Economic and Housing Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Research Brief | August 17, 2022

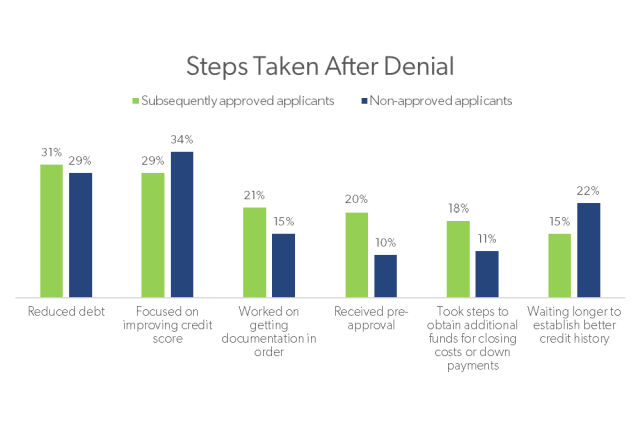

What Do Borrowers Do When a Mortgage Application Is Denied?

Although the housing finance industry may understand the basic denial causes, discovering how applicants respond after a denial can inspire potential solutions to increase the pool of approved applications going forward. More

-

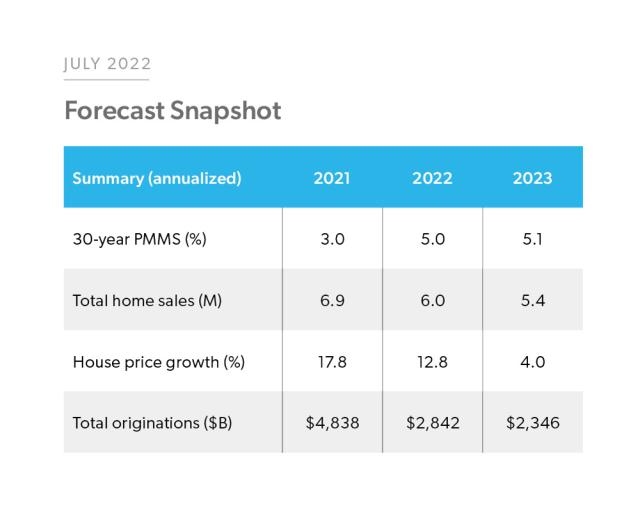

Forecast | July 20, 2022

Quarterly Forecast: Market Slowdown will Continue as High Rates and Prices Exacerbate Affordability Challenges

Rising mortgage rates and house price appreciation will continue driving a slowdown in the single-family purchase market. Homebuyer demand will moderate, rebalancing from the hot housing market of the last two years to a more normal pace of activity. More

-

Research Brief | June 29, 2022

Majority of Consumers Say They Would Consider Purchasing a Manufactured Home

With positive national sentiment, manufactured housing may be an untapped affordable housing solution. More

-

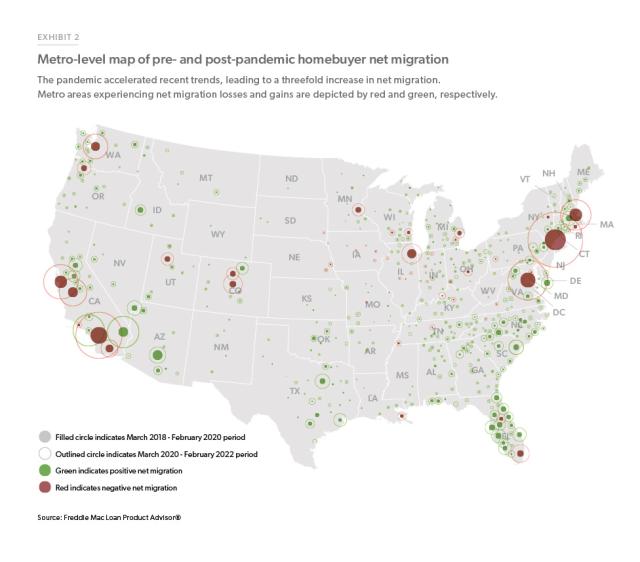

Research Note | June 22, 2022

In Pursuit of Affordable Housing: The Migration of Homebuyers within the U.S.—Before and After the Pandemic

In this Research Note, the first of a three-part series on migration, we compare net migration of homebuyers across U.S. metropolitan areas ("internal migration") and explore the patterns of metro-to-metro migration flows. More

-

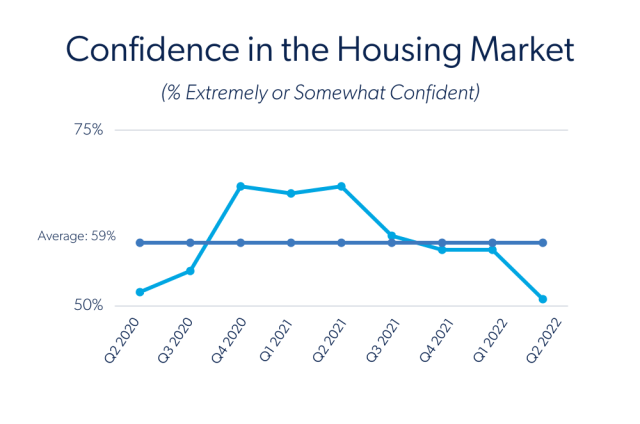

Research Brief | June 17, 2022

Housing Sentiment in the Second Quarter of 2022

In the second quarter of 2022, market confidence in the housing market has reached its lowest point since the onset of the pandemic. More

-

Research Note | June 9, 2022

What Drove Home Price Growth and Can it Continue?

Home prices, the best single indicator of whether market conditions favor buyers or sellers, jumped 33% nationally over the past two years. What is behind the strength of the housing market, and can it continue? More