Economic, Housing and Mortgage Market Outlook – September 2024

In this Issue

- The U.S. economy continues to expand but shows signs of slowing, which are consistent with a soft landing.

- While mortgage rates declined in August, homebuyers continue to wait for rates to fall further.

Recent developments

U.S. economy: The second estimate of Q2 economic growth released by the Bureau of Economic Analysis (BEA) in August showed Gross Domestic Product (GDP) grew at an annualized rate of 3%, up from a 1.4% annualized rate in Q1 2024. Consumer spending grew the fastest of all components, rising at an annualized rate of 2.9% in Q2, which was up from 1.5% in Q1 2024. Consumer spending contributed two percentage points to overall GDP in Q2 2024, up from one percentage point in the previous quarter. Private inventory investment also contributed to the acceleration of real GDP in Q2. However, these upturns were partially offset by a decrease in fixed residential investment.

The latest employment report from the Bureau of Labor Statistics (BLS) points to a cooling labor market. August’s total nonfarm payroll gains were 142,000. Though a bounce back from July, August’s job growth was still below the average monthly gain of 202,000 over the past year. The unemployment rate ticked down to 4.2%, slightly lower than last month’s highest rate since November 2021. In terms of the job growth by industry, manufacturing saw a decline over the month, reflecting a slowdown in the durable goods industries.

Job openings moderated from 7.9 million in June to 7.7 million in July, dipping further below the 8.8 million openings reported in July of last year, per the BLS. The number of job openings are now at the lowest level since January 2021. The job openings to unemployed ratio for July is at 1.07 and remains at the lowest since June 2021, while still above the pre-pandemic average (2016-2019) of 0.99.

Inflation continues to moderate. The Federal Reserve’s preferred inflation gauge, the core Personal Consumption Expenditure (PCE) Price Index, which strips out volatile food and energy prices, rose 0.2% month-over-month and was up 2.5% year-over-year in July 2024.1 Prices for goods were unchanged month-over-month whereas services increased 0.2% month-over-month and 3.7% year-over-year. The Consumer Price Index (CPI) increased 0.2% month-over-month in July after declining 0.1% in June. The index rose 2.9% year-over-year, which is the smallest 12-month increase since March of 2021. Core CPI also increased 0.2% month-over-month, slightly higher than June’s increase of 0.1%. The month-over-month energy index was unchanged in July after declining for two preceding months. Though July’s inflation data shows acceleration from last month, almost 90% of the increase in both headline and core CPI was driven by shelter prices.

According to the Senior Loan Officer Opinion Survey (SLOOS), credit conditions have begun to ease. The net percentage of banks raising credit standards moved down to 7.9% in Q2 2024, a decrease from 15.6% in Q1 2024. This is the lowest percentage since the Federal Reserve began to tighten policy in 2022. Looking at consumer lending, a moderate net share of banks (between 10% and 20%) reported tightening lending standards for credit cards and other consumer loans lowered credit limits. Standards for auto loans were unchanged, but a moderate net share of banks reported experiencing weaker demand for these loans. A significant share (between 20% and 50%) of banks tightened standards for commercial real estate loans, while residential real estate lending standards changed little.

The broad economy continues to expand, though it shows signs of slowing, which are consistent with a soft landing. The labor market is cooling with unemployment up and job growth moderating. Inflationary pressures are abating, and consumer price growth is on a path back toward 2%, which policymakers judge consistent with the Federal Reserve’s mandate of maximum employment and price stability.

U.S. housing and mortgage market: The decline in mortgage rates in July gave a slight nudge upward to home sales with total (existing + new) home sales for July rising 2.6% over the month to 4.7 million. Both existing and new home sales rose over the month of July. Pending home sales (a leading indicator of upcoming home sales) declined 5.5% month-over-month in July with all four U.S. regions declining in transactions monthly. Affordability challenges continue to impact the market as the pending home sales index level of 70.2 is the lowest reading since the index began tracking in 2001.

The homebuilder confidence index fell further to 39 in August from 41 a month earlier, according to the National Association of Home Builders’ Housing Market Index. The index remains below the threshold of 50, indicating poor building conditions over the next six months. Poor affordability from higher interest rates continue to weigh on builder sentiment. However, we have yet to see the impact of the falling rates on housing construction as it continues to decline. Housing starts for July were at a seasonally adjusted annual rate of 1.24 million, 6.8% below June’s 1.33 million units. Single family housing starts fell 14.1% from the previous month and were 14.8% below last July’s levels.

House prices for June 2024 as measured by the FHFA House Price Index, declined 0.1% month-over-month in June and rose 5.1% year-over-year. The monthly slowdown in appreciation this June could be attributed to elevated mortgage rates and a higher inventory of homes for sale. The states with the highest annual house price appreciation were Vermont at 13.4%, West Virginia at 12.3%, Rhode Island at 10.1% and Delaware at 10%.

The 30-year fixed-rate mortgage averaged 6.5% in August as measured by Freddie Mac’s Primary Mortgage Market Survey® and ended the month at 6.35%. According to the Mortgage Bankers Association (MBA) Weekly Application Survey, mortgage activity was slightly higher, driven by a pick-up in refinance activity. Refinance activity rose given falling mortgage rates and accounted for 46.4% of the total application activity as of the end of August. Despite the fourth consecutive week of declining mortgage rates, purchase applications have not shown much movement as prospective homebuyers remain patient in the wake of declining rates and the increasing levels of for-sale inventory.

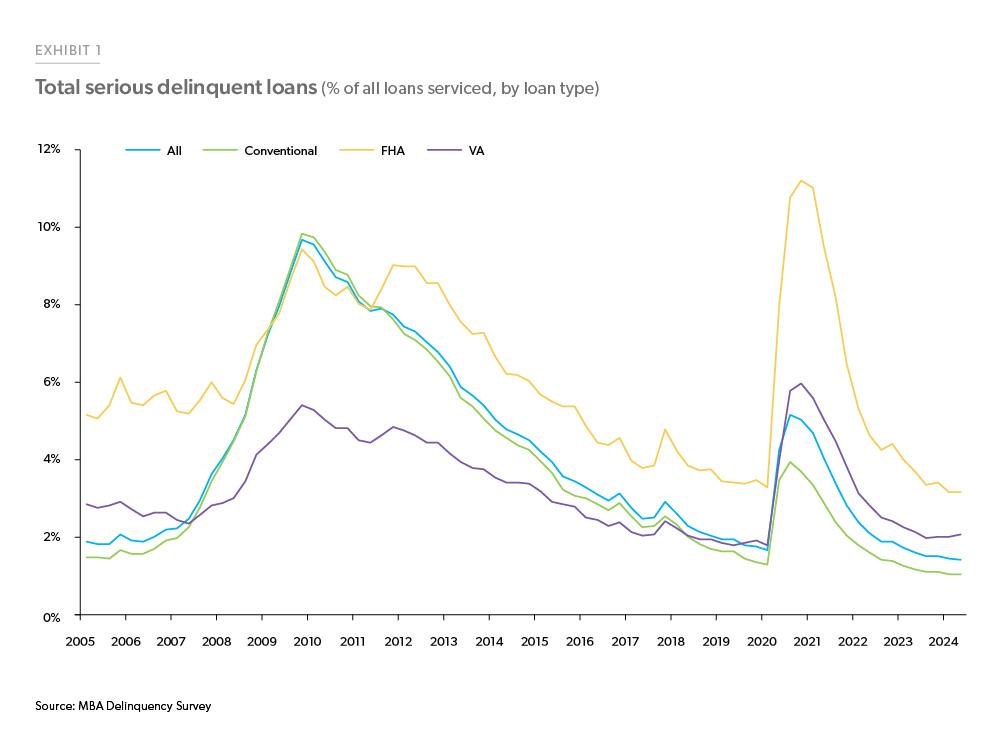

In terms of mortgage delinquencies, per the MBA’s mortgage delinquency survey, a seasonally adjusted (SA) 3.97% of outstanding debt was in some stage of delinquency as of Q2 2024, up three basis points from Q1 2024 and up 60 basis points year-over-year. Loans 30+ days delinquent ticked up one basis point from 2.25% in Q1 2024 to 2.26% in Q2 2024 and rose 51 basis points from Q2 2023. Loans in foreclosure decreased three basis points from last quarter to 0.43% in Q2 2024 and decreased 10 basis points year-over-year (SA). In terms of seriously delinquent loans (which is 90 days or more past due or in foreclosure), only VA loans saw an uptick from 2.01% in Q1 2024 to 2.07% in Q2 2024, down from 2.15% in Q2 2023, non-seasonally adjusted (NSA). The overall share of seriously delinquent loans declined from 1.44% in Q1 to 1.43% in Q2 2024 and was down 18 basis points from Q2 2023. The share of conventional loans was down from 1.06% in Q1 to 1.04% in Q2 2024, down from 1.61% in Q2 2023 and the share of FHA loans declined from 3.18% to 3.17% during the first and second quarter of the year and down from 3.71% in Q2 2023 (NSA), as shown in Exhibit 1. While early-stage delinquencies have been rising modestly, serious delinquency rates continue to fall, indicating that homeowners are able to deal with short-term distress and avoid serious delinquencies and foreclosures.

Overall, while mortgage rates declined from 6.85% in July to 6.5% in August, that may not be enough to give a boost to housing demand as homebuyers continue to wait for rates to decline further. On the supply side, housing construction remains low. Mortgage performance continues to be strong, especially for conventional borrowers.

Outlook

Despite the cooling labor market, our outlook for the economy still calls for a soft landing. We expect economic growth to continue, albeit at a slower pace. Under our baseline scenario, inflation is expected to cool further. The discourse around the timing and pace of potential future rate cuts will likely drive the near-term path of interest rates rather than the actual policy decision itself. While there is likely to be some volatility around any policy statements, we expect mortgages rates to decline further, though remaining above 6% by year-end.

We expect housing demand to improve, supported by lower mortgage rates. However, we do not expect home sales to get a significant boost because a modest improvement in affordability is insufficient to significantly increase the pool of buyers—particularly the first-time home buyers who are driving demand in the housing market. In addition, the housing inventory in the resale market is still struggling to gain momentum, mainly due to the rate lock effect. Unless rates fall significantly—something in the order of a full percentage point or more—we do not expect inventory of existing homes to come on the market in large numbers, limiting supply. We expect home sales to remain muted in 2024 and 2025. However, the tight supply and solid demand are expected to put upward pressure on home prices. We, therefore, expect home prices to continue to appreciate at a modest pace in 2024 and 2025.

Based on our expectation of muted home sales but increases in home prices, we forecast purchase mortgage origination volume to grow modestly. We expect the decline in the mortgage rates to slightly boost refinance originations. Overall, our forecast for total origination is a modest volume increase in 2024 and 2025.

Overall, our outlook remains optimistic. While prospective homebuyers continue to face affordability challenges due to high home prices, homeowners are experiencing significant wealth gains which makes them less vulnerable to adverse economic events. Under our baseline scenario, we do not foresee the economy going into recession.

See the September 2024 spotlight on “natural disasters and decision making.”

Footnotes

- BEA

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Caroline Cheatham, Finance Analyst