Mortgage Interest Rate Dispersion by Generation: Implications for the Housing Market

Mortgage interest rates are on the rise again, with the 30-year fixed-rate mortgage recently crossing the 7% mark, according to the Freddie Mac Primary Mortgage Market Survey®. While elevated interest rates have put homes out of reach for many prospective homebuyers, current homeowners are refraining from listing their homes for sale, keeping the existing home inventory low.

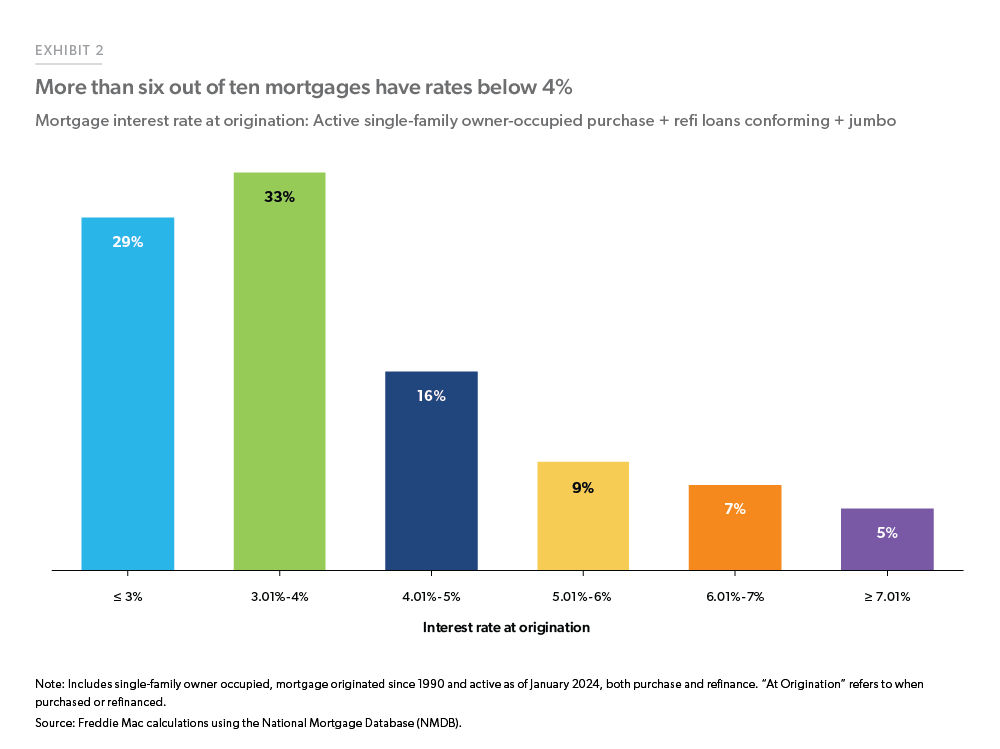

Many homeowners are hesitant to sell their current home to move to a new one because they secured historically low mortgage rates when rates on average were 3.20% in 2020 and 3.06% in 2021.1 Exhibit 2 shows that more than six out of ten mortgages have rates below 4% through purchase or refinancing. In previous analysis, we found that homeowners with a fixed mortgage rate have locked-in $66,000 in savings on average per household, and selling means giving up those savings.

While a financial disincentive exists for selling and moving to a new home in the current rate environment, life events will ultimately push people to move. More importantly, the interest rate that different generations have locked in will be a key determinant of whether there will be a healthy housing market churn to keep people moving along through their life stages. So, what does a typical mortgage look like for different generations, and what rates have they locked?

