Economic and Housing Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Spotlight | December 20, 2023

The Year in Review: Top Three Trends of 2023

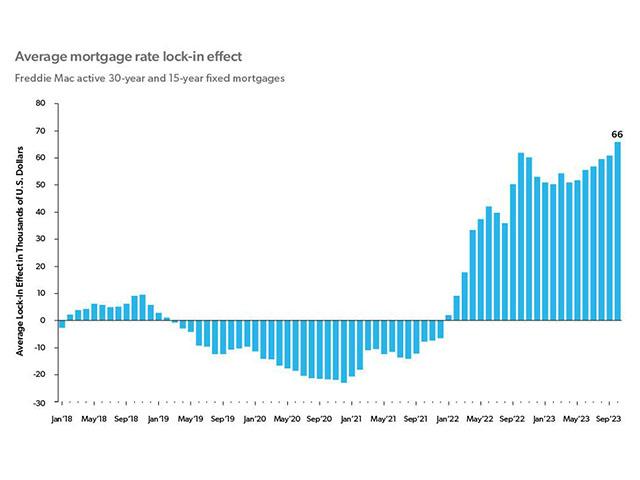

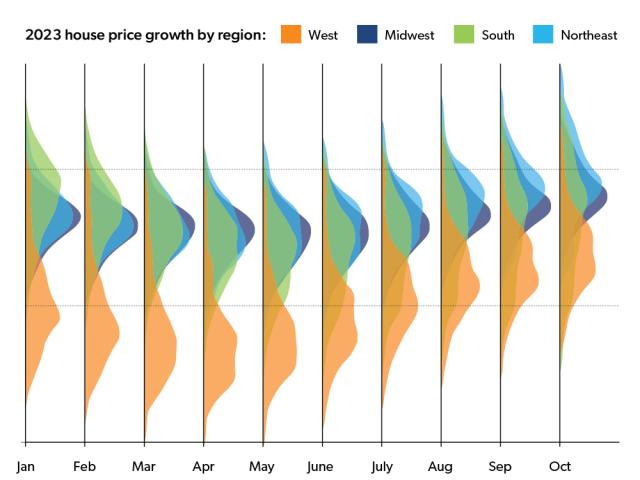

Our recap of 2023 spotlights the three key trends that defined the year: resilient consumers, the rate lock-in effect and a rebound in house prices. More

-

Outlook | December 20, 2023

Economic, Housing and Mortgage Market Outlook – December 2023

Bolstered by resilient consumer spending and investment, the U.S. economy expanded in 2023, defying expectations of a recession. More

-

Spotlight | November 21, 2023

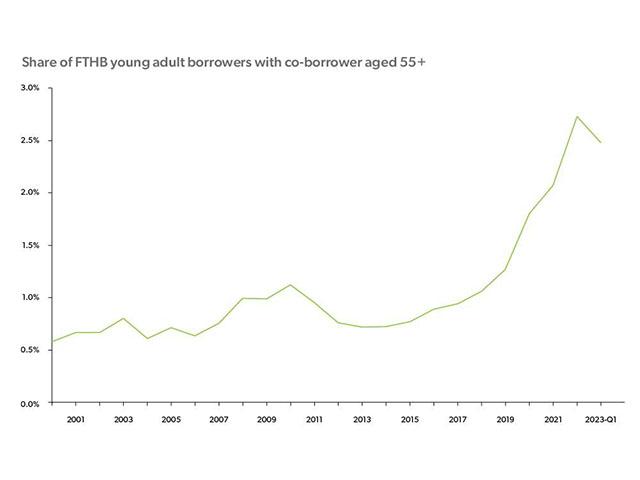

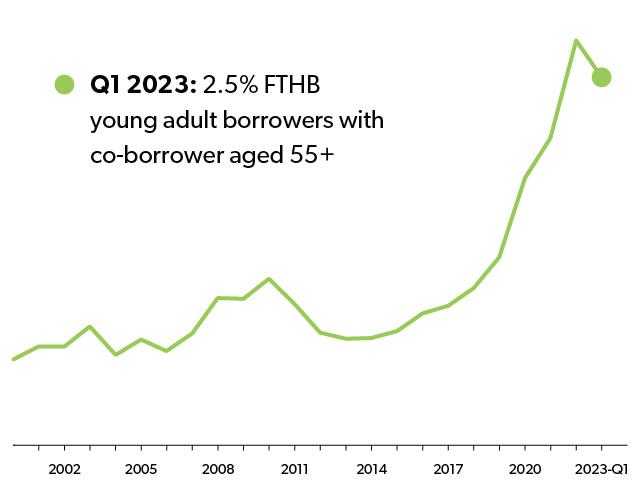

Young Adult Homebuyers are Cracking the Homeownership Code

Despite affordability challenges, young adult first-time homebuyers have been a dominant driver of the housing, getting help from co-borrowers aged 55+. More

-

Outlook | November 21, 2023

Economic, Housing and Mortgage Market Outlook – November 2023

Economic growth remained strong in Q3, primarily due to solid consumer spending. We expect the economy to slow down as the full impact of higher interest rates is felt. More

-

Spotlight | October 20, 2023

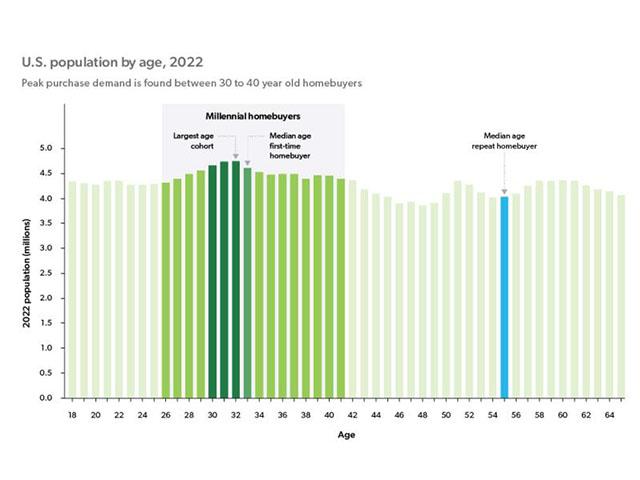

Millennial Household Formation — Potential for Another 2 Million Households

Millennials are not forming households at the same rate and age as Boomers and Gen Xers. If they had, there would be 2 million more households today. More

-

Outlook | October 20, 2023

Economic, Housing and Mortgage Market Outlook – October 2023

The U.S. economy continues to grow at a pace closer to long-term trend as the labor market and consumer spending remain strong. More