Economic, Housing and Mortgage Market Outlook – July 2024

In this Issue

- Economic growth for Q1 2024 slows to the lowest level since Q2 2022 while the labor market also shows signs of cooling.

- Home sales continue to remain low even as mortgage rates ease slightly, and while we see improvement in inventory, it remains below pre- pandemic averages.

Recent developments

U.S. economy: The third estimate of U.S. economic growth released by the Bureau of Economic Analysis (BEA) in June showed GDP growth at a 1.4% annualized rate in Q1 2024, a slight increase from the second estimate of 1.3%. Downward revisions to imports and upward revisions to nonresidential investment and government spending led to the upward revision of Q1 growth. Consumer spending, however, experienced a slowdown from 2.0% annualized growth in the second estimate to 1.5% in the final estimate for Q1 2024. Consumption spending’s contribution to GDP also declined from 1.3% in the second estimate to 0.9% in the final estimate. Real Gross Domestic Income (GDI) increased 1.3% in Q1 2024. The average of GDP and GDI, a supplemental measure of economic activity that equally weights GDP and GDI, increased 1.4% in Q1 2024.

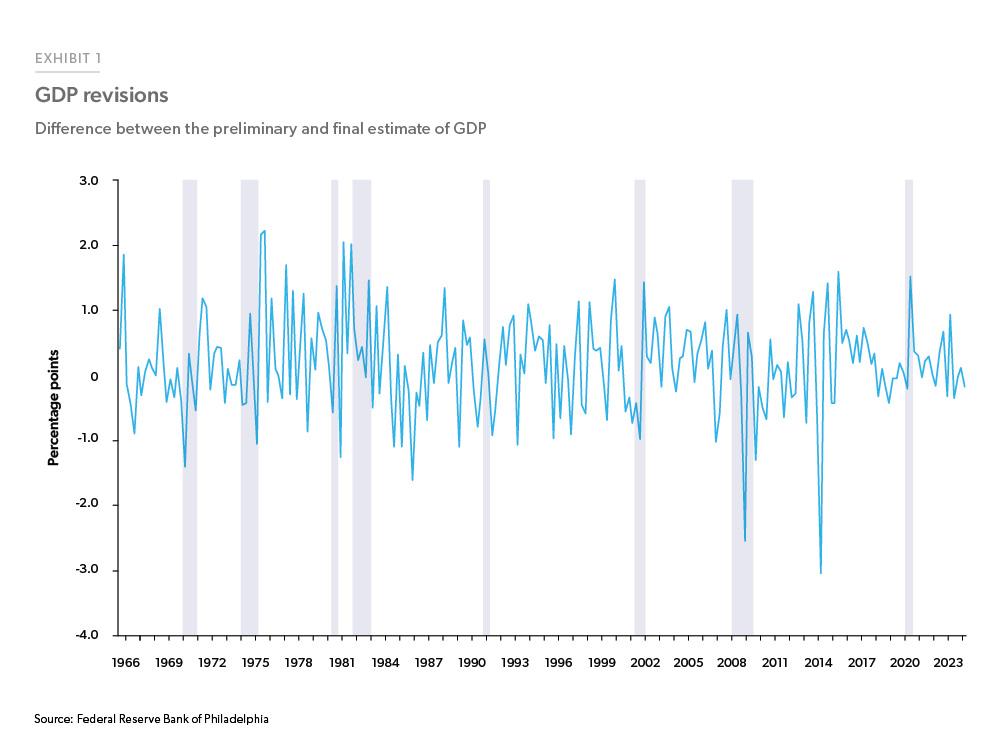

The final estimate for Q1 2024 GDP released in June was 18 basis points below the first estimate released in April. On average, the revisions to GDP from the preliminary to final estimate have been around 17 basis points since Q3 1965 (Exhibit 1). While there is no discernible pattern in the revisions to GDP estimates, typically, there are downward revisions to GDP at the beginning of a recession.1 However, during the pandemic recession in Q2 2020, there was an upward revision to the GDP estimate mainly due to the relaxation of the stay-at-home orders which led to an uptick in economic activity.

The labor market cooled as per the latest employment report from the Bureau of Labor Statistics (BLS). Total nonfarm payroll gains were 206,000 in June and along with that April and May total payroll gains were revised down by a combined 111,000 (57,000 for April and 54,000 for May). Around three-fourths of the job gains in June occurred in healthcare and social assistance and government. Year-to-date job growth for 2024 is 1.3 million with an average of 222,000 jobs added each month (down from an average of 247,000 jobs last month). However, the unemployment rate ticked up further to 4.1% and is now at the highest level since November 2021.

The Job Openings and Labor Turnover Survey (JOLTS) report released by BLS showed job openings rose to 8.1 million in May, after April was revised down by 140,000 to 7.9 million. Job openings for April were at the lowest level since March 2021. The job openings to unemployed ratio for May at 1.22 was at the lowest level since June 2021. The quits rate was unchanged at 2.2% for the seventh consecutive month. Overall, the job market appears to be cooling with the unemployment rate rising over the last few months and substantial downward revisions to job gains.

On the inflation front there was some encouraging news as the Federal Reserve’s preferred inflation gauge, the core Personal Consumption Expenditure Price Index, which strips out volatile food and energy prices, rose 0.1% month-over-month and was up 2.6% year over year in May 2024.2 The annual increase was the lowest since March 2021. Prices for goods decreased 0.4% month-over-month led by declines in gasoline and other energy goods along with recreational goods and vehicles. Prices for services were up 0.2% month-over-month in May and within services, healthcare had the largest increase over the month followed by housing and utilities.

