Housing Sentiment in the First Quarter of 2022

Freddie Mac’s quarterly housing outlook pulse survey evaluates public sentiment on housing-related issues. In the first quarter of 2022, we found that people remain confident in the strength of the U.S. housing market, a view that was catalyzed by low interest rates. However, many are concerned about making their housing payments, and more than a third reported spending more than 30% of their income on housing.

We are keeping a pulse on the following four key areas of the housing market.

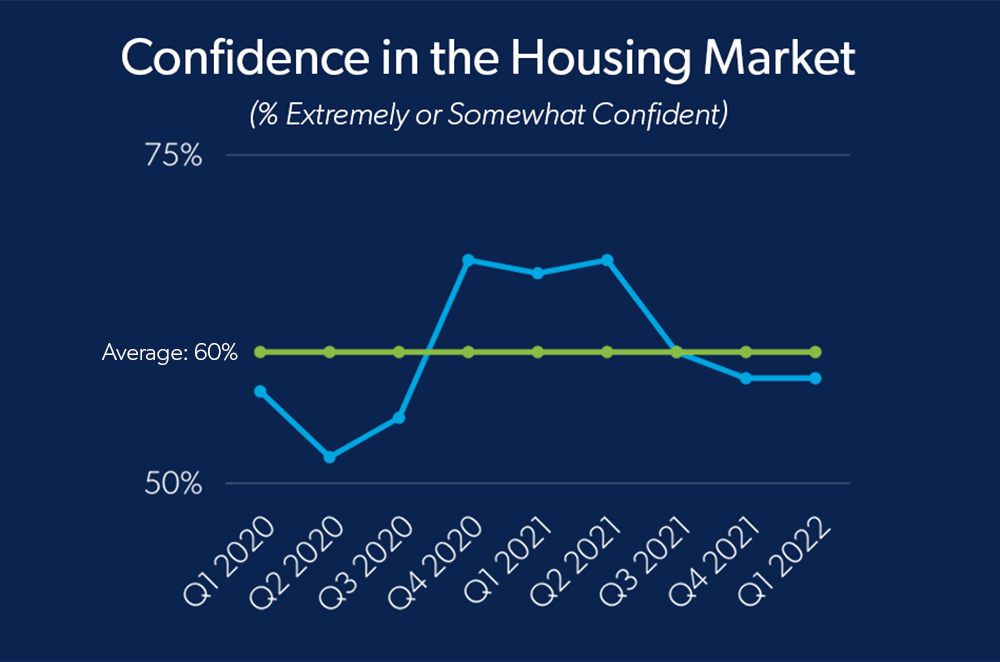

Market Confidence

- 58% are confident the housing market will remain strong over the next year. This is consistent with results from our sentiment survey in the fourth quarter of 2021 but lower than the 66% reported in the first quarter of 2021.

Housing Affordability

- 56% of renters and 24% of homeowners spend more than 30% of their monthly income on housing.

Payment Concerns

- 47% are concerned about making housing payments. This is true for 58% of renters and 41% of homeowners.

Market Activity

- 25% are likely to buy a house in the next six months.

- 17% of homeowners are likely to sell in the next six months.

- 24% of homeowners are likely to refinance in the next six months.

Freddie Mac’s Market Insights team partners with Heart+Mind Strategies to field its housing outlook pulse survey. This survey, conducted online February 11-23, 2022, included 1,197 interviews. Quotas were used to ensure a representative population of age, gender, ethnicity and region.

Interested in more consumer research? Gain insights into the housing market from surveys of homebuyers, homeowners and renters in Freddie Mac Consumer Research.