Economic and Housing Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Outlook | October 18, 2024

Economic, Housing and Mortgage Market Outlook – October 2024

The U.S. economy remains strong with upward revisions to GDP growth as well as job growth. More

-

Spotlight | September 23, 2024

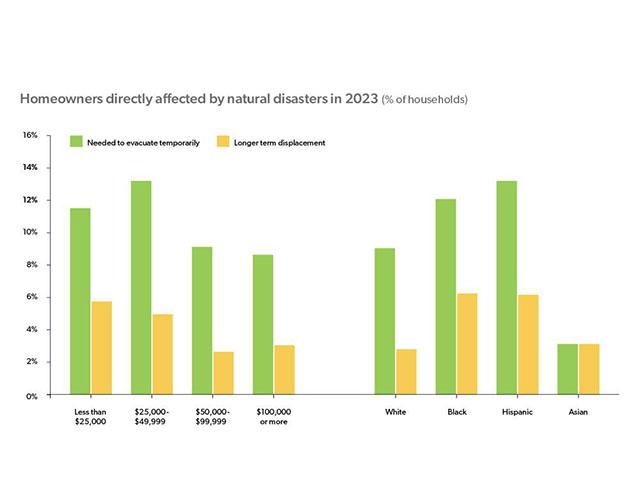

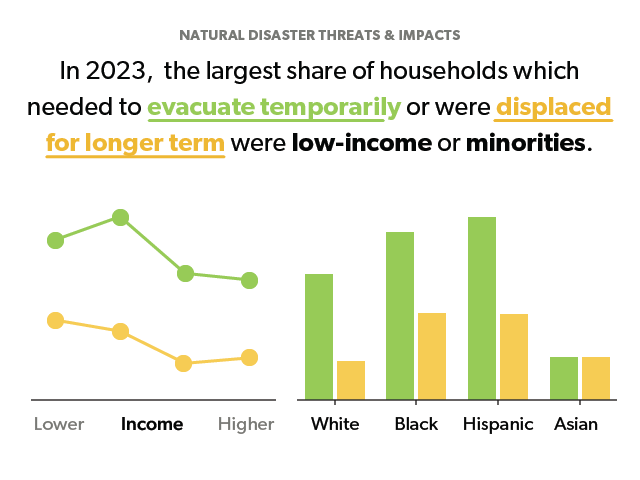

Natural Disasters and Decision Making

For renters, the threat of natural disasters is likely to affect location choices; whereas homeowners are more likely to invest in improving homes to reduce risk. More

-

Outlook | September 23, 2024

Economic, Housing and Mortgage Market Outlook – September 2024

The U.S. economy continues to expand but shows signs of slowing, which are consistent with a soft landing. More

-

Spotlight | August 20, 2024

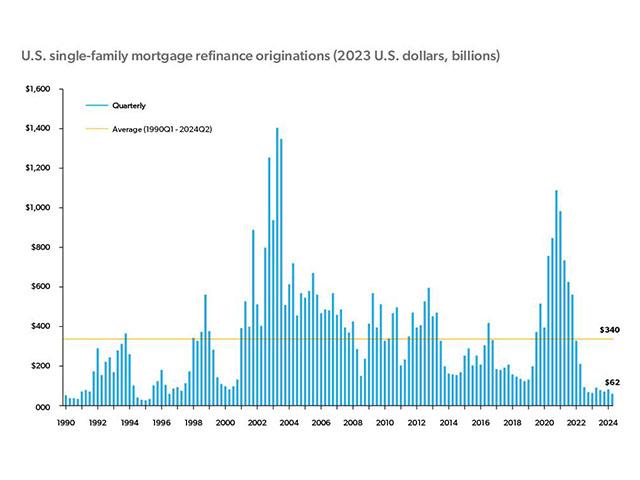

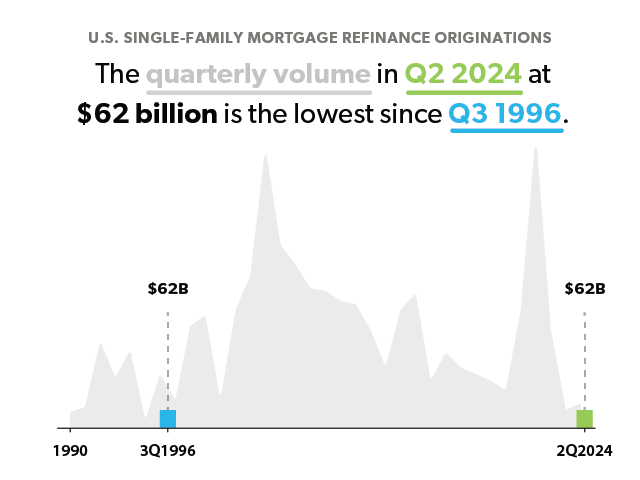

Refinance Originations Trends Through Q2 2024

Quarterly refinance volume in Q2 2024 was $62 billion, the lowest since Q3 1996. Refinance volume in the first half of 2024 was the weakest since the first half of 1995. More

-

Outlook | August 20, 2024

Economic, Housing and Mortgage Market Outlook – August 2024

The U.S. economy continues to remain strong as shown in Q2 2024 GDP growth, but some signs of cooling have emerged in the labor market. More

-

Spotlight | July 19, 2024

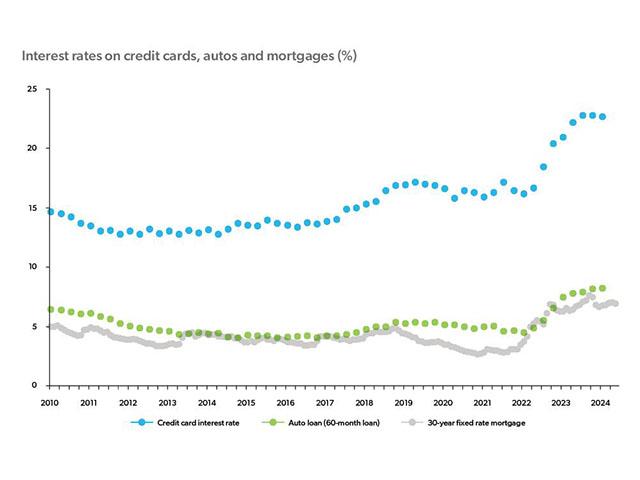

Credit Card, Auto and Mortgage Delinquencies

While credit card and auto loans are performing worse than their pre-pandemic average, mortgage loans are performing better. More