rate cuts in the second half of 2019 and again in 2020, we expect the Federal Funds effective rate to be 2.1% in the third and fourth quarter of 2019. Thus, our 2019 annual forecast for the Federal Funds rate has been lowered to 2.3%, before declining to 2.0% in 2020 due to the expected rate cuts next year.

As yield rates around the world fall, foreign investors are flocking to the American bond market. This has put significant downward pressure on the 10-year Treasury rate. We expect 10-year Treasury yields to decline to 2.2% in 2019, and then to 1.8% in 2020. Also, maintaining the spread between government bond yields, we expect the 1-year Treasury rate to be 2.1% in 2019, before dropping to 1.7% in 2020.

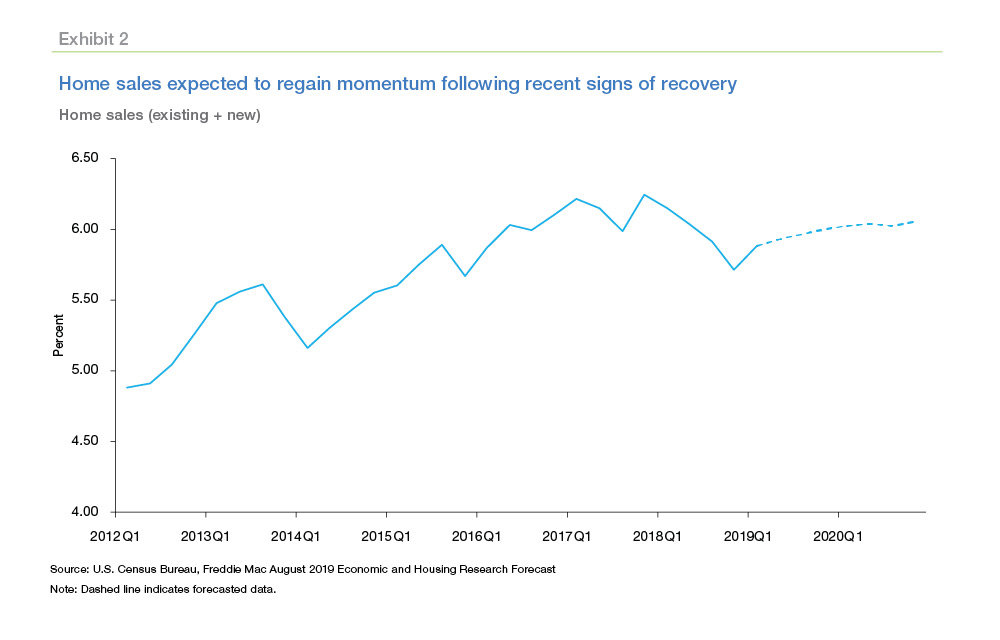

Homes sales showing signs of recovery

Consistently strong homebuilder confidence supports our view that housing starts will recover from their 2018 slump. We anticipate annual housing starts to be 1.25 million in 2019, before increasing to 1.28 million in 2020. Current mortgage rates have brought optimism that sales will recover in the second half of 2019. Given the combination of increased demand and a projected upward tick in

housing supply, we expect home sales to be 5.94 million in 2019, before reaching near-2017 levels in 2020, at 6.04 million.

Strong data over the last few months gives us reason to believe that house prices will continue to beat expectations in the coming months. We estimate that house prices will appreciate 3.4% in 2019, before tapering off slightly in 2020 at 2.6%.

Refinance originations expected to increase with low mortgage rates

We anticipate total originations to increase significantly relative to our July forecast. This increase is driven primarily by a surge in refinancing given the lower expected mortgage interest rate path in our August forecast. The MBA Mortgage Applications Refinance Index is up 50% in just the last month. This reinforces our belief in the strength of the refinance market. We estimate the refinance share of originations to grow to 43% in 2019 and 33% in 2020. More recently, purchase originations have also seen a modest increase in activity as new homebuyers look to take advantage of lower mortgage rates. We expect total annual mortgage originations to be 2 trillion in 2019 and 1.8 trillion in 2020.

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP