Economic and Housing Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Spotlight | March 20, 2024

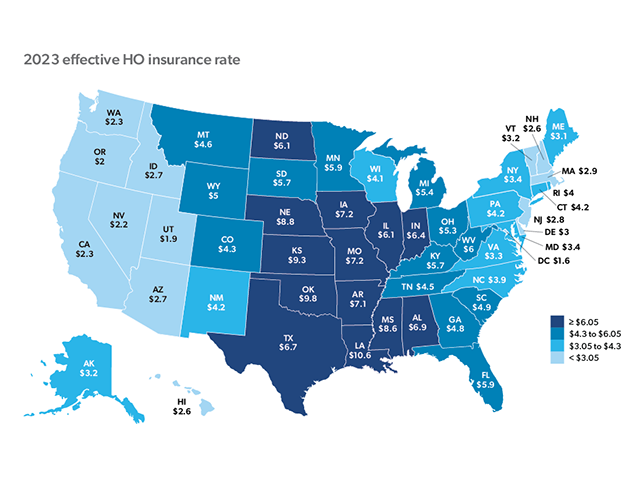

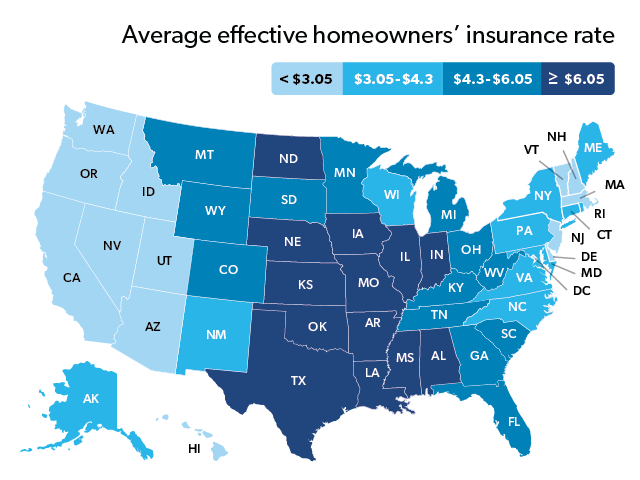

The Cost of Homeowners’ Insurance

Homeowners’ insurance costs are growing but are a small fraction compared to the mortgage principal and interest payments. More

-

Outlook | March 20, 2024

Economic, Housing and Mortgage Market Outlook – March 2024

While the U.S. economy remains robust, inflation pressure continues, which could keep mortgage rates higher for longer. More

-

Spotlight | February 26, 2024

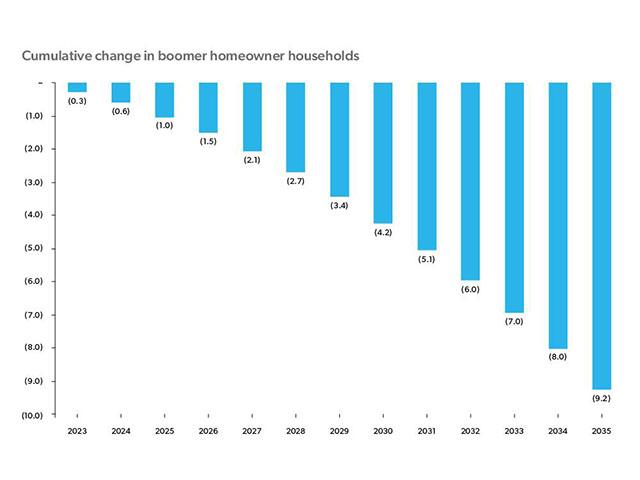

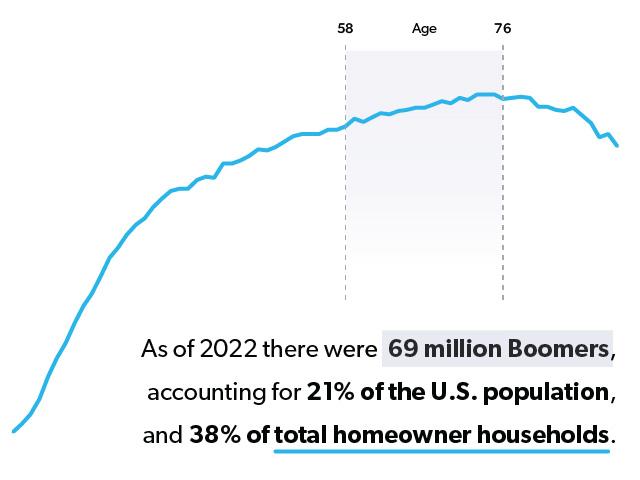

Aging Boomers and the Impact on the Housing Market Over the Next Decade

Baby Boomers’ housing decisions over the next few years could have a major impact on the housing market and homeownership aspirations of Millennials and Gen Z. More

-

Outlook | February 26, 2024

Economic, Housing and Mortgage Market Outlook – February 2024

The housing market continues to feel the impact of higher mortgage rates with home sales at multi-decade lows and starts declining over 2023. Robust demand and a lack of supply have led to a reacceleration in house prices. More

-

Spotlight | January 22, 2024

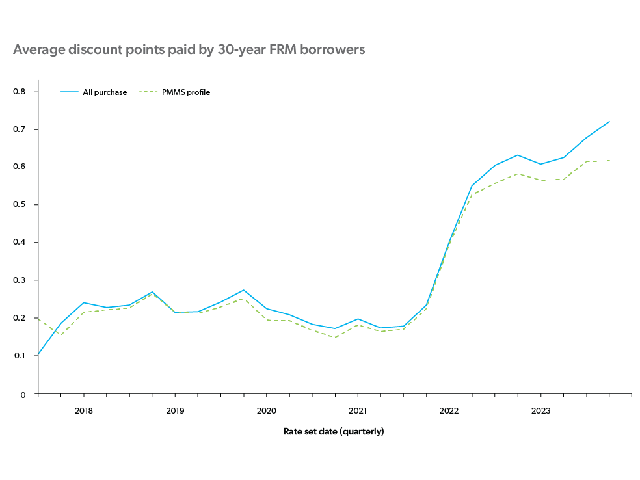

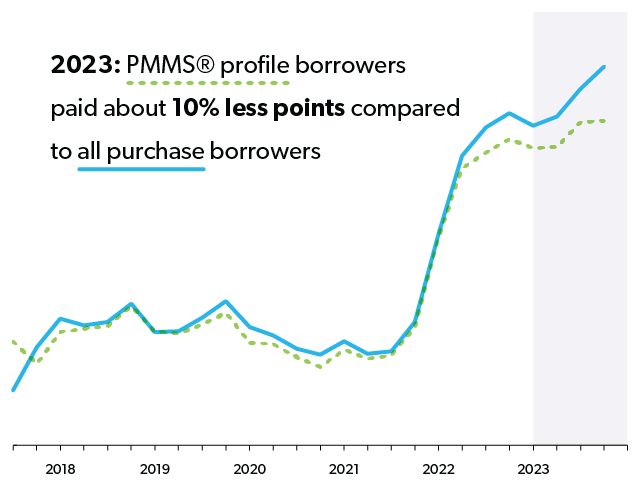

More Borrowers Pay Discount Points, But It May Not Be Worth It

Facing higher borrowing costs, borrowers are paying more discount points to buy down their mortgage rate, but they may not be getting the benefit. More

-

Outlook | January 22, 2024

Economic, Housing and Mortgage Market Outlook – January 2024

While the economy continues to expand and added 2.7 million jobs in 2023, signs point to a normalization in the labor market as job growth is expected to moderate in 2024. More