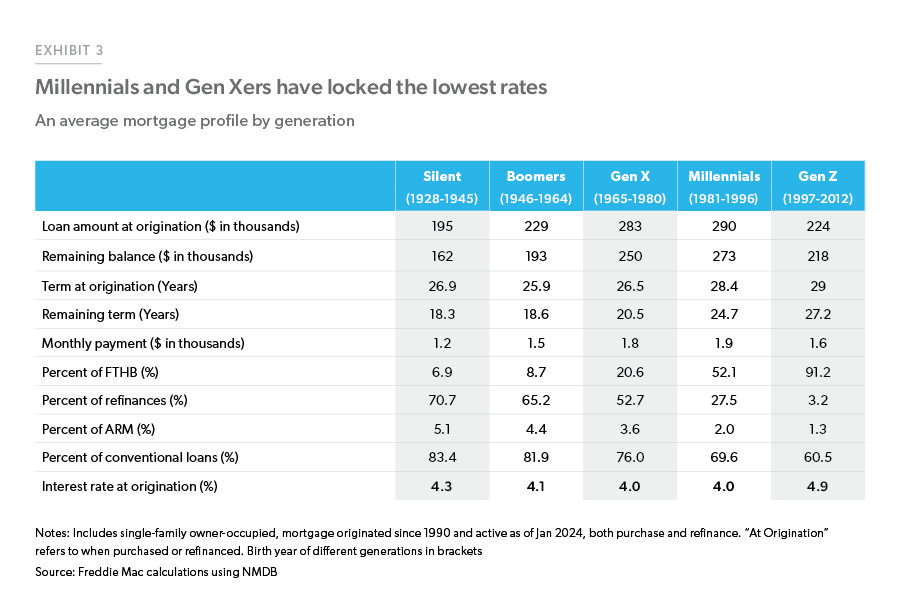

Our analysis of the borrower-level National Mortgage Database (includes all single-family owner-occupied purchase and refinance loans originated since 1990 and active as of January 2024) reveals that Millennials have the highest average loan amount and remaining balance, with a remaining term of 25 years on average (Exhibit 3). Interestingly, the Silent and Baby Boomer generations still have more than 18 years in remaining term, a result of refinancing at low rates in recent years. It’s worth noting that over 90% of Gen Z are first-time homebuyers and there are very few ARM rates, primarily concentrated among the Silent and Baby Boomer generations, with the majority of all generations opting for conventional loans.

Regarding average interest rates, Exhibit 3 shows that Gen Z has the highest rate at 4.9%, and Millennials and Gen Xers have the lowest rates at 4.0%. We find that purchase rates primarily drive the low rates Millennials obtained and the low rates of the Gen Xers are driven mainly by refinance rates. Millennials entered the market when the rates were low, with 37% of all Millennial borrowers’ purchases occurring in 2020 and 2021, according to our NMDB data analysis. While 25% of all Gen Xers’ purchases were in 2020 and 2021, Gen Xers who already were homeowners took advantage of low rates and refinanced during the low-rate period. Gen Z started stepping into the housing market when rates were high: 62% of Gen Z borrowers purchased a home in 2022 and 2023 when the rates on average were 4.9% and 6.7%, respectively, placing them at the higher end of the mortgage rate spectrum.

