Young Adult Homebuyers are Cracking the Homeownership Code

Prospective first-time homebuyers (FTHBs) have faced elevated home prices and more recently, the highest mortgage rates in a generation. Yet despite these affordability challenges, young FTHBs have been a dominant driver of the housing market.

From 2017 through 2022, there were over 12.6 million FTHBs in the United States, which is an increase of 4 million FTHBs compared to the previous 5-year period (2011 to 2016). How have they been able to crack the homeownership code?

There are several ways homebuyers are getting help, especially when it comes to down payments. In our previous analysis, we show that while savings and inheritance are the number one sources for a down payment, help from friends and families is also a fundamental source of down payment assistance.

In the latest available data, 22% of the borrowers in 2020 used family and friends’ help for a down payment, according to the National Survey of Mortgage Originations (NSMO).1 More interestingly, in our analysis using the latest available National Mortgage Database (NMDB),2 we find that the help from family goes beyond down payment assistance into the co-borrowing space.

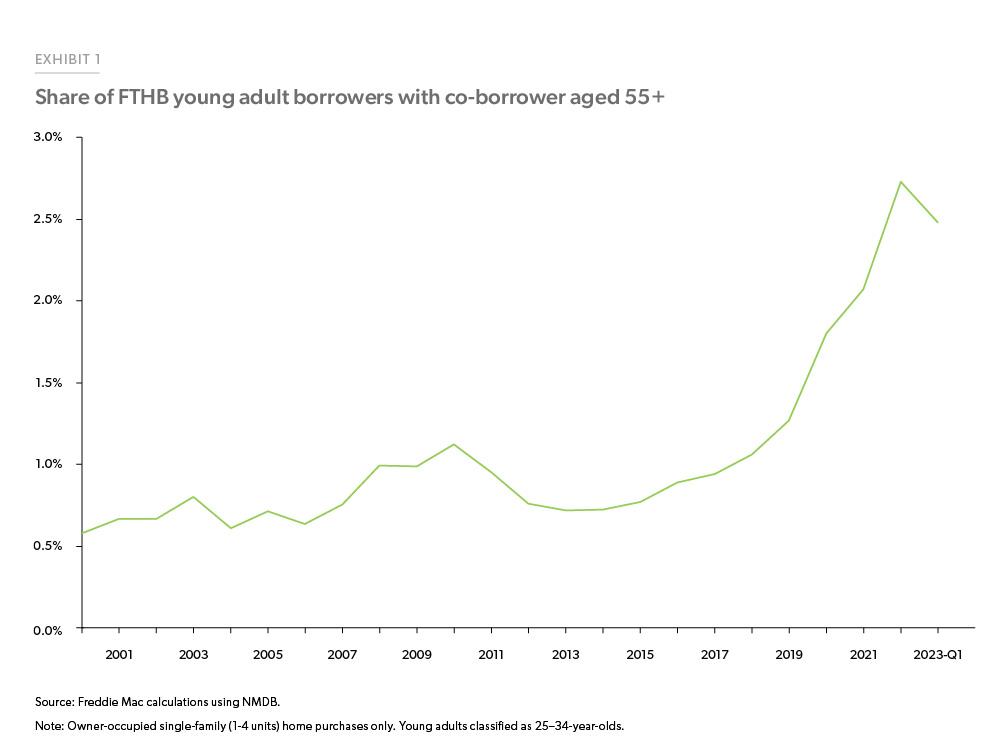

While co-borrowing with a spouse or a partner is the most common form of co-borrowing, there has been an increase in co-borrowing of 25–34-year-olds with a 55+ co-borrower (Exhibit 1, previous page). For example, in 2000, the share of young adult FTHBs with a co-borrower aged 55+ was 0.6%. At of the end of the first quarter of 2023, the share reached 2.5%.3

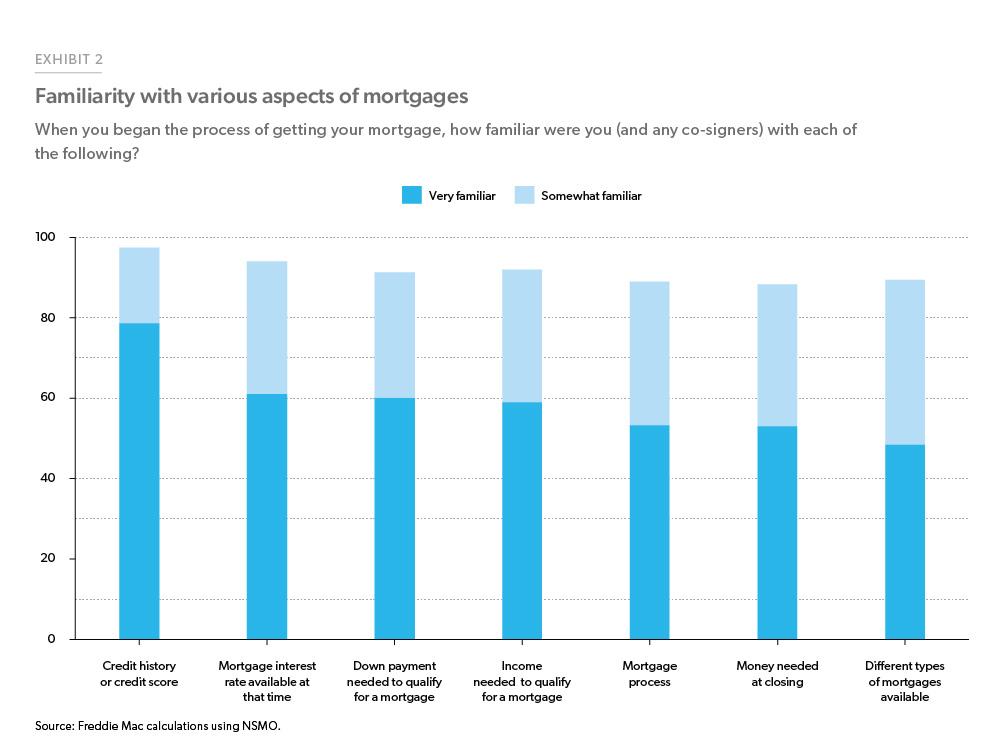

In addition to getting help from family and friends, familiarity with the mortgage process and products is important for a smooth transition to homeownership. To determine how familiar borrowers were with the process of getting their mortgage, we analyzed NSMO survey data which contain survey responses from a sample of mortgages that originated from 2013 through 2020.4 Exhibit 2 presents the percentage of respondents that were “very” or “somewhat” familiar with various aspects of mortgage financing. While almost all borrowers were familiar with their credit score or credit history when they began the mortgage process, there are gaps in the familiarity of other mortgage aspects. So, as FTHBs partner with a co-borrower, this could be an opportunity to help narrow that knowledge gap.

According to our calculations, only 60% of the respondents were “very” familiar with the down payment needed to qualify for a mortgage, and 31% were “somewhat” familiar. Another important factor determining the demand for a mortgage is the mortgage rate, and we find that there is a large dispersion in mortgage rates that the borrowers are offered, particularly in recent years. Similar to what we see with the knowledge about the down payment needed for their mortgage, 6 out of 10 respondents were very familiar with the mortgage rate available at the time they began the mortgage process.

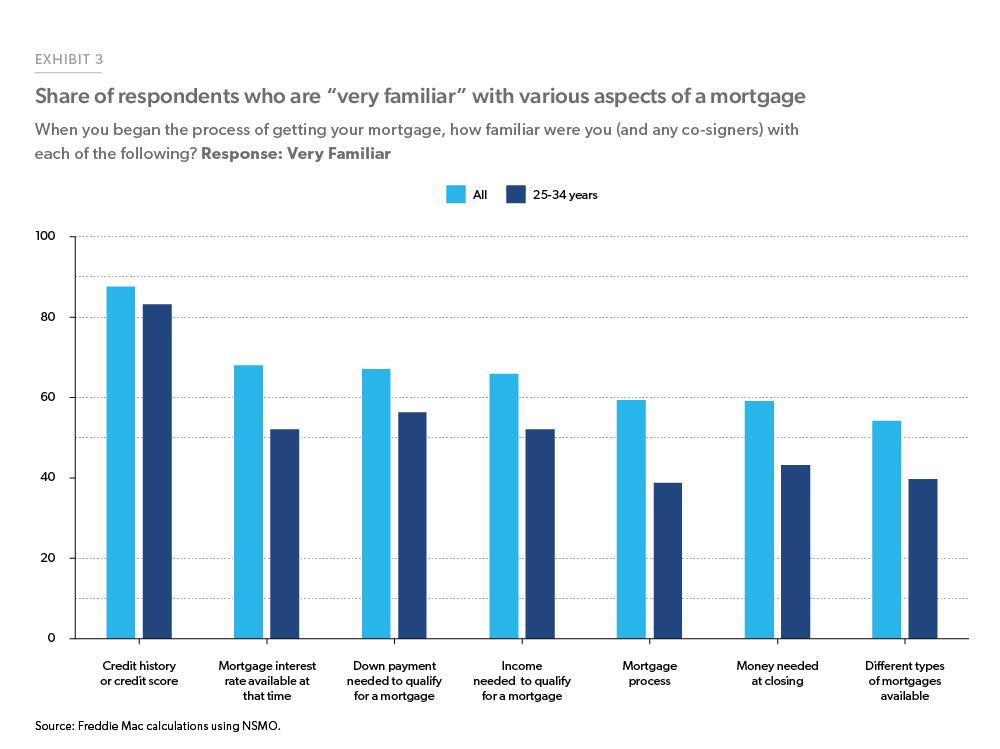

We also explored mortgage familiarity by age groups. While young adults are the ones who are in the forefront of housing demand, their familiarity with aspects of mortgage financing is lower than the overall population. For example, as shown in Exhibit 3, only 47% of 25–34-years-olds were “very” familiar with the mortgage rates available at the time they began their mortgage process compared to 61% of overall population who were “very” familiar. Among those 25–34-years-olds, familiarity is the lowest with the overall mortgage process and different types of mortgages available in the market, which is consistent with the familiarity of overall population.

The findings suggest an opportunity for the mortgage industry to educate borrowers about different aspects of mortgage financing – particularly for young adults who are going to drive the housing market for years to come. For over twenty years, Freddie Mac has reached millions of consumers with CreditSmart®, its free housing and financial capability curriculum aimed at helping consumers learn about the importance of building, maintaining and using credit so they can take the reins on their financial futures. Additionally, Freddie Mac recently launched DPA One®, a tool to help FTHBs understand and take advantage of down payment assistance programs nationwide.

Footnotes

- National Survey of Mortgage Origination (NSMO) is a quarterly mail survey jointly funded and managed by the Federal Housing Finance Agency (FHFA) and the Consumer Financial Protection Bureau (CFPB). NSMO provides unique and rich information for a nationally representative sample of newly originated closed-end first-lien residential mortgages in the United States, particularly about borrowers’ experiences getting a mortgage, their perceptions of the mortgage market, and their future expectations. We use the NSMO public use file updated on March 3, 2023. When asked did you use any of the following sources of funds to purchase this property, among the list of options provided where respondents could choose more than one, 22% selected gift or loan from family or friend.

- National Mortgage Database (NMDB) is a nationally representative five percent sample of residential mortgages in the United States

- We did a similar analysis last year using Freddie only data. Note that part of the difference in the trend comes from the fact that NMDB uses 7 years and Freddie uses 3 years with no mortgage to define FTHBs.

- While we don’t have the latest view, we believe that the familiarity will not be drastically different today compared to 2013-2020 averages.

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Song You, Macro & Housing Economics Senior

Lalith Manukonda, Finance Analyst