Almost 50% of Black and Hispanic Borrowers Could Save $1,200 Annually by Refinancing

Who could benefit from refinancing?

The recent record low mortgage interest rates provide many borrowers with an opportunity to save thousands of dollars by lowering their mortgage rate through refinancing. A recent Freddie Mac Research Note observed that, on average, homeowners who refinanced their 30-year fixed-rate mortgage in 2020 saved more than $2,800 dollars annually and reduced their interest rate by a full percentage point.1 But a closer look at who is refinancing demonstrates that many borrowers who could benefit from refinancing still aren’t pursuing the option.

What determines whether a borrower refinances?

The decision to refinance a mortgage is complex, and the optimal time to refinance for a household depends on many factors, such as the current market mortgage rate, the existing mortgage’s coupon, the loan balance, the length of time a household expects to live in a home, the volatility of interest rates, closing costs, inflation, the marginal tax rate, and the discount rate.2 The main factors that determine a borrower’s monthly savings on the mortgage coupon are the existing mortgage coupon, the rate the borrower could receive in the current market, and the current loan amount. This is balanced by the closing costs, tax implications, and how long the borrower expects to stay in that mortgage. Various tools can help a borrower with this decision.3

Which borrowers would benefit?

Borrowers with older originations with higher rates relative to current mortgage rates would benefit

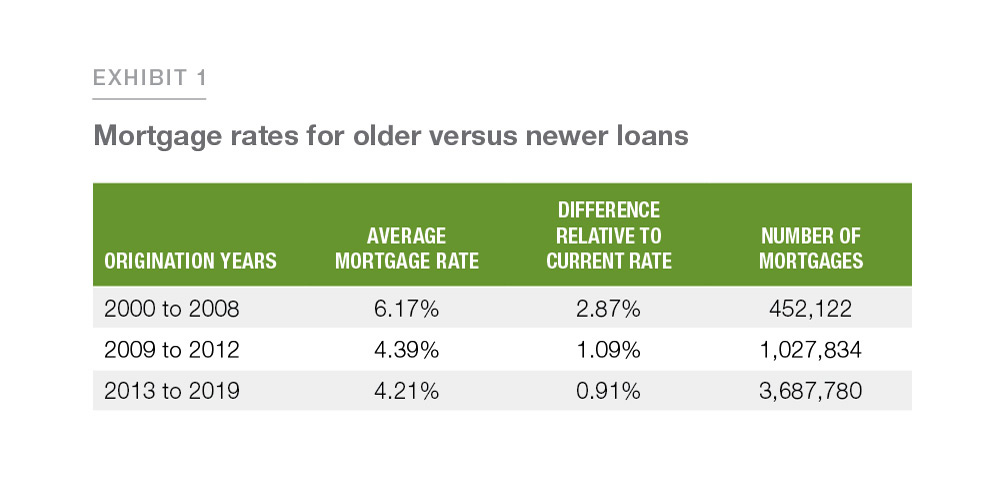

We examine 30-year fixed-rate loans that were active in January 2021 and funded by Freddie Mac to estimate the degree to which older loans have higher mortgage rates. Exhibit 1 shows that loans originated from 2009 through 2019 have rates that are about 1 percentage point higher than the current market rate. Those that were originated from 2000 through 2008 and are still active have an even higher average mortgage rate of 6.17%, which is almost 3 percentage points higher than the current market rate.4 At current rates most borrowers would benefit from refinancing, but refinancing may be especially beneficial for borrowers holding these older loans with relatively higher rates.

Black and Hispanic borrowers would especially benefit from refinancing

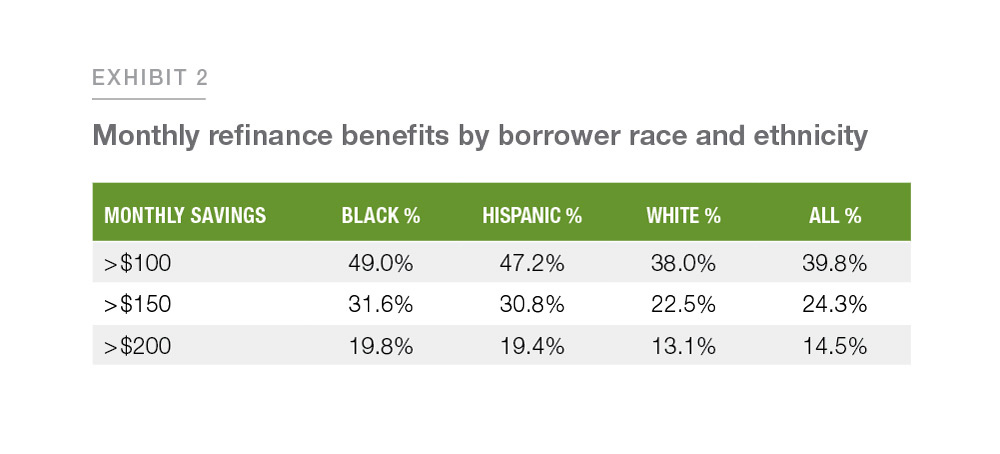

We examine 30-year fixed-rate loans that were active in January 2021 and funded by Freddie Mac to estimate the percentages of borrowers of different races and ethnicities that may benefit from refinancing. We focus on four groups for this analysis: Black, Hispanic, White, and All borrowers. Exhibit 2 shows the fraction of borrowers whose savings from refinancing would exceed certain dollar thresholds. For example, the first row reflects that nearly 40% of all these households could save at least $100 per month from refinancing at today’s rates, and this percentage is nearly 50% for Black and Hispanic borrowers and 38% for White borrowers. Moreover, nearly 15% of all borrowers could save at least $200 per month from refinancing, and this percentage is nearly 20% for Black and Hispanic borrowers and 13% for White borrowers.

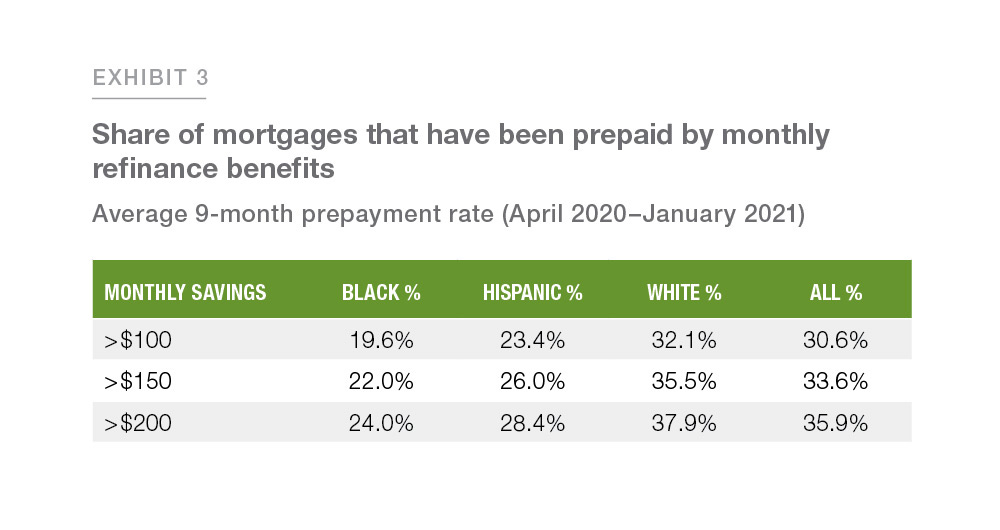

However, even though a higher proportion of Black and Hispanic borrowers have a financial incentive to refinance, they refinance their mortgages at substantially lower levels than White borrowers. Exhibit 3 displays the realized cumulative prepayment rates from April 2020 through January 2021 of loans that were active as of April 2020 by different monthly savings groups.5 It shows that for those who could save at least $100 a month, 19.6% of Black borrowers, 23.4% of Hispanic borrowers, and 32.1% of White borrowers prepaid over this period, whereas 30.6% of all borrowers have prepaid. These results are consistent with recent research showing that Black and Hispanic borrowers disproportionately do not refinance when it is economically beneficial for them to do so (see, for example, Gerardi, Willen, and Zhang 2020).

Closing costs can be a barrier to refinancing

Closing costs present a barrier to refinancing for some borrowers. Freddie Mac estimates that closing costs associated with a refinance average about $5,000, and many borrowers do not have enough liquid assets to cover these costs. According to the Federal Reserve’s 2019 Survey of Consumer Finances, about 59% of Hispanic borrowers, 53% of Black borrowers, and 32% of White borrowers had less than $5,000 in liquid assets,6 and current household financial reserves may now be even lower due to the pandemic and its impact on employment. As a result, closing costs can be a barrier to refinancing for many borrowers. For borrowers that are liquidity constrained, there are other options to consider. For example, a no-cost refinancing allows a borrower to pay a higher interest rate in exchange for not paying closing costs. If the spread between the current mortgage rate and the market rate is large enough, this could still end up saving the borrower money.7 Low-income borrowers also may be eligible for grants to cover such closing costs.

Also, by shopping for a refinance from more than one mortgage lender—ideally, three or more—a borrower is more likely to get a better interest rate, pay lower closing costs and save more money. Freddie Mac estimates that getting at least three quotes could save the typical borrower more than $2000, over the life of a mortgage.8

Potential aggregate savings for borrowers

The potential savings to borrowers and the market from refinancing is substantial. We use the 2019 American Housing Survey data and CoreLogic loan level servicing data to represent the entire U.S. mortgage population for 30-, 20-, and 15-year fixed-rate mortgages, and assume an average of $5,000 in closing costs. We estimate that 24 million borrowers would more than recover closing costs within five years of refinancing. Over five years, these borrowers would save an average of about $12,000 in mortgage payments, leading to net savings after closing costs of $7,000 per borrower and $170 billion in total.

Despite recent rate increases, mortgage interest rates continue to be at historically low levels. Yet, many borrowers who would benefit from refinancing have not taken advantage of this opportunity. These borrowers could save money and help build their wealth by refinancing their mortgages.

References

- http://www.freddiemac.com/research/insight/20210305_refinance_trends.page?

- Many papers have shown many borrowers should refinance but do not. See, for example, Agarwal, Driscoll, and Laibson (2013); Agarwal et al. (2020); and Gerardi et al. (2021).

- See, for example, https://myhome.freddiemac.com/refinancing/planning-to-refinance.html.

- The current market rate refers to the PMMS 30-year fixed rate of 3.30%, which is based on the 3/25/2021 PMMS survey result of a 3.18% rate with 0.7 points converted to a rate using a DV01 of 6. If these loans were refinanced into a shorter maturity mortgage, such as a 10- or 15-year fixed rate mortgage, the potential reduction in the rate would be even larger, but this rate reduction could be offset by higher principal payments due to faster amortization.

- The savings are calculated using the remaining balance in April. While prepayment rates include both refinances and turnovers, in the period examined borrowers have strong refinance incentives and, consequently, refinances are the dominant prepayment component.

- See https://myhome.freddiemac.com/refinancing/costs-of-refinancing.html.

- See, for example, https://www.thetruthaboutmortgage.com/no-cost-refinance-loans/.

- See http://www.freddiemac.com/research/insight/20180417_consumers_leaving_money.page?