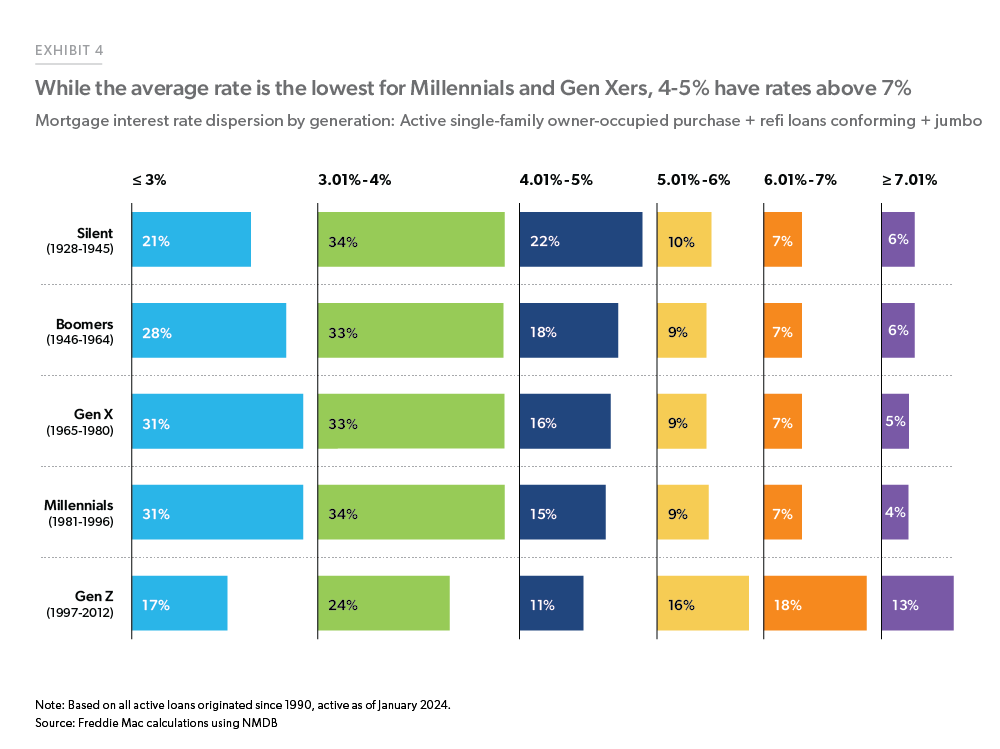

While the current rates make it challenging to spur purchase or refinance activity, there is dispersion in mortgage rates across and within generations that may lead to some mortgage activity if rates fall below the current levels. Exhibit 4 shows that although Millennials and Gen Xers have 4% rates on average, 4%-5% of the borrowers from those generations have rates above 7%.

So, what does this varied interest rate by generation mean for a housing market where refinance activity has tapered off and the inventory of existing homes for sale is lean? Next, we discuss two key implications.

Millennials and Gen Xers on average have low rates, but refinance potential still exists among these generations.

As mortgage rates stay higher for longer, refinance activity continues to be challenging. Looking at the average interest rate by generation, Gen Z is at the forefront regarding refinance potential with 13% of Gen Z having rates above 7%. However, Gen Z is a fraction of total mortgage borrowers, and the number of borrowers with a rate over 7% is slim among Gen Zers. The rate dispersion suggests that there is refinance potential among other generations, notably Gen Xers and Millennials. Millennials are the largest population cohort, and therefore, despite the low homeownership rate compared to Baby Boomers and Gen Xers, the sheer number of Millennial borrowers with rates >7% is high (Exhibit 5). But the refinance potential is mainly concentrated among Gen Xers, with almost 700,000 Gen X borrowers holding mortgage rates >7%. All generations combined, over two million mortgage borrowers have rates above 7%, with over 1.2 million borrowers from the Millennial and Gen X cohorts. If rates fall below 6.5%, an additional 1.4 million borrowers, i.e., a total of over 3.4 million, will have rates above 6.5%, primarily concentrated within the Gen X generation. These borrowers are more likely to refinance their mortgage.

Low rates will lock Gen Xers for longer, but Millennials may make the move regardless.

Due to the ongoing rate lock effect, the housing market is currently plagued by a lean inventory of existing homes for sale. While homeowners moving to another home does not add to the net supply of homes for sale, churn is essential for keeping people moving along through their life stages. An individuals demand for housing keeps evolving as young families move into starter homes and then transition up into larger homes as their families grow. Gen Xers are generally several years away from retirement and have already transitioned from their starter homes to accommodate their growing family; therefore, they are less likely to move from their current homes. The added benefit of low rates may mean that they will remain rate-locked for longer. Millennials, on the other hand—particularly the younger Millennials—are more prone to changing jobs and transitioning into bigger homes as families grow, making them more likely to move regardless of their current low rates. According to the American Community Survey, in 2022, when the average mortgage rate was 5.3%, 12% of Millennial homeowners still moved to a new place, while only 3.8% of Baby Boomers and 5.5% of Gen Xers moved. This suggests that while Baby Boomers and Gen Xers will likely stay put and retain their low mortgage rates, Millennials will likely unlock their locked rate and transition up.

To conclude, demographics play a significant role in the housing market. Mortgage rates acquired by different generations and their behavior will determine the future churn in the housing market. Our analysis suggests that while Gen Xers will be a savior for the refinance market if and when rates decrease, Millennials will likely support the purchase market by upgrading from their starter homes. However, mortgage rates are not the only determinant of the moves. House prices also play a leading role, and risks are weighted to the upside with growing prices, which may keep the housing churn lower for longer.

Footnotes

- These rates are average rates on all loans originated since 1990. Rates on average for conventional loans were 3.11% in 2020 and 2.96% in 2021, according to Freddie Mac Primary Mortgage Market Survey®.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Song You, Macro & Housing Economics Senior

Jessica Donadio, Finance Analyst