Economic and Housing Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Research Brief | January 24, 2023

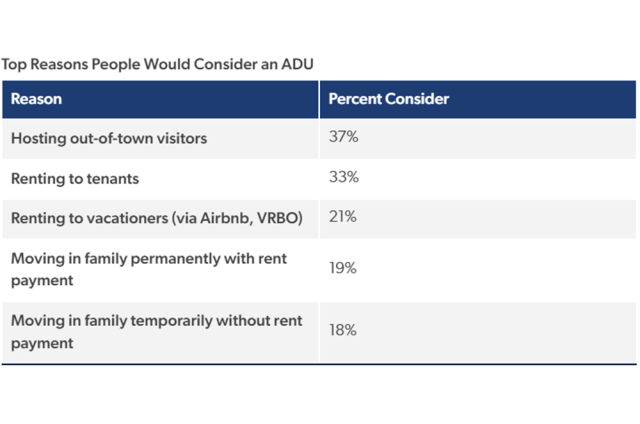

ADUs Can Increase Housing Stock, But Most Are Unfamiliar

A recent Freddie Mac survey attempted to gauge familiarity and interest in accessory dwelling units. The general lack of familiarity underscores the need for additional education and dedicated financing options. More

-

Research Brief | December 20, 2022

Housing Sentiment in the Fourth Quarter of 2022

In the fourth quarter of 2022, consumer confidence continued to decline while payment concerns increased notably. More

-

Research Note | December 7, 2022

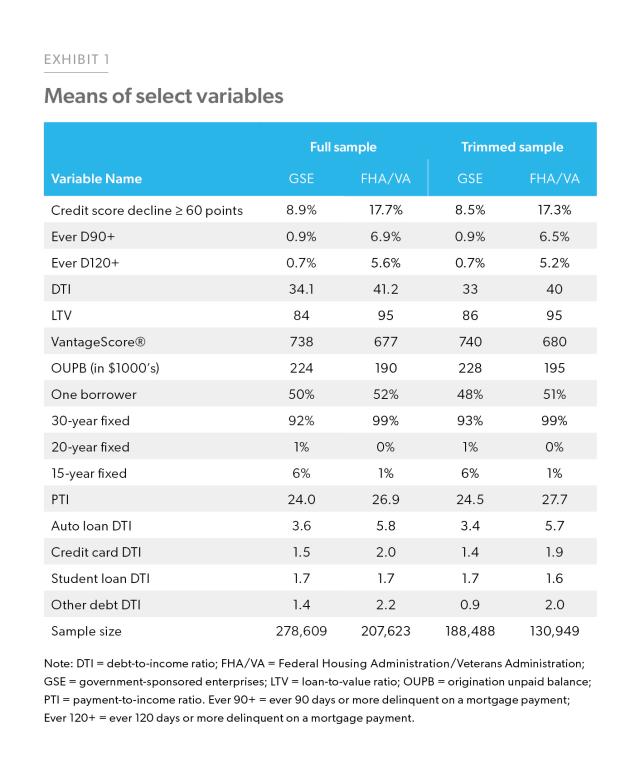

The Drivers of Financial Stress and Sustainable Homeownership

This analysis explores the drivers of financial stress among first-time homebuyers. Identifying the factors leading to household financial stress is important to understanding what makes homeownership sustainable. More

-

Research Note | November 9, 2022

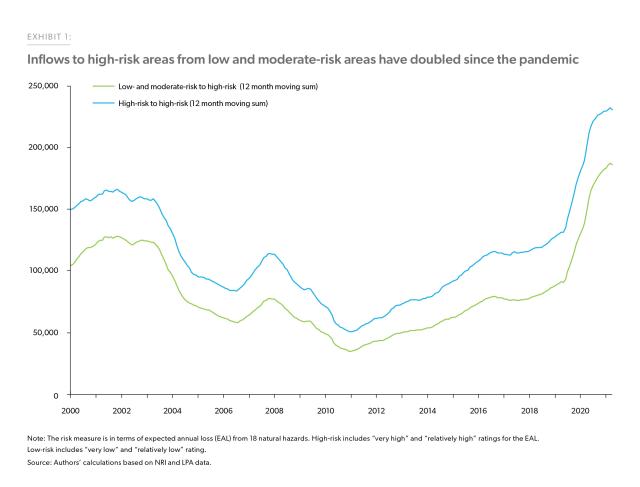

Migration to Environmentally Risky Areas: A Consequence of the Pandemic

The pandemic amplified the exodus from large, expensive metro areas to smaller, more affordable destinations. Many such desirable destinations that are farther from the cities are not only less costly but are also closer to natural amenities. Natural amenities, however are often associated with environmental risks and moving closer to these amenities can also mean increased exposure to various natural hazards. More

-

Research Note | November 3, 2022

Freddie Mac’s Newly Enhanced Mortgage Rate Survey Explained

To ensure that Freddie Mac’s Primary Mortgage Market Survey® continues to provide high-quality information on the mortgage market, we are making new enhancements to our methodology. More

-

Research Brief | November 2, 2022

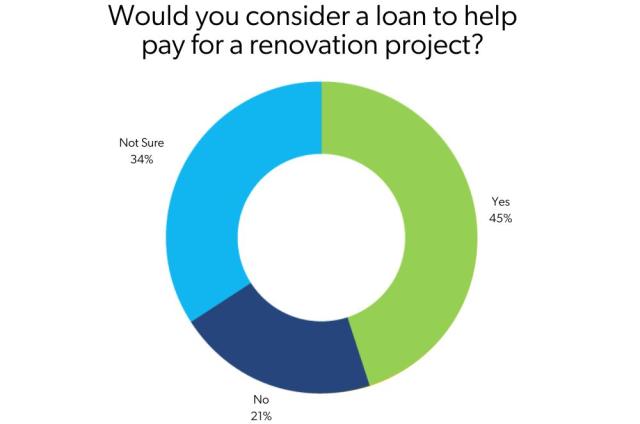

Homeowners Hold Positive Attitudes Toward Renovating But Cost, Financing Awareness and Emotion Hold Them Back

Older housing stock and higher levels of home equity may encourage more owners and buyers to renovate. But many are not prepared for long-term or costlier projects. More