Overall, while economic growth for Q1 2024 was the slowest since Q2 2022, it still reflects a growing economy. There has been some moderation in inflationary pressures, and per the Fed dot plot, there might be only one rate cut this year. The higher for longer rates are affecting consumer delinquencies, which we discuss in detail in this month’s Spotlight. The labor market, while still strong by historical standards, is showing some signs of cooling as the unemployment rate sits at the highest level since November 2021.

U.S. housing and mortgage market: The housing market continues to remain slow after being impacted by high mortgage rates. Total (existing + new) home sales for May at 4.7 million fell 2.3% from April and were down 4.9% from a year ago. Unlike the last couple of months when existing home sales declined while new home sales picked up, both existing and new home sales declined in May. Existing home sales were 4.11 million (seasonally adjusted annual rate) in May, down 0.7% month-over-month and 2.8% year-over-year.3 New home sales for May fell 11.3% from April to an annualized rate of 619,000, accounting for about 13% of total home sales.4 Both existing and new home inventory improved over May but still remains below the pre- pandemic average.5 Existing home inventory picked up 19% year-over-year to 1.28 million units, while new home inventory is at the highest level it’s been since January 2008.

Homebuilder confidence fell to 43 in June from 45 a month earlier, according to the National Association of Home Builders’ Housing Market Index. The decline is below the threshold of 50, indicating poor building conditions over the next six months. The primary driver of the decline was attributed to higher mortgage rates and increases in construction cost.6 Housing construction also experienced a decline in May. According to the U.S. Census Bureau, new residential construction fell in May with total housing starts declining 5.5% month- over-month. Single-family starts declined 5.2% month-over-month, and multifamily starts fell by 10.3%. Despite the fall in units started, the units under construction for multifamily remains high at 898,000 units.

The April FHFA Purchase-Only Home Price Index showed a 0.2% month-over-month increase after remaining unchanged the prior month. Year-over-year house price growth remained robust at 6.3% for April.

The 30-year fixed-rate mortgage averaged 6.92% in June, as measured by Freddie Mac’s Primary Mortgage Market Survey® and ended the month at 6.86%. According to the Mortgage Bankers Association (MBA) Weekly Application Survey, mortgage activity increased over the month as rates ticked below 7%. Overall mortgage activity was up 14.5% month-over-month and was unchanged year-over-year at the end of June. Refinance activity during the last week of June was up 25.9% compared to the same week a month earlier, while purchase applications were up 8.0% month-over-month at the end of June.

Overall, high mortgage rates and house price appreciation has led to a slowdown in the housing market and is causing housing inventory to pick up.

Outlook

We expect the U.S. economy to continue to be affected by higher interest rates, leading to a lower growth rate and a weaker labor market in 2024 and 2025. While incoming inflation data is reassuring, under our baseline scenario, a weaker economy and labor market will further cool inflation, though remaining above the Federal Reserve’s target rate of 2%. We anticipate a rate cut towards the end of this year if the job market cools off enough to keep inflation in check. This rate cut, if it occurs, could lead to a slight easing of mortgage rates in 2024, offering a glimmer of hope for prospective buyers. We expect mortgage rates to decline further in 2025 to below 6.5%, further stimulating the housing market by making homeownership more affordable.

Despite strong housing demand, the housing outlook remains subdued under our baseline scenario, particularly for home sales. Our opinion hinges on the significant challenges posed by high mortgage rates, high home prices and a lack of homes available for sale. While inventory is improving in some parts of the country, supply remains short due to solid fundamentals in the housing market. We anticipate these challenges to persist in 2024 keeping total home sales volume down. However, we expect some improvement in home sales in 2025 with easing mortgage rates. Due to strong demand fundamentals, we expect upward pressure on home prices and forecast home prices to increase in 2024 and 2025.

We anticipate a modest increase in purchase origination volumes this year and into 2025, supported by high home prices. However, we do not expect purchase origination volumes to be significantly higher than in 2023, as affordability challenges will limit home sales. On the refinance side, we expect refinance origination volumes to remain flat in 2024. However, we expect the drop in mortgage rates to below 6.5% in 2025 to prompt buyers who obtained higher rates in 2023 to refinance into lower rates. Under such a scenario, we expect the refinance volume to grow modestly next year. With some pickup in refinance and purchase originations, we forecast total origination volumes in 2024 and 2025 to grow modestly.

Overall, we remain optimistic about the economy. While the high interest rate environment is deteriorating the credit performance, making it more difficult for credit borrowers to meet their payment obligations, particularly in the auto and credit card segments, homeowners’ credit performance remains solid. The resilience in homeowners’ credit performance indicates their ability to weather adverse economic impacts, if any. We expect homeowners to remain resilient as they have accumulated a large chunk of equity to tap into if negative incomes hit them.

See the July 2024 spotlight on consumer delinquencies, “Credit Card, Auto and Mortgage Delinquencies.”

Footnotes

- https://www.stlouisfed.org/on-the-economy/2014/may/do-revisions-to-gdp-follow-patterns

- BEA

- National Association of Realtors

- U.S. Census Bureau

- Pre-pandemic average is considered to be the period from 2016-19.

- National Association of Home Builders (https://www.nahb.org)

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Kristine Yao, Macro Housing Economics Director

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior