Economic and Housing Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Spotlight | June 20, 2024

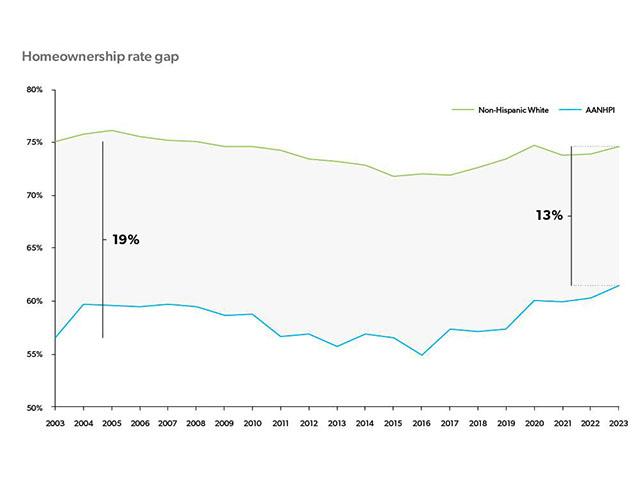

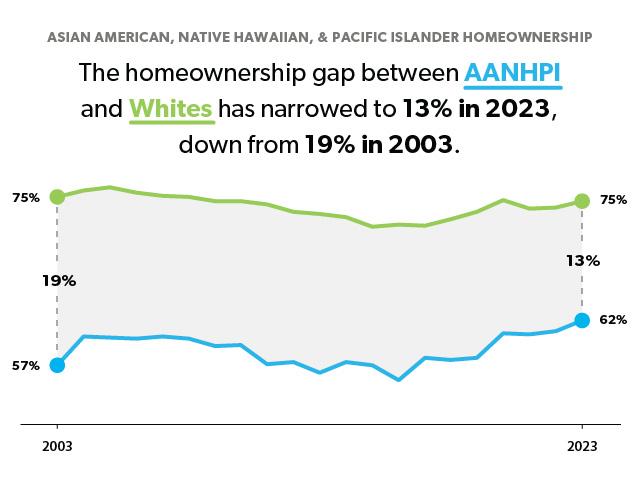

Asian American, Native Hawaiian, and Pacific Islanders Homeownership Gap

The Asian American, Native Hawaiian, and Pacific Islander cohort is growing as a percentage of the population, and we expect their homeownership rate to increase. More

-

Outlook | June 20, 2024

Economic, Housing and Mortgage Market Outlook – June 2024

Even though economic growth tempered in the first quarter of the year, it remains in line with historical averages. More

-

Spotlight | May 16, 2024

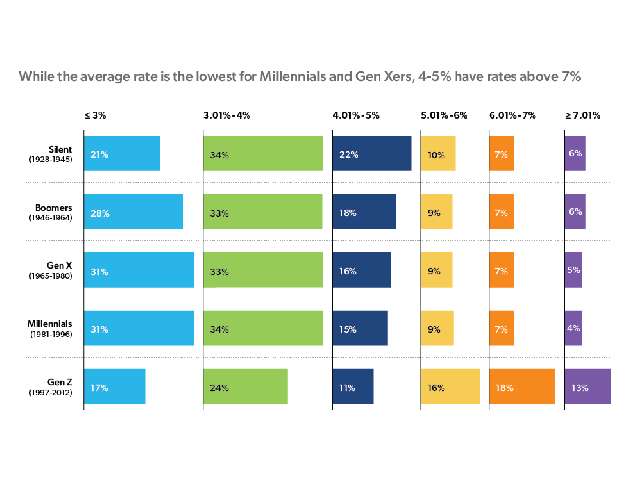

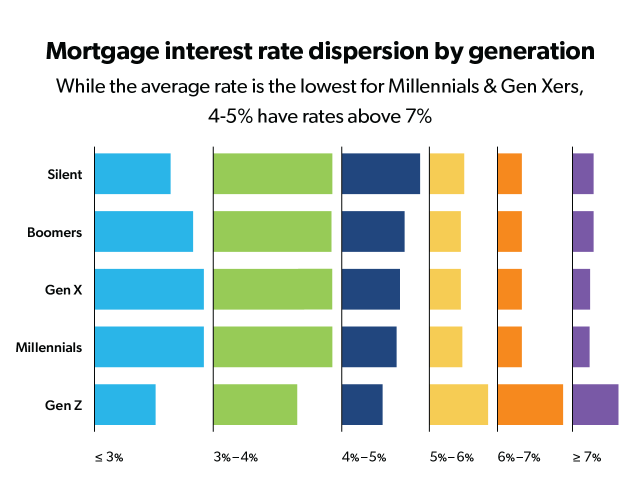

Mortgage Interest Rate Dispersion by Generation: Implications for the Housing Market

An analysis suggests that while Millennials and Gen Xers on average have secured low mortgage rates, refinance potential still exists among these generations. More

-

Outlook | May 16, 2024

Economic, Housing and Mortgage Market Outlook – May 2024

Mortgage rates rose above 7% in April and these higher rates slowed the housing market with declines in home sales and new construction. More

-

Spotlight | April 18, 2024

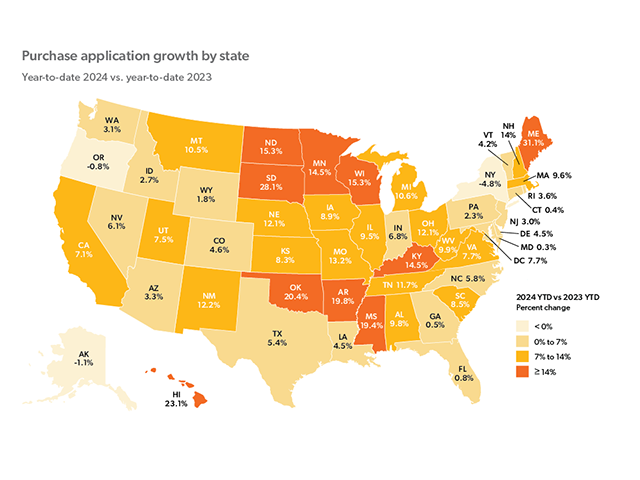

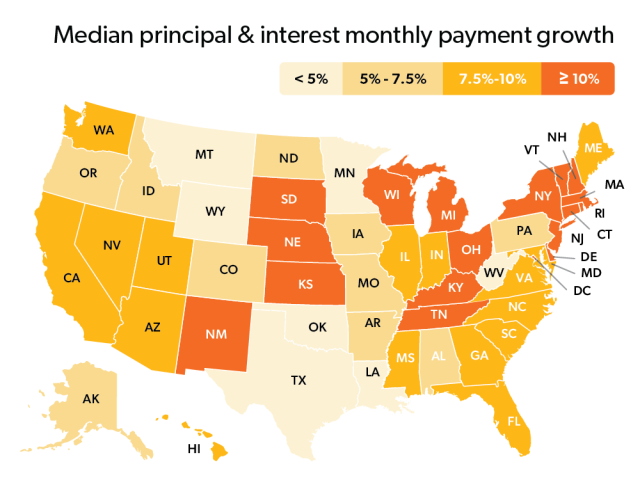

The 2024 Spring Homebuying Season: An Early Preview Using Mortgage Application Data

A preview of spring homebuying season shows a healthy recovery and first-time homebuyers carrying demand, making up almost 6 out of 10 purchase applications. More

-

Outlook | April 18, 2024

Economic, Housing and Mortgage Market Outlook – April 2024

Housing demand is on the rebound, but with mortgage rates still averaging 6.8%, many prospective homebuyers continue to be priced out of the market. More