How Higher Prices Have Changed Housing Costs, Consumer Spending Plans

In the past 12 months, rising inflation has impacted consumers’ household spending, rent prices and future financial plans.

The May 2022 Consumer Price Index increased 8.6% year-over-year, the largest 12-month increase since December 1981. Higher prices for food, gasoline and housing spurred the Federal Reserve to raise rates three times since March 2022 to combat inflationary pressures, with more likely to follow.

To better understand how consumers feel about the current state of inflation and how they are likely to change their behavior as a result, Freddie Mac conducted a poll among 2,000 consumers June 6–10, 2022.

Concerns About Higher Prices Impact on Housing

According to our poll, rising prices have left many somewhat concerned (33%) or very concerned (51%) about an impending economic recession. In addition to recessionary concerns, consumers are also concerned about how they will be personally impacted by various housing-specific factors, such as:

- Rising interest rates.

- Less money to put toward savings.

- Higher home prices.

- Being unable to pay for housing.

Concerns about higher prices have become real for many, as 96% of respondents indicated that price increases in the past 12 months have impacted their household spending, in ways both large and small.

Individuals have reported putting less money toward savings, delaying essential and non-essential repairs or improvements to their property, and increasing spending on credit cards to cover expenses. Some are finding roommates to split costs or even moving to save money.

Rising Rents and Shifting Plans

Along with higher prices on frequently purchased goods and services, survey respondents reported seeing rising costs to rent and buy a home in the past 12 months.

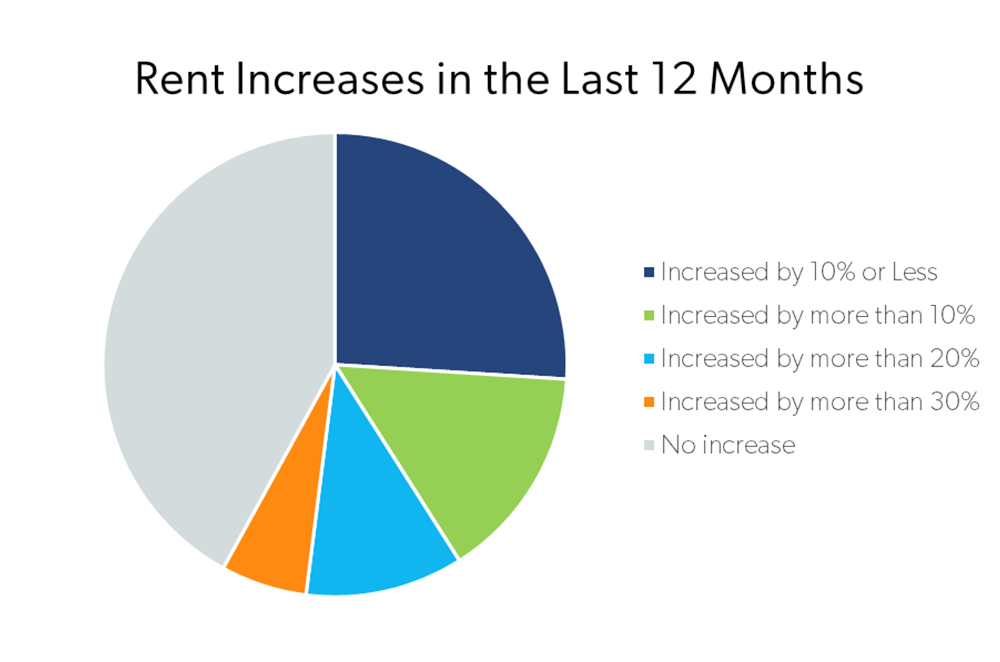

According to the survey, nearly 60% of renters saw their rent payment increase last year. More than half of these renters reported increases greater than 10%.

Fortunately, approximately half of our survey respondents reported receiving a raise at work. And for nearly 7-in-10 renters, their wage increase was sufficient to cover their increased rent.

Still, fears persist as many renters who saw an increase in their rent in the last year report that they are extremely or somewhat likely to miss rent payments (57%) or are concerned about having to move because of rent increases (69%).

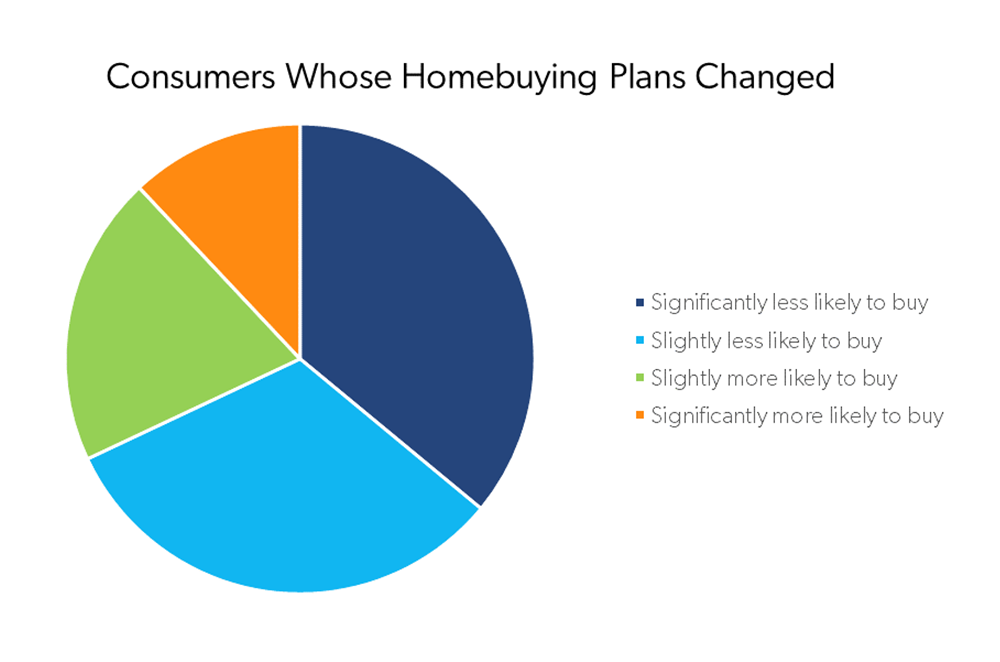

Price increases have caused many to reconsider their plans to buy homes. Among consumers who report their plans to buy a home have changed:

- 36% are significantly less likely to buy.

- 32% are slightly less likely to buy.

- 20% are slightly more likely to buy.

- 12% are significantly more likely to buy.

Reasons for these changes vary, but they remain tied to economic headwinds. For instance, among those more likely to buy, the most common response, at 21%, was readiness to become a homeowner. The second most common response, at 20%, was that buying will be less expensive than their current monthly housing payment.

Among those less likely to buy, top reasons include:

- 44% say home prices have increased.

- 32% say interest rates have increased.

- 29% say inability to save for a down payment.

Based on our findings, many consumers may be likely to moderate their spending on items as varied as groceries and homes while current economic conditions persist.

Interested in more consumer research? Gain insights into the housing market from surveys of homebuyers, homeowners and renters in Freddie Mac Consumer Research.